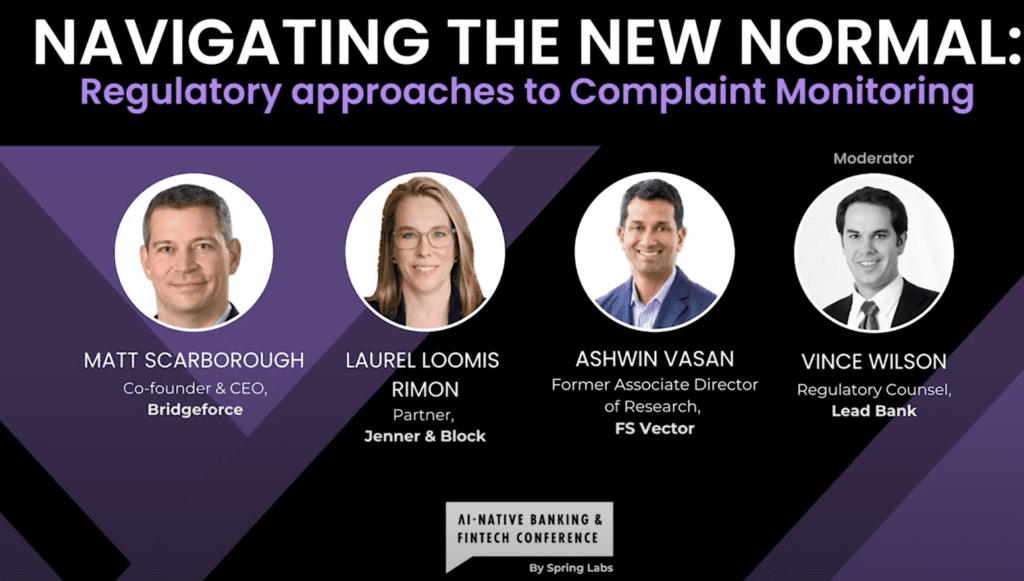

Matt Scarborough, CEO and Co-Founder of Bridgeforce Data Solutions, was invited to speak on a panel at Spring Lab’s AI-Native Banking and FinTech Conference this fall. The panel, titled ‘Navigating the New Normal: Regulatory Approaches to Complaint Monitoring,’ was moderated by a sponsor bank regulatory counsel and brought together other industry experts, including a former DOJ Prosecutor and CFPB Enforcement Officer, and a former CFPB Research Associate Director, to discuss what is happening in the regulatory landscape related to complaint monitoring and the role that AI can play in this area.

The full 45-minute-long recording of the panel can be viewed here.

We want to share the highlights of this discussion with our readers, so as a timely exercise, we asked AI for suggestions on what was most important.

To do this, we utilized a free YouTube Transcript Extractor to convert the full video into text. We then downloaded the file as a txt file to be fed into ChatGPT.

We used three different prompts to illicit different highlights from ChatGPT: one with no additional prompting aside from ‘provide a summary of this transcript,’ another with a prompt specifically focusing on Credit Reporting and Disputes, and lastly, a prompt focusing on AI.

Below, you’ll find all three summaries provided for your convenience. This exercise took less than an hour to complete—significantly faster than the day or more it would traditionally take to watch the video and take notes. We encourage you to try a similar exercise and discover AI’s value in delivering concise summaries and analyses.

As an organization, Bridgeforce Data Solutions continues exploring the value AI can provide to the credit reporting and disputes ecosystem we serve.

We recently announced our first product utilizing Generative AI for 2025. AI Agent Assist will assist Dispute Agents in:

- Combining data and ruleset insights from our Disputes Module with your detailed procedures to ensure compliant and efficient investigations.

- Using AI chat features to ask questions about an account in plain English and receive a response.

- Creating an automated audit trail of all the questions and answers provided during each dispute investigation.

We continue to work closely with our initial test clients to ensure the AI product’s utmost accuracy, and we look forward to sharing more with you in the future.

Until then, we invite you to view this insightful panel here and try your hand at using AI to create summaries based on your areas of interest. If you don’t have the time, review the summaries we created using AI below.

ChatGPT Summary Without Additional Prompts

Panel Overview

The panel, moderated by Vince Wilson of Lead Bank, included experts in regulatory, legal, and business domains:

- Ashwin Vasan (FS Vector, former CFPB research associate director)

- Laurel Lumonis Ramon (Jenner & Block, former DOJ prosecutor and CFPB enforcement officer)

- Matt Scarborough (Bridgeforce Data Solutions, business and tech leader)

The discussion explored the regulatory landscape, the evolution of consumer complaint handling, and the role of AI in financial services.

Evolution of Consumer Complaint Management

- CFPB’s Complaint System: Since its inception in 2011, the CFPB complaint portal has evolved from a rudimentary system to a comprehensive public database incorporating NLP models to anonymize data. Complaints now inform regulatory policies and enforcement actions.

- Increasing Volume: Over 6.3 million complaints have been received since 2011, with the majority submitted in recent years. This reflects increased consumer awareness and system usage, especially in credit reporting.

Key Regulatory Insights

- Complaint Handling Challenges: Financial institutions face growing scrutiny over complaint resolution. Regulators often analyze complaint trends to identify systemic issues, using consumer data in enforcement actions.

- Complaint as Intelligence: Complaints serve dual purposes: regulatory compliance and internal product improvement. Effective handling requires categorization, root-cause analysis, and meaningful responses.

- Expectations for Institutions: Regulators, increasingly sophisticated in their methods, expect institutions to adopt advanced tools and processes for complaint management.

AI’s Role and Opportunities

- Data-Driven Insights: AI helps manage complaint volumes by identifying patterns, filtering noise, and surfacing meaningful trends. This is especially valuable for categorizing disputes and detecting potential regulatory risks.

- Credit Reporting Disputes: AI plays a critical role in managing disputes within the credit reporting ecosystem. Despite challenges with frivolous disputes, clean and well-maintained data mitigates risks and supports compliance.

- Iterative Deployment: Institutions benefit from deploying AI incrementally, focusing on specific problem areas. This approach builds trust with regulators while enhancing operational efficiency.

Practical Advice for Institutions

- Regulatory Alignment: Communication with regulators, transparency in processes, and robust monitoring systems are vital when integrating new technologies.

- Compliance Challenges: Institutions must navigate ambiguities, such as defining complaints versus inquiries, and address regulatory expectations around consumer protections.

- AI in Low-Risk Areas: AI adoption is safer in low-stakes functions like internal data analysis and pattern detection, rather than direct consumer interactions.

Key Insights from Q&A

- Complaint Volumes: The CFPB expects complaints for most financial products, using data spikes to guide regulatory focus. Institutions with low complaint volumes may attract scrutiny.

- Dark Patterns: Practices that obscure product costs or mislead consumers are increasingly under scrutiny. Consumer confusion, even without formal complaints, can indicate potential violations.

- Credit Reporting Complexity: Many disputes arise from inaccuracies or consumers attempting to game the system. AI and enhanced data governance can help reduce frivolous claims while addressing genuine issues.

ChatGPT Summary with a Focus on Credit Reporting and Complaints

Credit Reporting Complaints and Disputes Overview

Dominance in Complaints:

- Credit reporting issues account for the largest volume of complaints filed with the CFPB, representing 80-90% of recent complaints.

- A significant portion relates to the three national credit reporting agencies (NCRAs), particularly regarding inaccurate information on credit reports.

Nature of Disputes:

- Disputes often arise from:

- Legitimate inaccuracies in credit data.

- Consumers leveraging the system to challenge valid debts in hopes of having them removed.

- Many disputes involve data issues that could be resolved with better data governance, while others are frivolous or exploitative.

Challenges in Handling Credit Reporting Disputes

Volume and Noise:

- The sheer volume of disputes and complaints includes a mix of valid and invalid claims, creating challenges in filtering meaningful cases.

- Institutions struggle to differentiate actionable complaints from noise, particularly those generated by credit repair organizations.

Consumer Expectations:

- Consumers often bypass furnishers (the original sources of credit data) and go directly to the NCRAs or the CFPB, believing these channels will elicit faster or more serious responses.

- This bypass can complicate dispute resolution for financial institutions and the NCRAs.

Regulatory Oversight:

- The CFPB scrutinizes complaint handling by NCRAs and furnishers, expecting tailored responses to consumer disputes rather than dismissive form letters.

- Automated processes that prioritize cost-efficiency over accuracy have drawn significant criticism, as seen in the CFPB’s 2021 report on reduced response rates from NCRAs.

Role of AI in Managing Disputes

Data Analysis and Categorization:

- AI is instrumental in identifying patterns, categorizing disputes, and detecting systemic issues within credit reporting.

- Tools such as natural language processing (NLP) can help analyze narratives, flag common issues, and extract actionable insights.

Improving Accuracy and Efficiency:

- AI can support compliance by identifying data inaccuracies more quickly and comprehensively than manual reviews.

- Institutions can use AI to clean and manage data, reducing the volume of frivolous disputes and enhancing the quality of responses.

Tailored Responses:

- AI systems can be trained using established procedures (e.g., desktop manuals) to provide more specific and consumer-focused responses, meeting regulatory expectations.

Recommendations for Handling Disputes

Data Governance:

- Maintaining high-quality data reduces the likelihood of disputes and strengthens the institution’s ability to rebut frivolous claims.

- Data issues often attract credit repair organizations, which exploit weaknesses in reporting systems.

Regulatory Communication:

- Institutions should proactively demonstrate how AI tools improve accuracy, consumer outcomes, and complaint handling processes.

- Regulators value transparency and incremental improvements, particularly when tied to consumer protection goals.

Consumer Interaction:

- Institutions must strike a balance between leveraging AI for efficiency and providing responses that feel human and personalized, especially in escalated disputes.

- Overreliance on automation without proper oversight can harm consumer trust and invite regulatory scrutiny.

Lessons from Regulatory Actions

CFPB Expectations for Credit Reporting Agencies:

- NCRAs faced criticism for using automated processes to dismiss disputes resembling form letters, which led to lower response and relief rates for consumers.

- Following public admonishment, NCRAs increased tailored responses, demonstrating the importance of addressing complaints seriously and specifically.

Balancing Efficiency and Compliance:

- While AI can streamline processes, institutions must ensure that operational improvements do not come at the expense of consumer protection.

ChatGPT Summary with a Focus on AI

Role of AI in Financial Services

AI’s Growing Importance: AI is increasingly utilized in regulatory compliance, complaint management, and credit reporting due to its ability to handle vast data volumes, uncover patterns, and improve operational efficiency.

AI in Complaint Handling

Data Analysis and Categorization:

- AI enables better categorization of complaints and distinguishes between complaints and general inquiries or feedback.

- It identifies trends and root causes of complaints, helping institutions prioritize regulatory risks and consumer protection efforts.

Public Database Management:

- The CFPB employs AI, including natural language processing (NLP) models, to redact personally identifiable information (PII) from complaint narratives in its public database.

Addressing Noise:

- AI helps filter out frivolous or repetitive complaints and disputes, enabling institutions to focus on legitimate issues.

- Particularly in credit reporting, AI detects and manages “junk” data while ensuring genuine data issues are addressed.

AI in Credit Reporting and Disputes

Improving Data Quality:

- AI tools are used to scan credit bureau files, such as Metro 2 data, for inaccuracies.

- Institutions employing AI for data governance can mitigate disputes stemming from data errors and attract fewer frivolous claims.

Responding to Consumer Complaints:

- AI systems can generate tailored responses based on predefined procedures, aligning with regulatory expectations for specific and meaningful replies.

- However, caution is advised in using AI for direct consumer interactions due to regulatory concerns about generic or automated responses.

Implementation of AI

Iterative Approach:

- Institutions are encouraged to adopt AI incrementally, targeting specific use cases (e.g., identifying complaint trends or analyzing dispute data) rather than deploying broadly.

- This approach minimizes risk, builds regulatory trust, and allows for better oversight of AI applications.

Generative AI in Compliance:

- Desktop procedures and regulatory frameworks provide a strong foundation for training generative AI tools.

- These tools act as “co-pilots,” supporting human decision-making rather than replacing it entirely.

Regulatory Considerations for AI

Guardrails and Monitoring:

- Robust governance frameworks are essential for AI adoption, including monitoring performance and addressing potential biases.

- Institutions must be prepared to demonstrate how AI improves consumer outcomes and aligns with public policy goals.

Regulatory Acceptance:

- Regulators are open to AI if institutions can show clear benefits, transparency, and a solid monitoring process.

- AI adoption should not be solely for cost-cutting; it must address specific problems and enhance compliance or consumer experience.

Cautionary Tales:

- In 2021, credit reporting agencies faced criticism for using AI to automate dispute dismissals, resulting in reduced consumer relief. This highlights the need to balance efficiency with regulatory and consumer protection.

AI’s Potential and Challenges

Strengths:

- AI can analyze unstructured data, uncover meaningful insights, and improve the efficiency of complaint and dispute management.

- It enhances compliance by providing more comprehensive data analysis than manual processes can achieve.

Risks:

- Direct AI interactions with consumers pose higher risks, as these require responses that are both specific and empathetic.

- Without proper oversight, AI can amplify systemic issues or attract regulatory scrutiny.

Key Applications of AI

- Complaint Analysis: Identifying patterns and addressing root causes to improve products and services.

- Credit Reporting Data Quality: Cleaning and monitoring data to prevent disputes and ensure regulatory compliance.

- Consumer Interaction: Supporting tailored responses while ensuring a human-like touch in communications.

Conclusion

AI is a transformative tool in financial services, offering opportunities to enhance compliance, streamline operations, and improve consumer outcomes. However, its success depends on careful implementation, robust governance, and alignment with regulatory expectations.

About Bridgeforce Data Solutions:

Bridgeforce Data Solutions, a leading fintech, offers the Data Quality Scanner, an end-to-end accuracy solution for credit reporting and disputes. The Data Quality Scanner is an automated, low-cost, low-IT AWS cloud-based diagnostic tool with two modules: Furnishing and Disputes. The Furnishing module assesses data quality before or after furnishing for 100% of furnished data, while the Disputes module identifies data issues in credit bureau disputes, how credit bureaus transform furnished data, and how well dispute agents resolve data quality issues. These unique features make the Data Quality Scanner a powerful solution for the 50+ financial institutions that actively use it, including top banks, credit unions, and fintech lenders, a testament to our industry leadership.