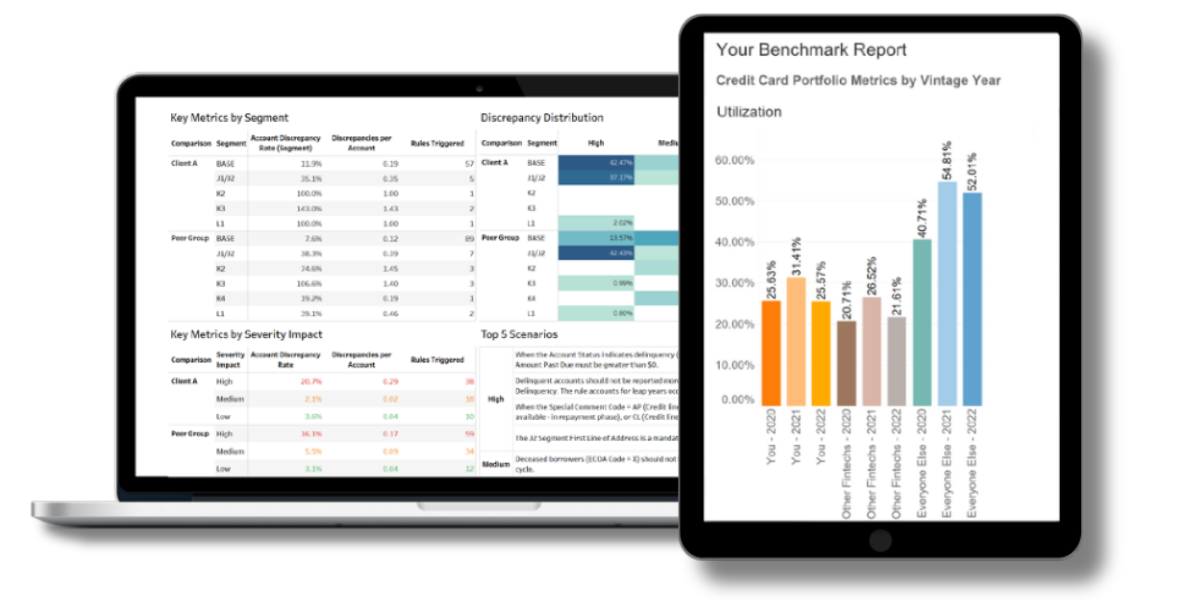

Benchmark: See Where You Stand

Compare the accuracy of your credit reporting data to your peers with our 1-Minute Self-Audit covering key credit reporting and FCRA accuracy and compliance processes.

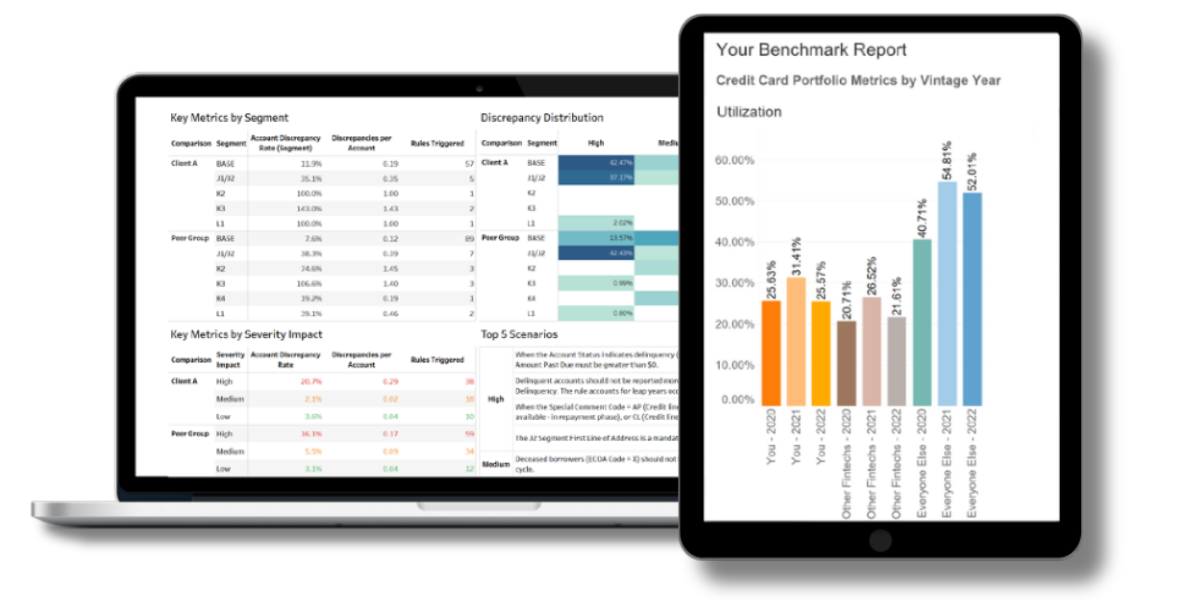

If you don’t have an automated solution that comprehensively assesses all of your accounts, like DQS, you don’t really know where you stand. For initial baseline results, we see clients have between 15-25% of accounts with at least one discrepancy. Complete the self-audit now.