July 2025 Update:

Despite ongoing uncertainty around the CFPB’s future, its complaint database remains active, with total complaints surpassing one million per quarter in both Q1 and Q2 of this year. In addition, an internal CFPB memo confirmed that—despite recent staffing cuts—the Bureau remains committed to prioritizing enforcement of FCRA violations.

Stay tuned for more quarterly insights as we continue to track trends in CFPB complaints and regulatory activity.

Established in 2011, the Consumer Financial Protection Bureau (CFPB) collects, monitors, and processes millions of responses to consumer complaints regarding financial products and services. The volume of complaints has steadily increased year over year. In 2023, the CFPB received 1.3 million complaints involving more than 3,400 companies. This escalating trend underscores the growing importance for companies and consumers alike to understand the workings of these complaints and extract valuable insights from this extensive data pool.

In this blog, we will dive into how the complaints process works for consumers and companies receiving complaints. We will explore how complaints are handled and what is done with the data. We’ll also explore how this data can be effectively leveraged for learning and improvement purposes.

The CFPB Complaints Process: Consumer Side

Consumer Identifying a Situation to File a Complaint

The first step is for a consumer to recognize that there is something to file a complaint about.

Many underlying causes can lead to a complaint. These include financial problems like errors in billing statements, unauthorized charges, or discrepancies in loan terms.

Consumers may also file complaints in response to deceptive practices, such as misleading advertising, hidden fees, or failure to disclose important information. Deficient customer service experiences, such as unresponsive support, difficulty in resolving disputes, or lack of assistance, can also prompt consumers to seek recourse via the complaint process.

While all these factors contribute to the complaint volume, none garner more CFPB complaints than credit or consumer reporting, which accounted for more than 81% of all consumer complaints in 2023.

Complaints factors can include errors or inaccuracies on a consumer’s credit report, including incorrect personal information or payment history. Fraudulent activity, such as identity theft or unauthorized credit inquiries, can also prompt consumers to file this type of complaint. Disputes with creditors or collection agencies regarding the reporting of debts, concerns about credit score calculations or drops without explanation, and challenges in getting errors corrected or receiving timely assistance are additional factors that drive consumers to submit credit reporting complaints.

Once a consumer identifies the situation in which to file a complaint, the next step is to inform the CFPB through their complaint filing systems.

Filing a Complaint with the CFPB

When a consumer is ready to file a complaint with the CFPB, they have a couple of avenues.

Online Complaint Portal

The most common and convenient method for consumers to submit complaints to the CFPB is through its online complaint portal. This portal is accessible 24/7 and guides consumers through the process step by step. Once an account is made, consumers can provide detailed information on their complaint, what company it applies to, and what a fair resolution might be for that complaint. They also have the option to upload applicable supporting documentation. This process has five total screens to work through and should take consumers 7-10 minutes to fill out

Once the complaint is submitted, any status updates can be viewed directly in the portal or via email updates from the CFPB.

Filing a Complaint by Phone

Another option for submitting complaints is by calling the CFPB at their toll-free number. From there, the US-based contact center works with consumers to make sure the complaint is filed appropriately. The customer support team can help in over 180 languages and take calls from consumers who are deaf, have hearing loss, or have speech disabilities. This process should take 25-30 minutes in total.

The most important items to include:

According to the CFPB’s website, there are four important items that should be included in the complaint.

The first are the key facts in the consumer’s own words. This should be a couple of clear and concise sentences about the problem. This can include information like important dates, amounts, and communications that have been had with the company.

The second item that should be included is any relevant documents. This can consist of items like account statements and communications with the company. Consumers should be aware that the maximum page limit for submittal is 50 pages.

Third, is the company about which the consumer is filing the complaint. The CFPB provides a list of companies that have signed up to receive complaints. This allows the CFPB to directly forward the complaint to them to ask for a response. If the company is not available on that list the CFPB will let consumers know what to do next.

The last item is the proper contact information. Name, email, and phone number will be needed to create an account. An address must also be provided so the company can respond to the complaint. If a person or company submits a complaint on another consumer’s behalf, the relationship with the consumer must be disclosed.

What happens next?

At the end of the complaint submittal process, there is also an option that asks for approval to publish the information in the Consumer Complaint Database. They will remove information that directly identifies the consumer. This allows companies and consumers to view an aggregate of complaint data to see trends and other insights.

Once all this information is complete, the CFPB will forward the information to the appropriate company. According to their website, most of the companies will respond within 15 days, but in some cases the company will let the consumer know their response is in progress and provide a final response in 60 days.

The CFPB Complaint Process: Company Side

After a consumer submits a complaint to the CFPB, the CFPB will first review the complaint to ensure it is complete and is not missing any important information. If the complaint is incomplete, the CFPB may contact the consumer for more details.

After the complaint is confirmed, the CFPB routes it to the relevant party, typically the company in question. If deemed appropriate, they may redirect it to a more suitable government agency and inform the consumer. This process can also happen in reverse, with government agencies forwarding complaints to the CFPB.

Once a company receives a complaint from the CFPB, it is responsible for responding within 15 calendar days. If the response is not final, the company is responsible for letting the CFPB know. They will then have up to 60 days to provide a final response.

The company’s response should include the following information:

Steps Taken to Respond to the Complaint

The first thing that should be included in the company’s response is the steps taken in communicating with the consumer. This should detail the substance of the response, including a description of the communications that have happened with the consumer. Copies of relevant written communications with the consumer can be included in this step.

Communications from the Consumer

The second item available in the response is all communications received from the consumer. These should describe any items communicated to the company from the consumer’s end. Again, items should be attached here showing how the consumer responded to any steps the company has taken.

Follow-up Actions or Planned Follow-up Actions.

The company should then describe any follow-up actions that the company has taken or is planning to take in continuing response to the complaint. This can include things such as a monetary correction for the issue, submitting a correction to a credit bureau, or notification that no action should be taken.

A Category that Captures Your Response

Finally, the company should select a category that summarizes the overall response. The CFPB Company portal manual, under section 5.3, has a full list of available responses. Some examples of response categories are closed with monetary relief, closed with explanation, or directed to related company.

Once all this information has been submitted, the CFPB forwards the response to the consumer. Here, the consumer can review the company’s response and provide feedback to the CFPB on whether it was satisfactory. The CFPB also allows consumers to consent to the publication of their complaint narratives in the Consumer Complaint Database.

What is Done with CFPB Complaint Data

As mentioned earlier in the blog, the CFPB received just over 1.3 million complaints this past year, which provides an abundance of information and data points that can be used for the CFPB, companies, and consumers to gain deeper insights into what is occurring in the financial landscape.

All these stats can be found at the CFPB’s Consumer Complaint Database where the data can be viewed by individual products and sub-products and by the specific issue. It is also available to be downloaded as a CSV file.

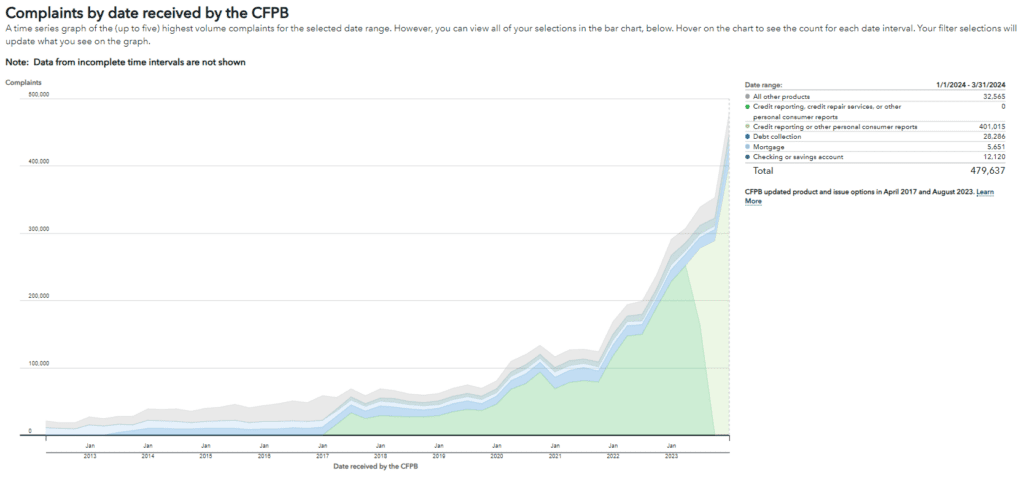

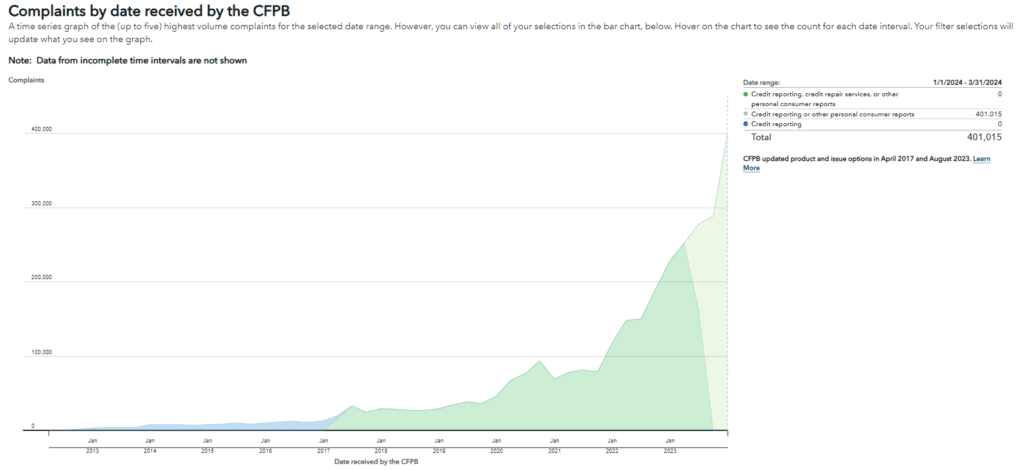

An example that can be depicted via the database is Complaints by Date Received by the CFPB since the start of the complaints process.

This can also be further broken down by specific complaints categories, such as credit or consumer reporting and date ranges.

Leveraging their analysis of the complaints data assists the CFPB with their work to supervise companies, enforce federal consumer financial laws, and write better rules and regulations. Additionally, the data is shared with state and federal agencies and used to help provide reports to Congress.

An example of this was the last semi-annual report shared on March 29. 2024, which can be found here.

Where are complaints sent?

These complaints are also being sent directly to the companies responsible for them. Companies can use this data to identify trends and patterns in complaints and make improvements to their products and services. For example, if a company sees a spike in complaints about a particular issue, it can investigate and take action if needed. Companies can also use the complaints process to connect with dissatisfied customers and address their concerns, which can help improve customer satisfaction and retention.

All in all, consumers submitting their complaint data helps the CFPB prioritize areas of focus, shape their policies moving forward, and lets companies know what issues are occurring in the marketplace.

CFPB Complaints: The Next Step

The CFPB complaint system provides a formal way for consumers to voice their concerns with issues that may be occurring in the overall financial landscape. This straightforward process to submit, monitor, and address complaints, consumers and companies alike can help shape changes to better the financial landscape for all.

At Bridgeforce Data Solutions, we will continue to monitor the ongoing evolution of the CFPB complaints system and complaints related to credit reporting and disputes and their impact on the industry.

If you would like to read more on this topic, check out our quarterly blog post that breaks down the stats on CFPB complaints as well as FCRA litigation.