Q2 and the Ongoing Rise of CFPB Complaints

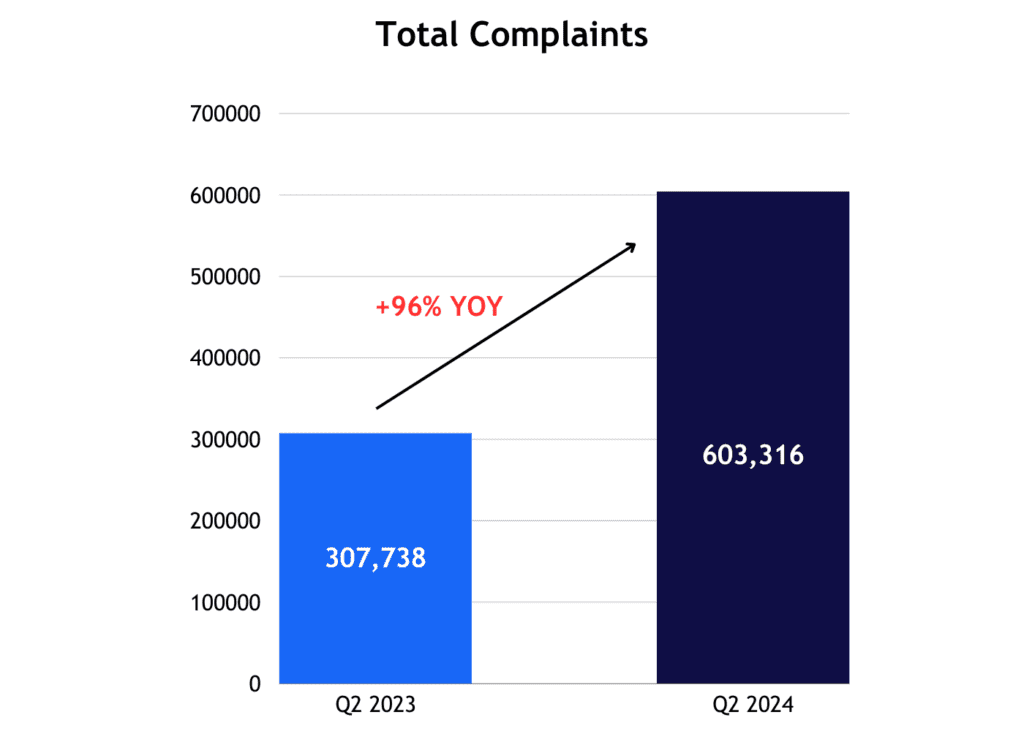

The total number of CFPB Complaints rose year-over-year again in Q2, with 603,316 complaints filed between April and June. This is a 96% increase from the 307,738 complaints filed in the same timeframe in 2023.

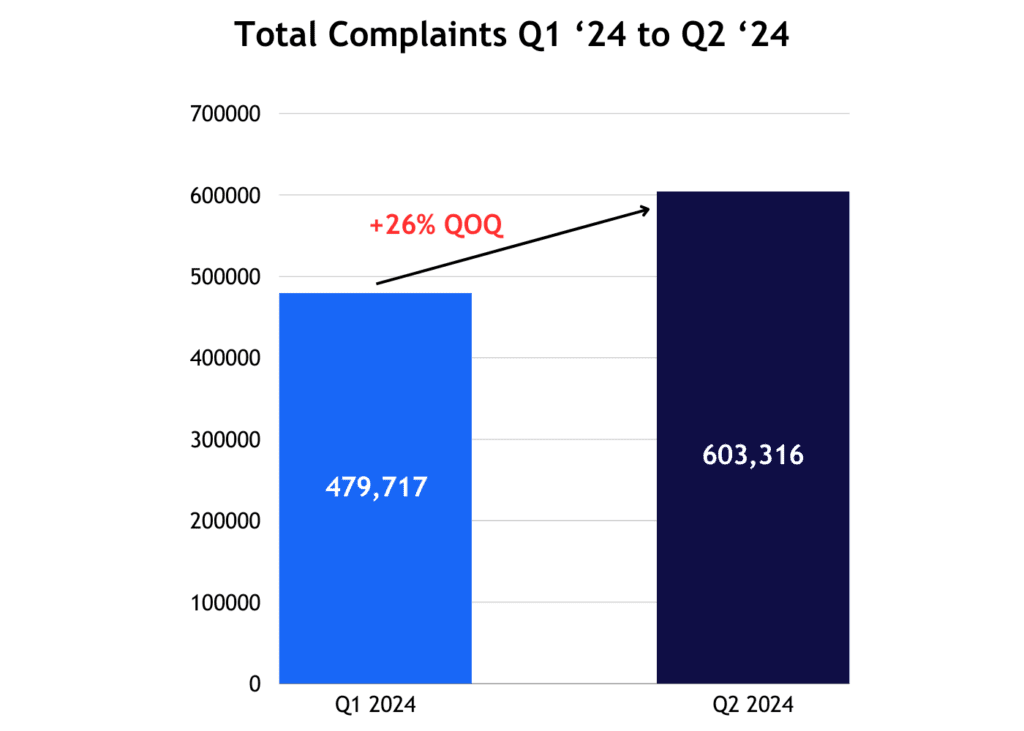

Additionally, the total number of complaints increased by 26% from the first to the second quarter of this year, from 479,717 to 603,316, respectively.

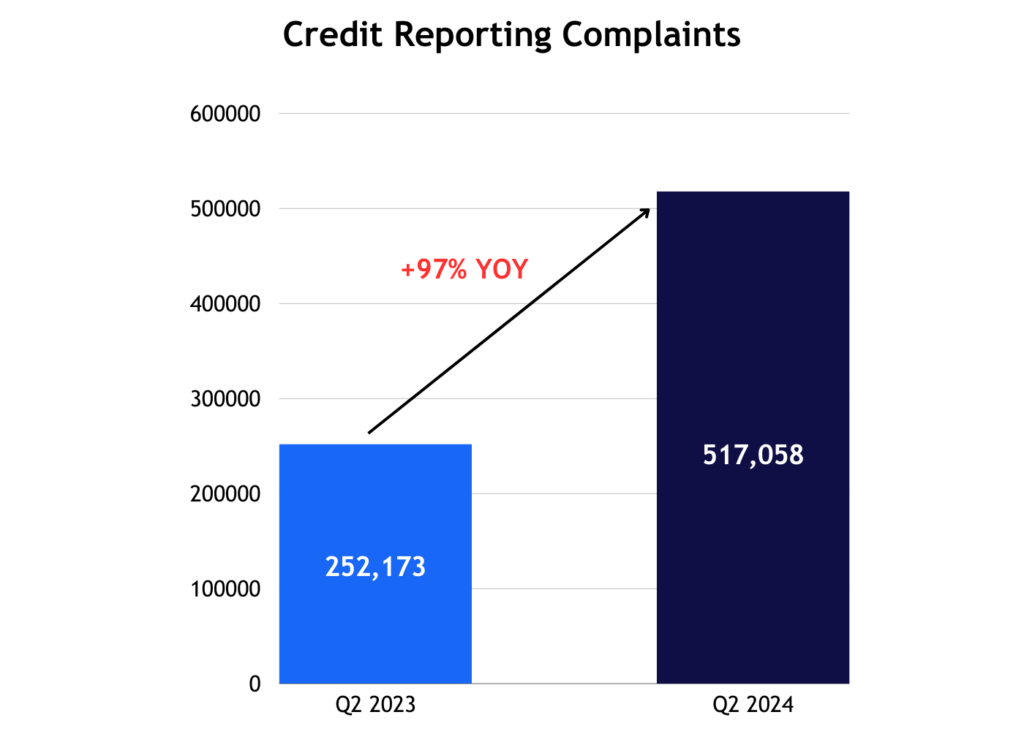

As mentioned in prior blogs, credit reporting complaints continue to make up most of this data, accounting for 85% of all complaints in the first half of 2024.

In the second quarter of this year, we saw a 105% increase in the number of credit reporting complaints, going from 252,173 complaints in Q2 of 2023 to 517,058 complaints in Q2 of 2024.

Credit Reporting Complaints Q2 ‘23 to Q2 ‘24

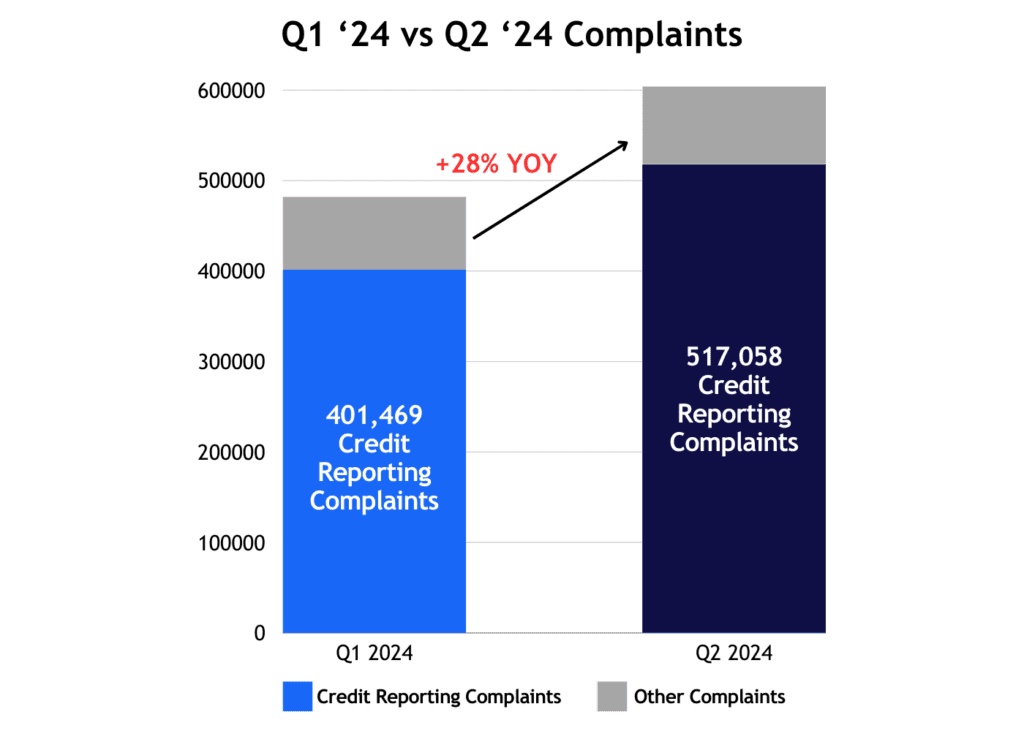

Credit Reporting Complaints also rose from Q1 of 2024 to Q2 of 2024, rising from 401,469 in Q1 to 517,058 in Q2.

Credit Reporting Complaints from Q1 ‘24 to Q2 ‘24

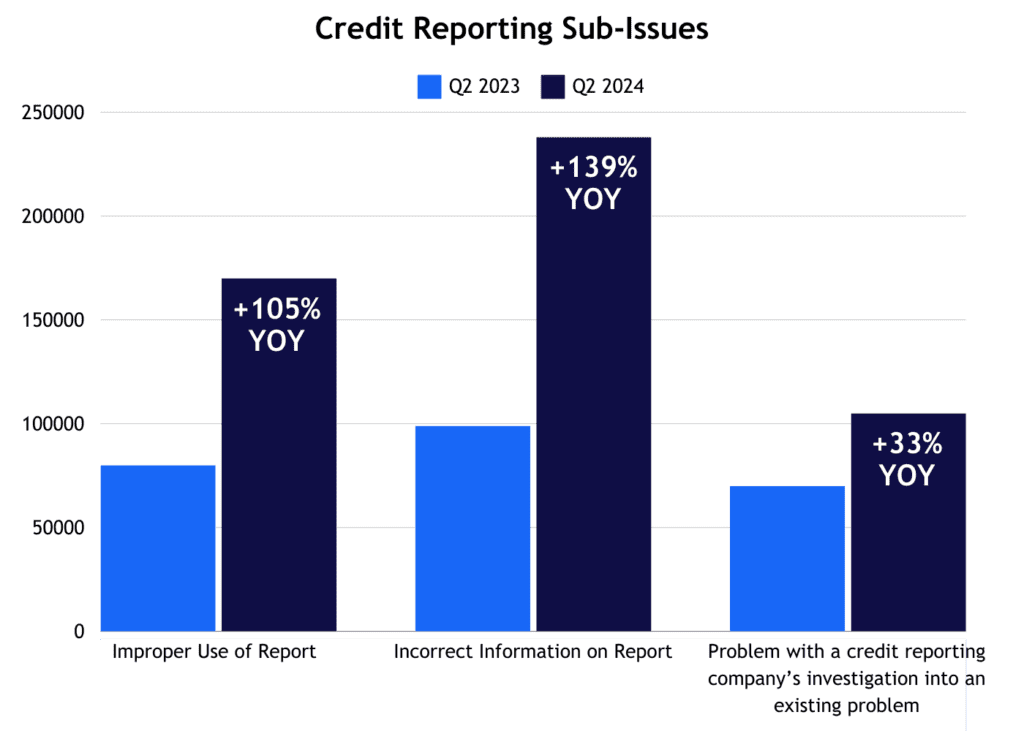

Credit Reporting Sub-Issues

Similar trends exist when we look at the Credit Reporting Sub-Issues. The three largest sub-issues, ‘improper use of a report’, ‘incorrect information on report’, and ‘problem with a credit reporting company’s investigation into an existing problem’, all rose year-over-year.

The largest sub-issue, ‘incorrect information on report’ increased the most year-over-year, going from 98,759 total complaints in Q2 of 2023 to 235,945 total complaints in Q2 of 2024. This sub-issue now comprises 46% of all credit reporting complaints, rising from the 39% it accounted for in Q2 of 2023.

‘Improper use of a report’ also saw a significant rise year-over-year, going from 80,809 complaints in Q2 of 2023 to 165,679 complaints in Q2 of 2024, comprising a 105% increase.

The third most reported sub-issue, ‘problem with a credit reporting company’s investigation into an existing problem,’ still saw a substantial increase, going from 72,305 total complaints in Q2 of 2023 to 107,630 total complaints in Q2 of 2024, for an overall increase of 33%.

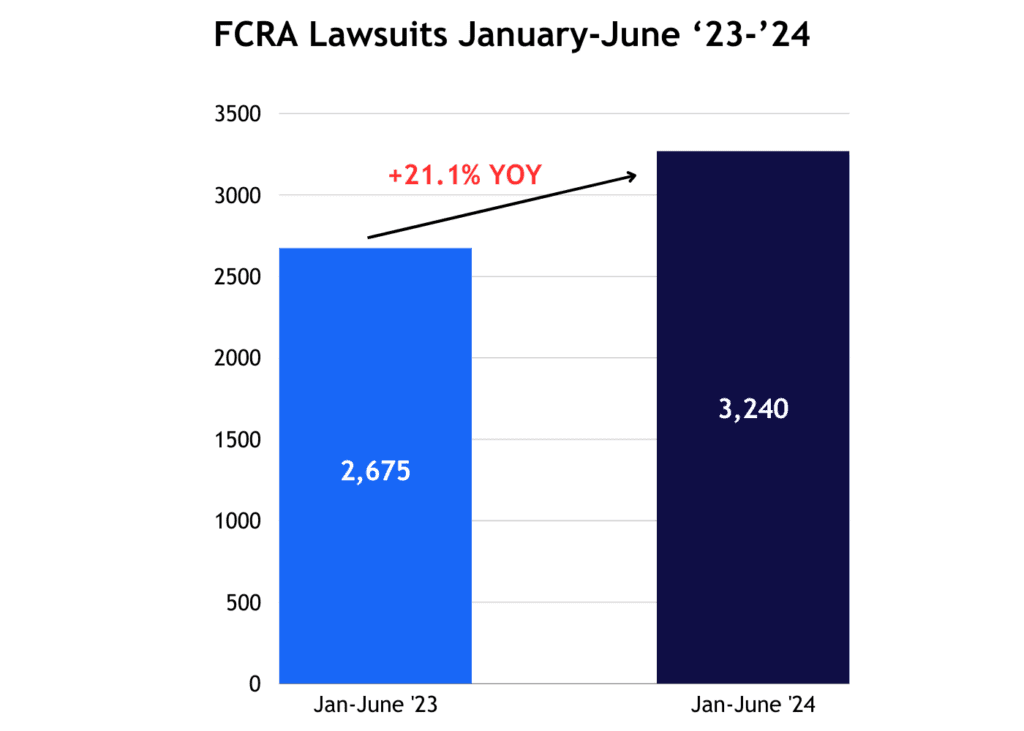

FCRA Lawsuits

FCRA lawsuits have also continued to rise compared to last year. WebRecon reported in June that the total number of FCRA lawsuits has gone up from 2,675 lawsuits filed between January and June of 2023 to 3,240 during the same time frame in 2024, for a total increase of 21.1%.

Looking at June 2023 compared to June 2024, the numbers have risen 10.5% from 448 in 2023 to 496 in 2024.

Reduce CFPB Complaints

As these numbers continue to rise, it becomes evident that all stakeholders in the credit reporting ecosystem must collaborate to ensure data quality. No single party can effectively address all issues. To support these collaborative efforts, our Data Quality Scanner comprehensively assesses the Metro 2® Data quality journey of all furnished accounts and any associated disputes to identify and resolve the root causes of data quality issues. The Data Quality Scanner enables furnishers of all sizes and credit bureaus to monitor and evaluate the end-to-end Metro 2® data quality journey, significantly reducing CFPB complaints, FCRA regulatory and litigation risks, and disputes operational expenses.

We will continue to monitor CFPB complaints and FCRA litigation quarterly and share new credit reporting and dispute-related regulatory guidance and actions as they become available.

For more information or to schedule a demo of the Data Quality Scanner solution, contact our Head of Product. You can also schedule a meeting directly at this link.

Mike Eisel

[email protected]

VP of Product and CRM