September 4, 2025, Update:

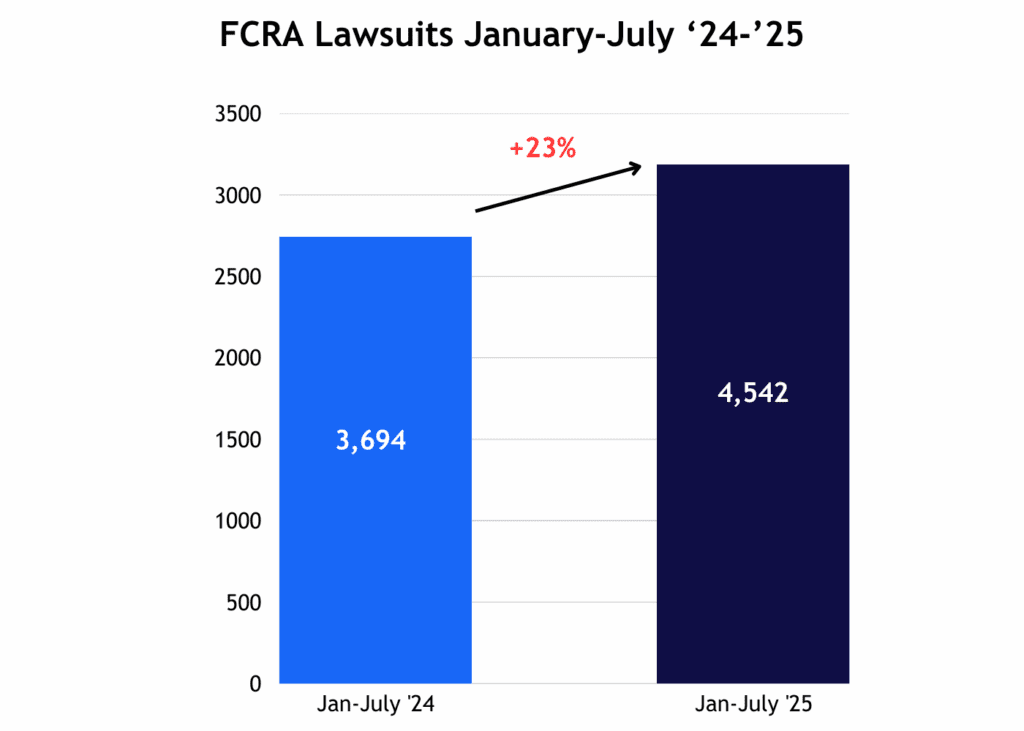

After publishing this story on July 24, 2025, WebRecon released the updated July data on FCRA lawsuits, and the upward trend continues. Lawsuits climbed 18.9% from June to July, jumping from 663 to 788 cases.

Year-to-date comparisons show a similar trajectory with FCRA complaints increasing from 3,694 in 2024 to 4,542 in 2025, a 23% rise.

These steep jumps highlight the growing regulatory and litigation risks across the industry. We will continue tracking these developments and sharing insights to help organizations stay prepared.

Introduction

As the current administration continues to scrutinize the CFPB’s authority and future trajectory, we’re closely following its role in the regulatory landscape. Despite political headwinds and internal cuts, the CFPB continues to publish complaint data, which we’ve continually monitored over the past two years.

Meanwhile, we came across a new complaints data source, the FDIC’s 2025 Consumer Compliance Supervisory Highlights, which showed a 14% increase in consumer complaints in 2024 compared to 2023, totaling 26,451 inquiries. Credit cards were the most cited product, with credit-reporting disputes and transaction discrepancies topping the issues raised across all products.

Of these complaints, the FDIC investigated over 10,800, identifying 305 apparent errors and 132 regulatory violations, resulting in approximately $33 million in consumer restitution.

Below, we break down the key statistics from Q2 2025 and compare them to those of past quarters.

We’re also keen on hearing your take: Have you seen rises in disputes volumes at your organization? Answer at the poll below. Once we’ve collected enough responses, we’ll share what the industry is saying.

Thanks, as always, for following along.

Complaints Continue to Rise, Begin to See Leveling Off

Note: All Data is from the CFPB Complaints Database as of July 16, 2025

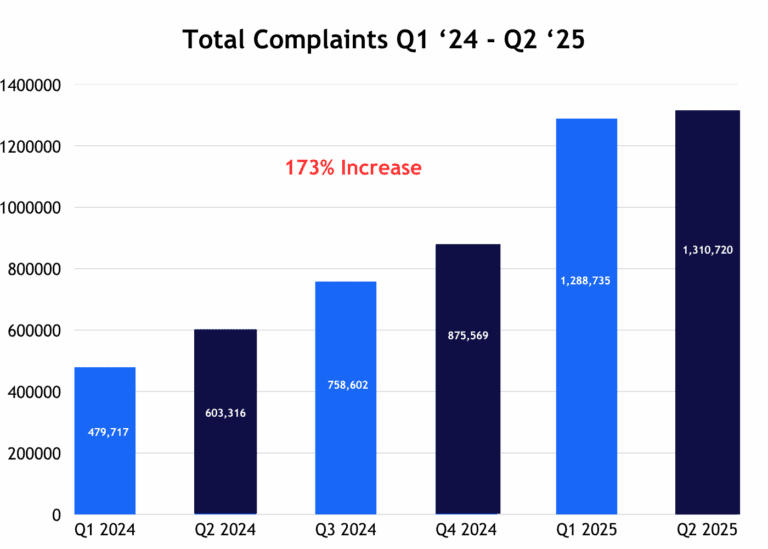

Consumer complaints filed through the CFPB Complaints Portal have once again reached an all-time high, albeit with only a slight increase in total complaints, quarter-over-quarter, rising from just over 1.2 million complaints in Q1 of this year to 1.3 million complaints in Q2 of the previous year.

Despite the quarter-over-quarter leveling off, complaints have still increased by 173% since the beginning of Q1.

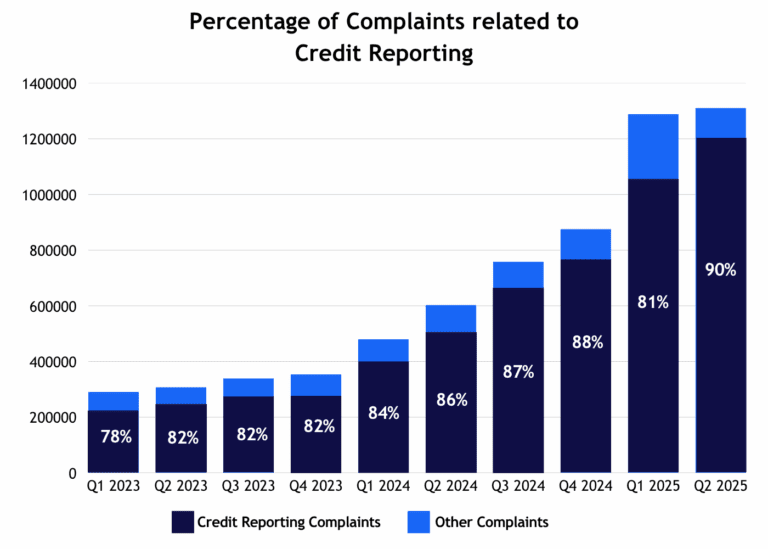

As mentioned in past blogs, credit reporting complaints continue to account for the majority of these complaints. The percentage of credit reporting complaints accounting for total complaints has increased quarter over quarter, from 81% in Q1 of this year to 90% in Q2.

Credit Reporting Complaints Q2 ’24 to Q2 ’25

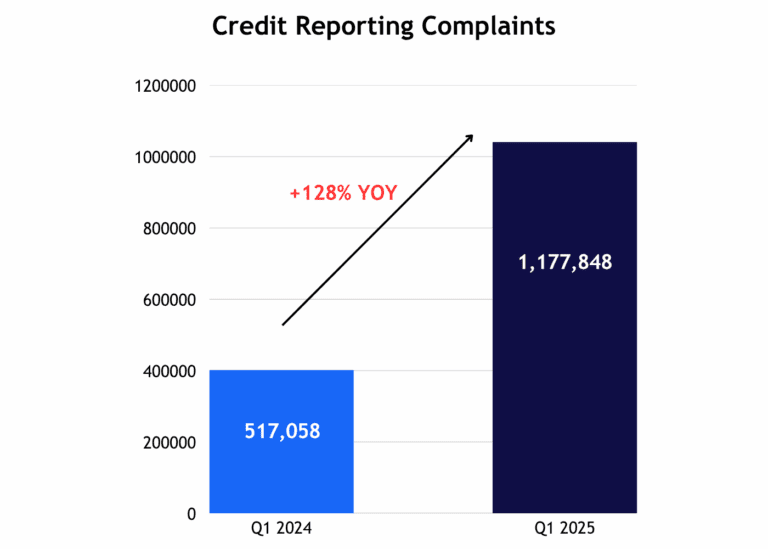

In the second quarter, we saw a 128% year-over-year increase, going from 517,058 complaints related to credit reporting in Q2 of last year to 1,177,848 in Q2 of this year quarter.

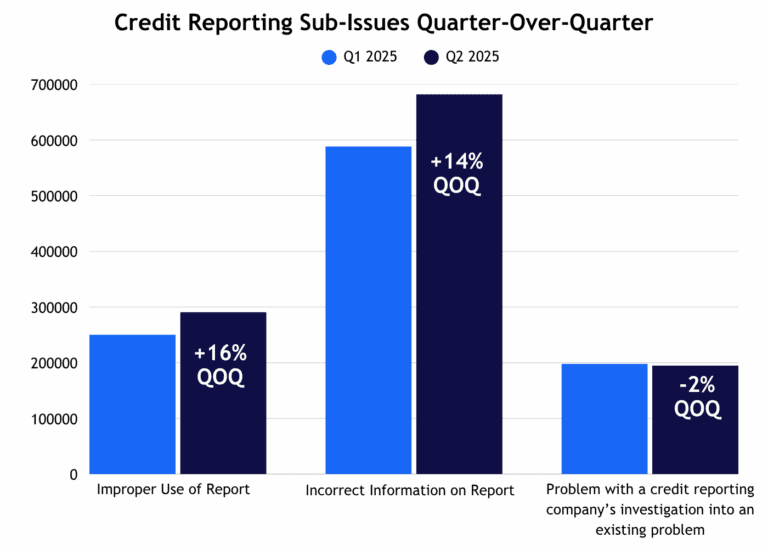

Credit Reporting Sub-Issues

The top sub-issues for credit reporting remained the same, with the following three sub-issues being the primary reasons for these credit reporting complaints: Incorrect information on report, Improper use of report, and Problem with a credit reporting company’s investigation into an existing problem. Two of these increased about 15% quarter over quarter, with ‘Problem with a credit reporting investigation into an existing problem ‘ decreasing 2%.

FCRA Lawsuits

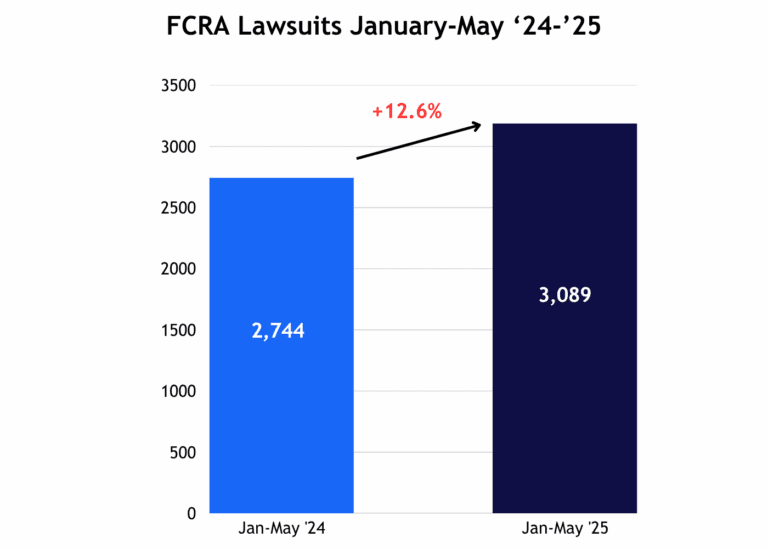

FCRA lawsuits have continued to rise as well. According to WebRecon, they have gone from 606 lawsuits in April of this year to 667 in May for an increase of 10.1% month over month. They have also increased year to date, with lawsuits rising from 2,755 in January through May 2024 to 3,089 in the same time frame in 2025 for an increase of 12.6% year over year.

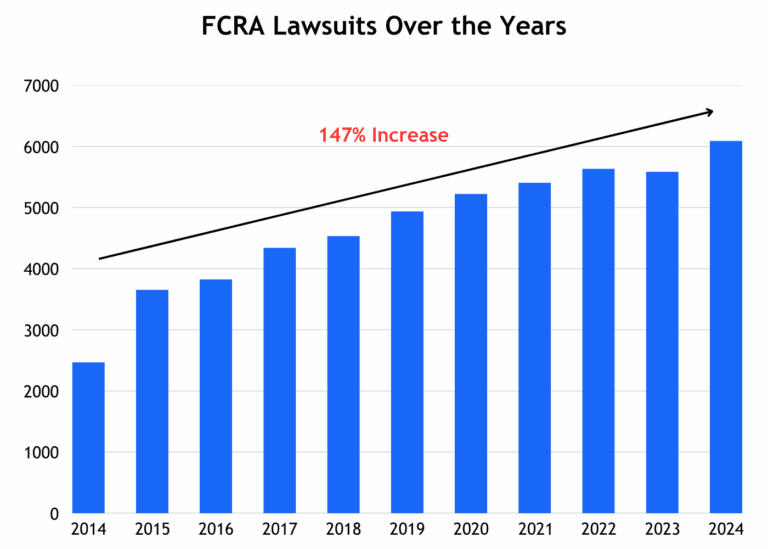

The data looks the same over the last ten years, with FCRA lawsuits steadily rising year-over-year for an overall percentage increase of 147% since 2014.

Reducing FCRA-related Complaints and Litigation

As complaint volumes hit new highs, we have also conducted recent polling of furnishers at various events. Our findings indicate non-seasonal increases in disputes ranging from 10% to over 50% from the start of the year, with some product categories experiencing increases of up to 100%. Additionally, our decade-long analysis shows that 15-25% of trade lines submitted to credit bureaus without automated controls contain errors.

To help, we now offer an exclusive Free Trial Program of our industry-leading Data Quality Scanner, the only end-to-end accuracy solution for credit reporting and disputes. This free trial, which can be completed without PII and IT involvement through our partnership with Equifax, provides a summary-level report on FCRA data quality issues and actionable insights for improvement.

To learn more or request a free trial, please reach out to our Head of Product or schedule time directly using this link – https://bridgeforcedatasolutions.com/contact-us/

We will continue to monitor complaints and litigation trends on a quarterly basis and share timely updates on regulatory developments that affect credit reporting and disputes.

About Bridgeforce Data Solutions

Bridgeforce Data Solutions is a new breed of RegTech SaaS company that offers the Data Quality Scanner, the only end-to-end accuracy solution for credit reporting and disputes.

The Data Quality Scanner is an automated, low-cost FCRA diagnostic and oversight solution that requires no IT integration. It is used by over 50 financial institutions, including six of the top 20 banks, seven of the top 10 credit unions, and many lenders and servicers of all sizes, to reduce credit reporting errors by more than 90% and disputes by over 30%.