With the third quarter officially ending, we are again looking at the CFPB complaints and FCRA litigation data to see what trends have occurred through 75% of the year. This is an ongoing series, and you can check out our last blog here.

To note, all complaints data is from the CFPB official website as of November 6, 2024

Q3 and the Continued Rise of CFPB Complaints

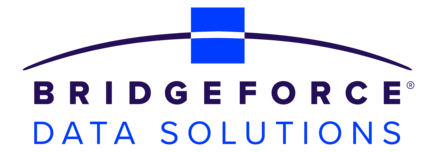

The total number of CFPB Complaints rose year-over-year again in Q3, with 758,602 complaints filed between July and September. This is a 124% increase from the 339,394 complaints filed in the same timeframe in 2023.

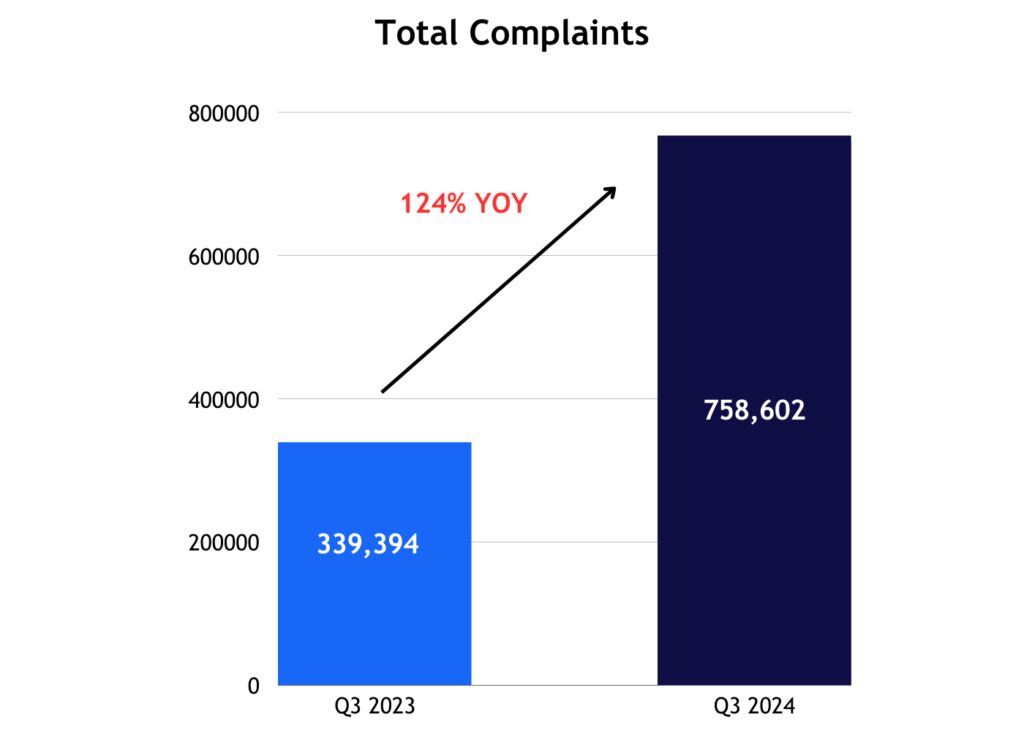

Additionally, the total number of complaints increased by 58% from the beginning of the year, going from 479,717 total complaints filed in Q1 to 603,316 in Q2 and now 758,602 in Q3.

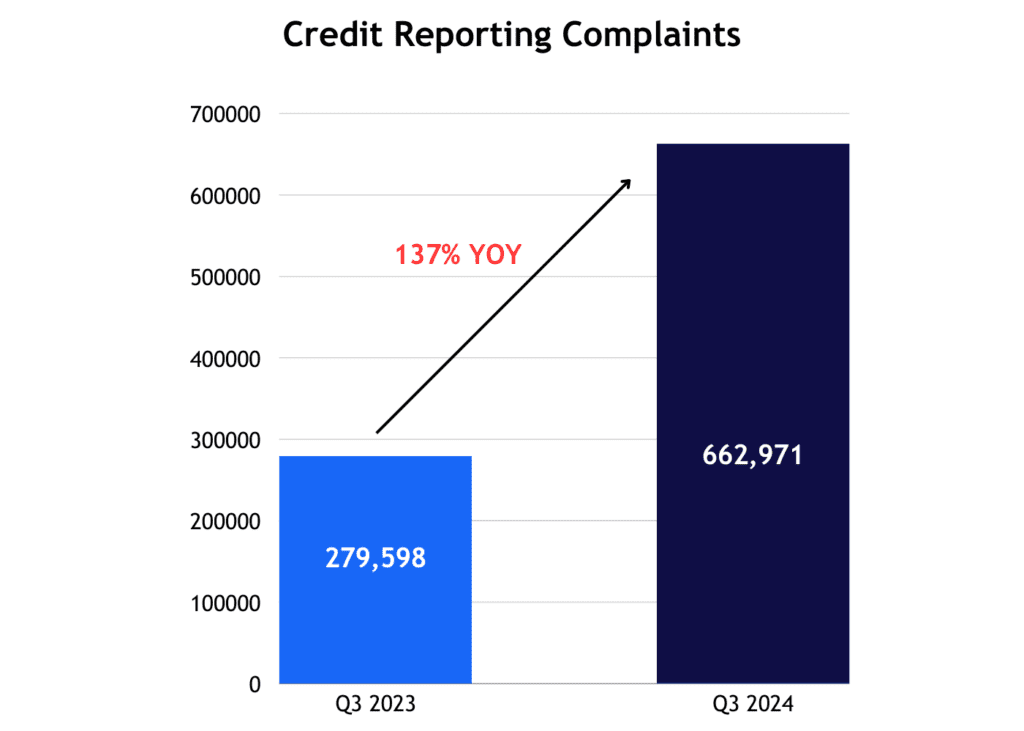

As we have mentioned in past blogs, credit reporting complaints continue to make up the vast majority of this data, accounting for 86% of all the complaints three-quarters into the year.

Credit Reporting Complaints Q3 ‘23 to Q3 ‘24

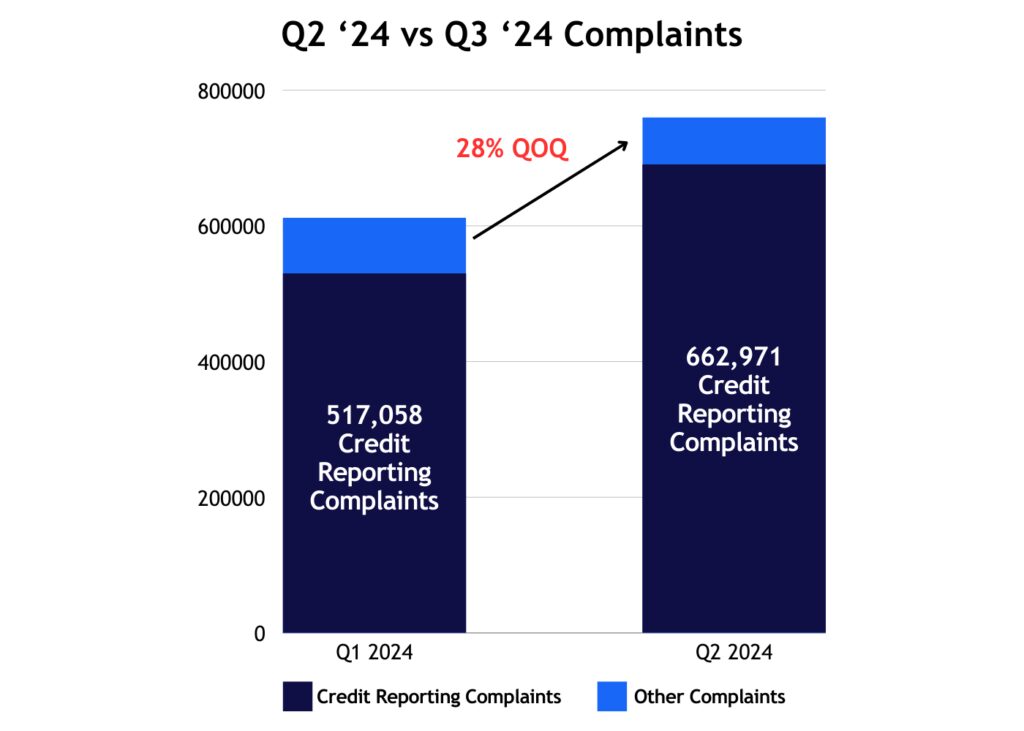

In the third quarter, we saw a 137% year-over-year increase, going from 279,598 complaints in Q3 of last year to 662,971 in Q3 of this year.

Credit reporting complaints also rose from Q2 of 2024 to Q3 of 2024, from 517,058 in Q2 to 662,971 in Q3.

Credit Reporting Sub-Issues

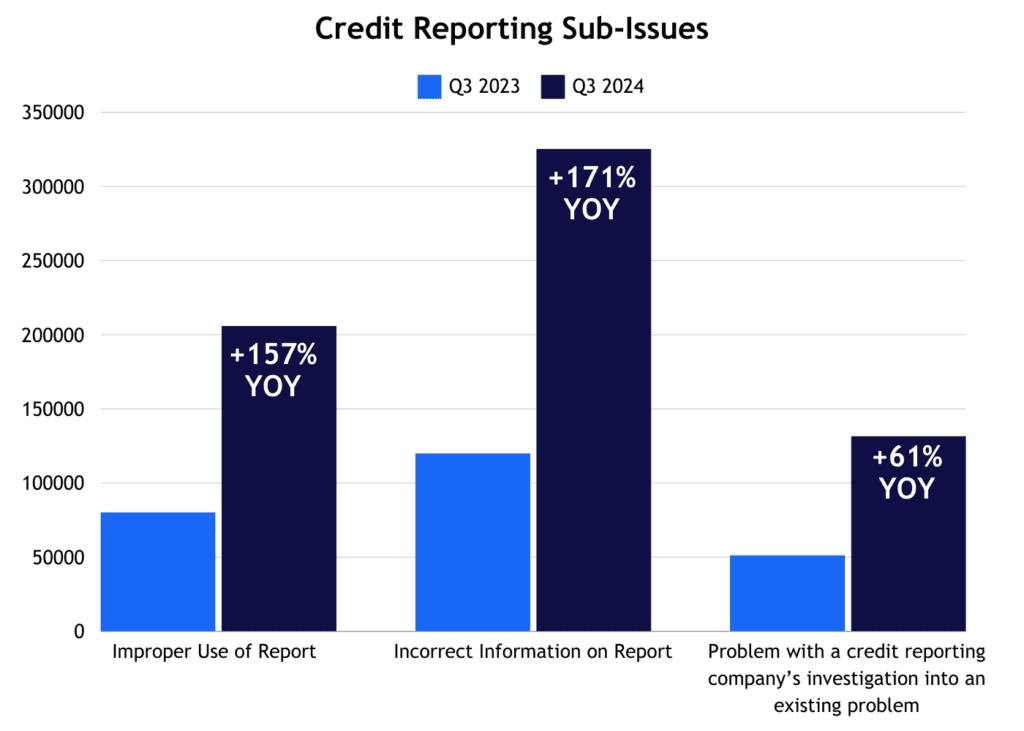

Similar trends exist when we look at the Credit Reporting Sub-Issues. The three largest sub-issues, ‘improper use of a report’, ‘incorrect information on report’, and ‘problem with a credit reporting company’s investigation into an existing problem’, all rose year-over-year for the 3rd straight quarter.

The largest sub-issue, ‘incorrect information on report,’ increased the most year-over-year, going from 120,028 total complaints in Q3 of 2023 to 325,347 in Q3 of 2024. This sub-issue now comprises 49% of all credit reporting complaints, rising from the 43% it accounted for in Q3 of 2023.

‘Improper use of a report’ also saw a significant rise year-over-year, going from 80,194 complaints in Q3 of 2023 to 205,859 complaints in Q3 of 2024, comprising a 157% increase.

The third most reported sub-issue, ‘problem with a credit reporting company’s investigation into an existing problem,’ still saw a substantial increase, going from51,408 total complaints in Q3 of 2023 to 131,694 total complaints in Q2 of 2024, for an overall increase of 61%.

FCRA Lawsuits

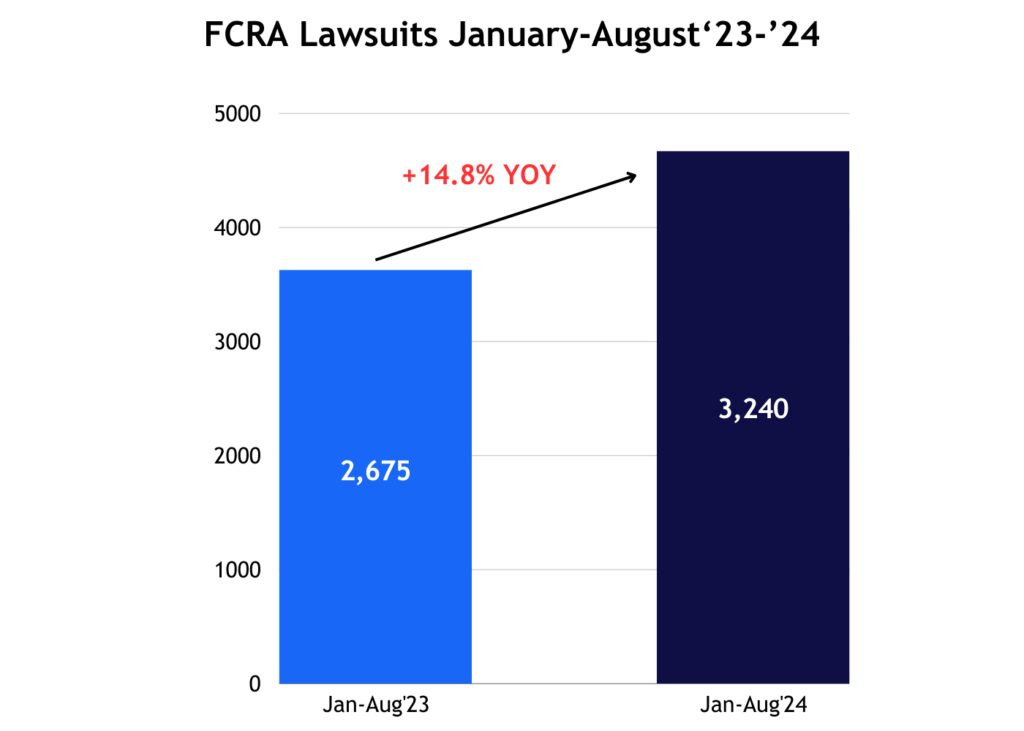

FCRA lawsuits have continued to rise since last year. WebRecon reported in August that the total number of FCRA Lawsuits filed between January and August of last year went from 3,629 to 4,166 between January and August, for a total rise of nearly 15%.

Reduce CFPB Complaints

As these numbers continue to rise, it becomes evident that all stakeholders in the credit reporting ecosystem must collaborate to ensure data quality. No single party can effectively address all issues. To support these collaborative efforts, our Data Quality Scanner comprehensively assesses the Metro 2® Data quality journey of all furnished accounts and any associated disputes to identify and resolve the root causes of data quality issues. The Data Quality Scanner enables furnishers of all sizes and credit bureaus to monitor and evaluate the end-to-end Metro 2® data quality journey, significantly reducing CFPB complaints, FCRA regulatory and litigation risks, and disputes operational expenses.

We will continue to monitor CFPB complaints and FCRA litigation quarterly and share new credit reporting and dispute-related regulatory guidance and actions as they become available.

For more information or to schedule a demo of the Data Quality Scanner solution, contact our Head of Product. You can also schedule a meeting directly at this link.

Mike Eisel

[email protected]

VP of Product and CRM