See how your data measures up. Start a free trial of the Data Quality Scanner and stay ahead of social media and AI’s impact on credit reporting. Fill out the form to learn more.

Earlier this year, we explored how social media was shaping conversations around credit reporting and repair. Since then, the chatter has only intensified, especially with FCRA-related litigation and complaints continuing to record highs year over year.

A new industry report shared new data showing the credit repair industry is projected to double in size by 2032, driven by rising consumer demand and the adoption of automation and AI tools. With more than 43,000 businesses already operating in the space, this growth signals a major shift in how disputes are managed and resolved. For furnishers, this means the pressure to modernize processes is only increasing.

Also, earlier this fall, Consumer Reports warned about TikTok influencers promoting a fake CFPB payout scam tied to Zelle and Cash App, a reminder of how quickly bad information can spread online.

With this in mind, we revisited TikTok and YouTube to see which “tips and tricks” are trending now and what they reveal about the evolving credit repair landscape.

How the Data Quality Scanner Helps

As these trends evolve, the need for automation and AI-driven solutions to stay ahead of scammers and manage growing dispute volumes has never been greater. Strong, end-to-end compliance processes that ensure maximum possible accuracy in credit reporting and dispute resolution are essential for reducing risk and maintaining trust.

The Data Quality Scanner (DQS) is built to handle this. It scans billions of tradelines and hundreds of thousands of disputes annually, helping furnishers significantly reduce reporting errors and disputes while lowering operational costs and regulatory risk.

Looking ahead, we are currently piloting AI-powered tools that will provide real-time decision support, enabling furnishers to identify and resolve issues even faster and with greater accuracy.

Equally important is educating consumers about the risks of quick-fix credit repair schemes and promoting safer alternatives like non-profit credit counseling through organizations such as the NFCC.

TikTok

Despite uncertainty around a potential sale, TikTok continues to dominate shortform video content with over 1.9 billion monthly active users. Searching for “credit repair” now reveals a mix of familiar strategies and new trends, some helpful, others questionable.

Click the images to be taken to the TikTok video

One of the most talked-about trends involves using ChatGPT to scan credit reports and generate dispute letters. Creators are sharing specific prompts to help users automate the process, positioning AI as a shortcut to credit improvement.

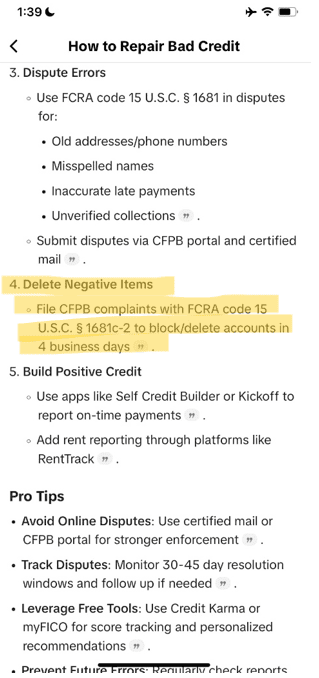

Another popular video outlines a 10-step process for credit repair, emphasizing that the Consumer Financial Protection Bureau (CFPB) is the best place to file disputes rather than going through credit bureaus. This approach is gaining traction among viewers looking for “official” solutions.

Several posts are advertising pre-written dispute letters for purchase, claiming they can help erase negative marks. One such video has 3.3K likes and over 2K comments, signaling strong engagement despite the questionable tactics.

A creator takes a more realistic stance, warning viewers to avoid anyone promising quick fixes. They stress that while errors can sometimes be leveraged to remove negative items, it requires expertise, not shortcuts, and advertising their own services.

It is a positive sign though that creators are starting to warn consumers about paying to try and fix credit.

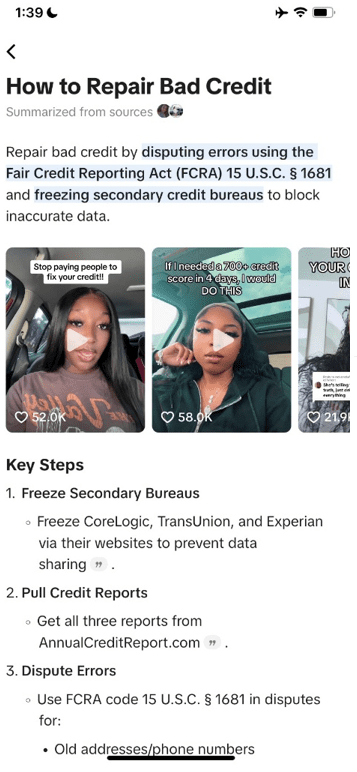

In addition to the typical posts, TikTok now recommends an ‘AI overview’ for questions users ask. Here users can see the trends of what is being shared because the input is aggregated across the videos shared, including controversial tips like ‘delete negative items.’

YouTube

While TikTok dominates short-form content, YouTube remains the go-to platform for longer, more detailed credit repair advice with over 2.5 billion monthly active users. Over the past five months, several videos have gained traction by offering step-by-step strategies and cautionary tips.

One emerging trend is the promotion of high-limit tradelines as a way to boost credit scores quickly. A recent video claims adding a $50,000 authorized user tradeline can increase your score by up to 70 points. While this tactic can temporarily improve utilization ratios, it’s a legal gray area and often frowned upon by lenders and potentially risky for consumers. Results vary widely, and the practice raises compliance and ethical concerns under FCRA and lender guidelines.

The second video focuses on legitimate, compliance-friendly strategies for improving credit scores. Key recommendations include disputing inaccuracies through official channels, lowering utilization, and building positive history with secured cards or credit builder loans. The creator strongly warns against scams and “magic letters,” positioning education and FCRA compliance as the safest path forward.’

Other Social Media Sites

Through our research, TikTok and YouTube appear to have the most frequent uploads related to credit repair. Other platforms such as Instagram, Facebook, and X show far fewer posts on this topic. While some results do appear in searches, they are primarily from individuals or businesses advertising their services rather than sharing new tactics.

Conclusion

The surge in social media content around credit repair, combined with the rise of AI-driven dispute tools and increasing FCRA-related litigation, signals a major shift in the industry. The credit repair market is also projected to more than double by 2032, and thousands of credit repair organizations are starting to use AI to dispute at scale. This rapid evolution means manual processes are no longer enough; furnishers must act now to keep pace and protect against mounting compliance risks.

The Data Quality Scanner (DQS) is the only comprehensive accuracy solution for credit reporting and disputes. Our automated, low-cost, no-integration solution is trusted by leading financial institutions, including six of the top 20 banks and seven of the largest 10 credit unions, to reduce reporting errors by more than 90 percent and disputes by over 30 percent.

By providing a complete view of the Metro 2® data lifecycle, furnishers can proactively identify issues, minimize disputes, and lower both operational costs and regulatory risk.

Schedule a demo with us today to learn how DQS can enhance your compliance efforts.