From Frustration to Clarity: Cutting Disputes with an AI Readiness Review to Identify Where AI Can Step in Next

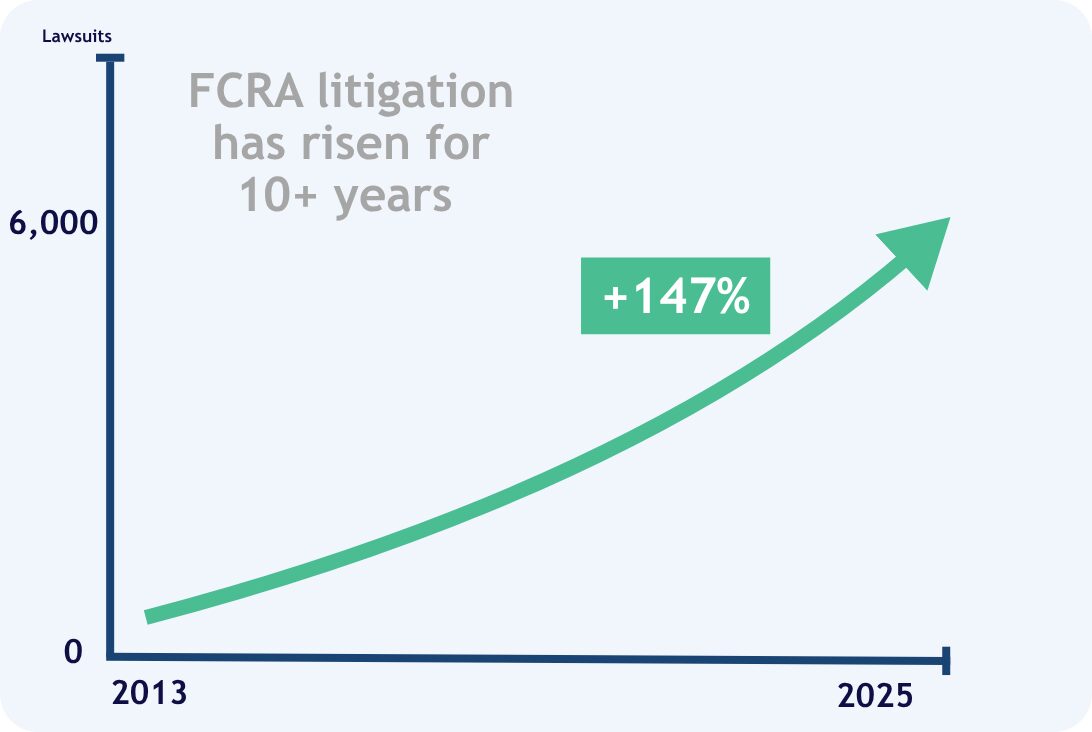

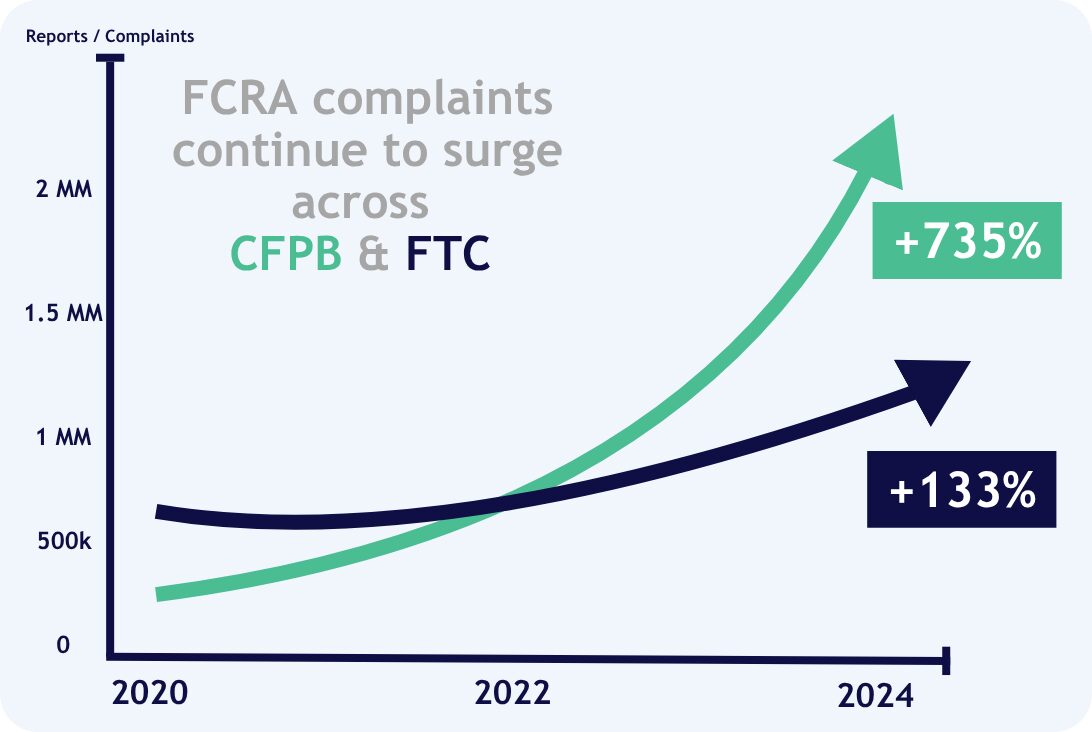

TikTok and AI generated dispute templates have turned credit repair into a high-volume content engine. Across credit unions, banks, servicers, fintechs, auto, and mortgage portfolios, three themes dominate: confusion, frustration, and concern about meeting