Data furnishers play a critical role in today’s credit ecosystem. As a trusted steward of consumer data, Equifax is committed to investing in practices and partnerships that help us better support customers in ensuring accurate data reporting. Joining forces with Bridgeforce Data Solutions supports this commitment by helping furnishers referred from Equifax enhance the quality of their data, resulting in improved accuracy, lower dispute rates and reduced compliance risk.

Robert Eison, Chief Operating Officer for Equifax United States Information Solutions (USIS)

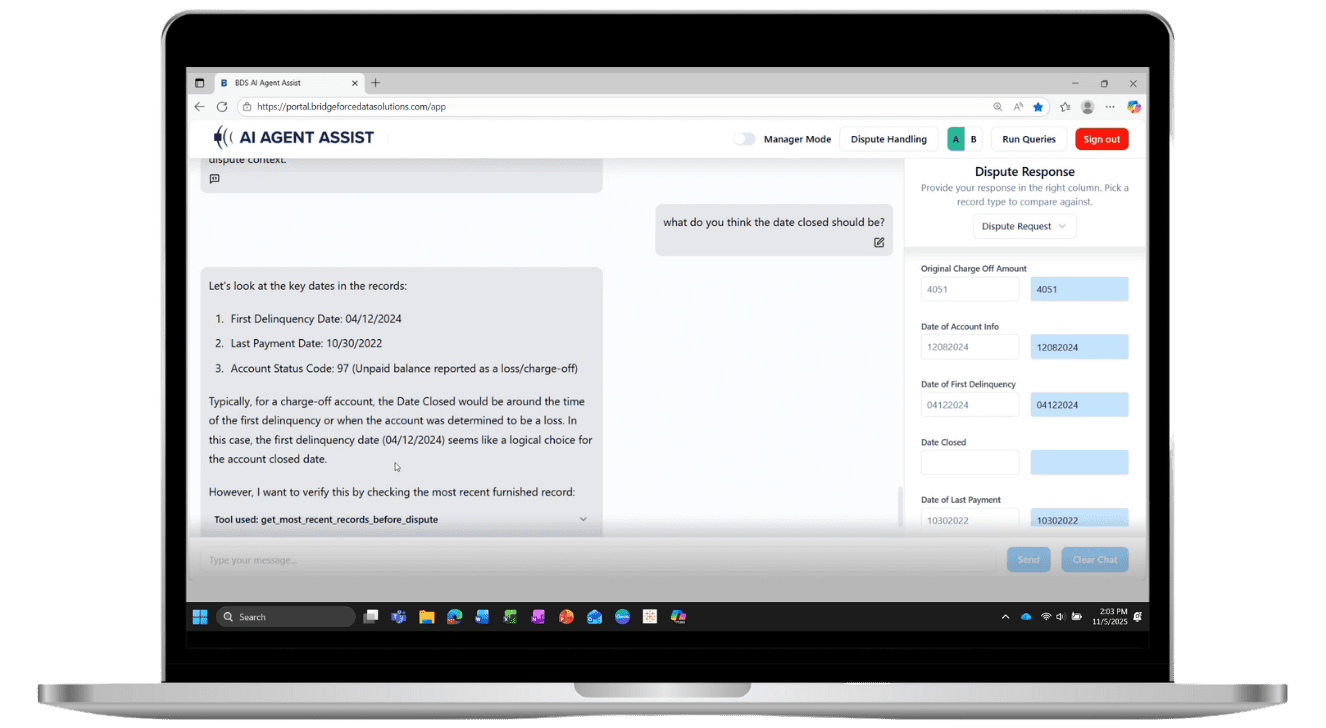

We are happy to see Bridgeforce Data Solutions continue to lead the way in the development of new specialized financial technology solutions that improve their clients’ outcomes by significantly reducing regulatory risks and operational costs. They continue to come up with first-of-its kind ways to utilize our solutions and are a great example of using AWS to best serve their clients. We look forward to seeing what they develop in the future using our new AI tools.

Ben Schreiner, Head of Business Innovation, US SMB for AWS

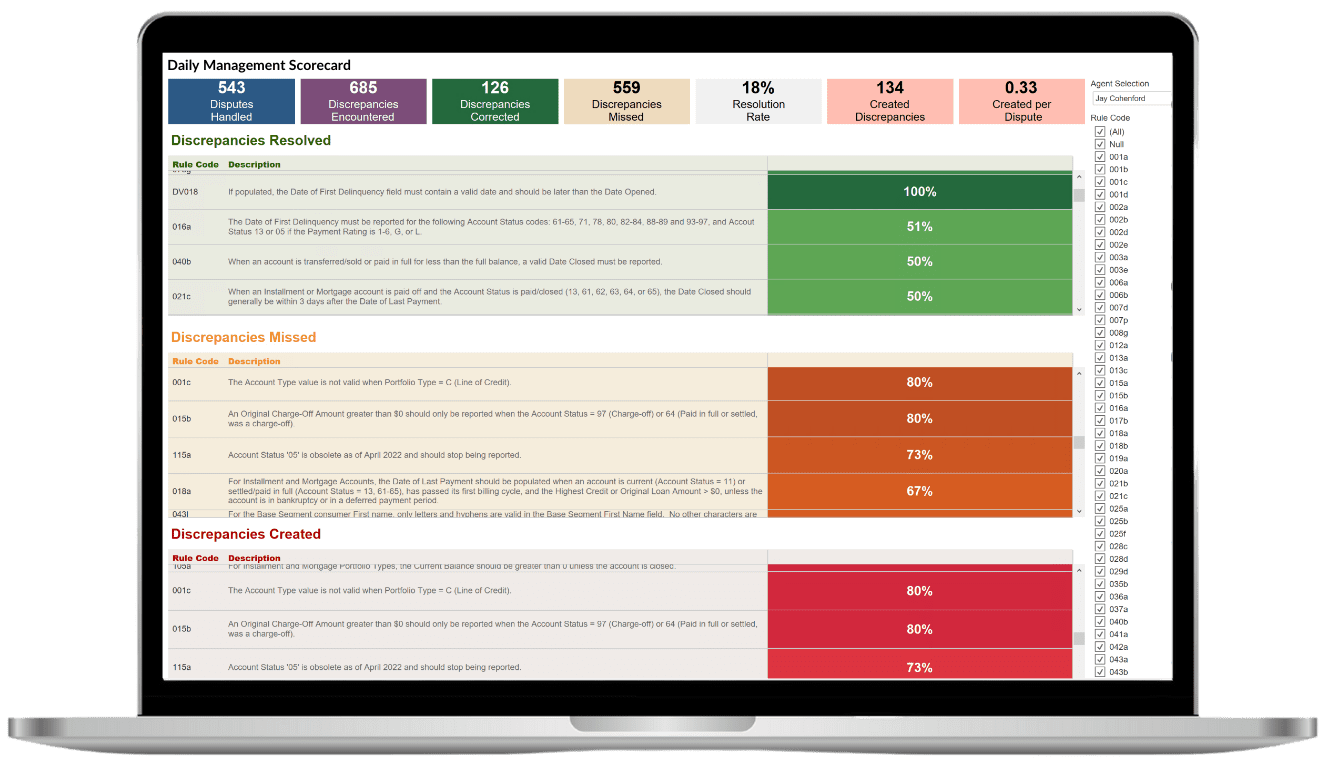

Within the first year, the Data Quality Scanner helped us improve our credit reporting accuracy — a 70% reduction in discrepancies. It directly contributed to the effective rating on our FCRA audit.

Senior Executive, Top Bank

Our organization has been using the Data Quality Scanner for some time now, and I cannot recommend it enough. Using the Data Quality Scanner continuously and working with the Bridgeforce Data Solutions’ team of experts helps me sleep at night.

Senior Leader, Top 10 Credit Union

We could not believe how easy it was to get started using the Data Quality Scanner. With other vendors, we’re used to drawn out projects with many hurdles and unexpected challenges. That has not been the case here, thank you so much!

Senior Executive, Top 20 Credit Union

I have worked with Big 4 firms on similar engagements. From my experience, the knowledge, insight, recommendations, and quality of deliverables provided through the engagement far exceeded my expectations and superior to the firms I have worked with in the past. If ever asked for recommendations on this type of work I will always recommend Bridgeforce first.

-Picsart-BackgroundRemover.png)