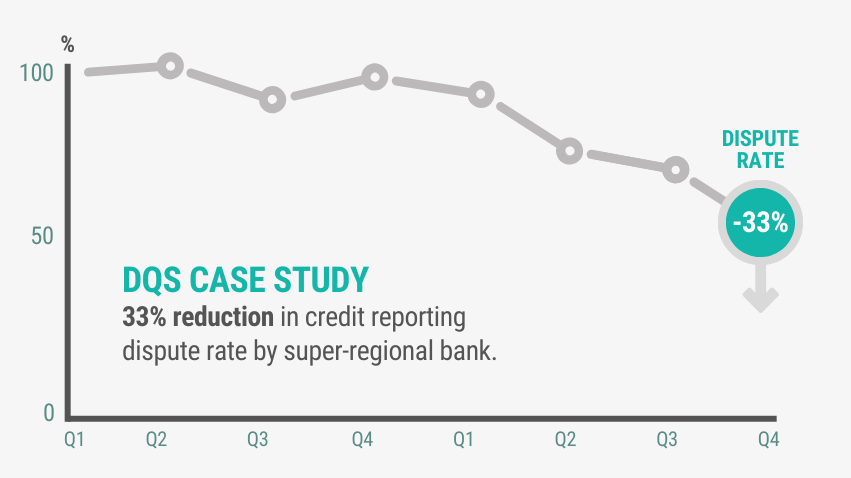

Equifax & Bridgeforce Help You Find, Prioritize, & Fix Credit Reporting Issues

An Innovative Partnership from Two Industry Leaders

Equifax is committed to maintaining the highest standards for data accuracy and compliance. Through our partnership, furnishers now have seamless access to Bridgeforce’s industry-leading Data Quality Scanner® along with credit reporting and disputes management consulting. Together, Equifax and Bridgeforce offer a best-in-class credit reporting compliance and disputes management solution.