Benchmark: See Where You Stand

Compare the accuracy of your credit reporting data to your peers with our 1-Minute Self-Audit covering key credit reporting and FCRA accuracy and compliance processes.

With the threat of costly disputes, complaints, lawsuits, and regulatory inquiries looming, it’s important to ensure your credit reporting accuracy and compliance processes are in line with your peers. But it can be hard knowing where to start. That’s where the Data Quality Scanner (DQS) can help.

Are you doing enough to monitor

credit reporting and disputes accuracy?

Many credit furnishers are surprised to learn that their credit bureau data accuracy rates are worse than they realize when speaking to our industry experts.

Are you doing enough to monitor credit reporting data accuracy?

Many credit furnishers are surprised to learn that their credit bureau data accuracy rates are worse than they realize when speaking to our industry experts.

Credit Reporting Data Issues

are Common in Disputes

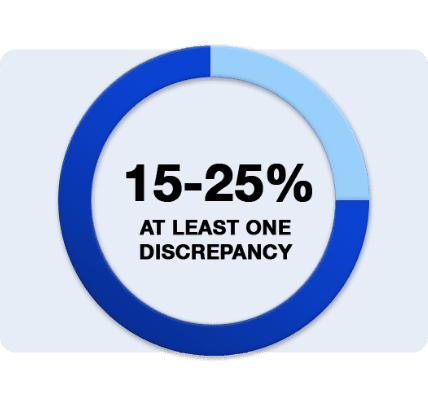

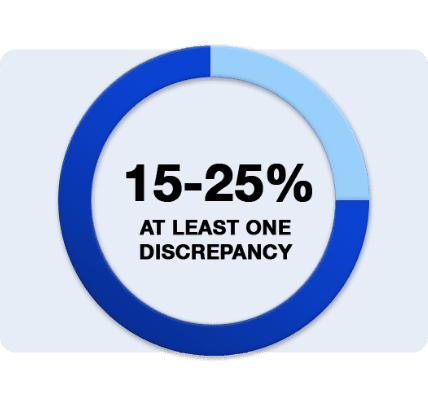

15-25% of accounts have at least one issue after the first time run.

Credit Reporting Data Issues

are Common in Disputes

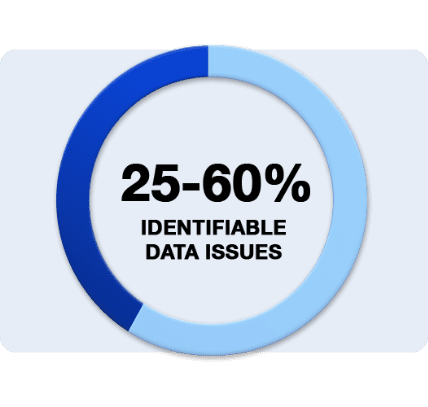

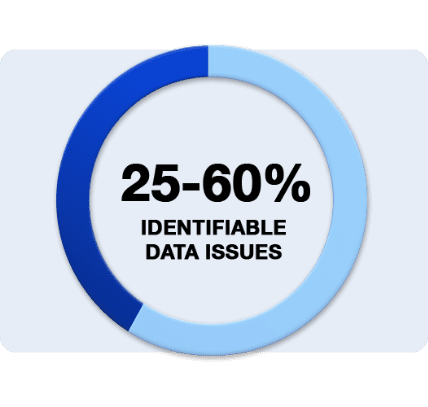

25-60% of indirect disputes have an

identifiable data issue upon receipt.

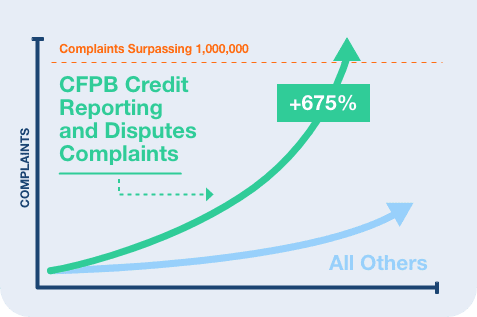

And Consumers Are

Starting To Notice

Credit Reporting CFPB complaints now comprise 3x the volume of all other complaint reasons combined.

Many Furnished Accounts Encounter Data Issues

15-25% of accounts have at least

one issue after the first time run.

And They Are Especially Common in Disputes

25-60% of indirect disputes have an

identifiable data issue upon receipt.

Dispute Agents are Only Catching Some

About 4 out of 5 data issues identified at the time of dispute go unresolved in the response.

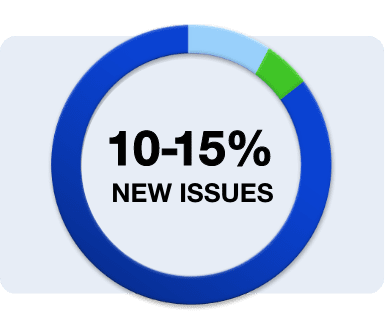

While Creating New Issues in their Responses

10-15% of ACDV responses create new data issues.

DATA QUALITY SCANNER: iMPROVE ACCURACY & REDUCE DISPUTES.

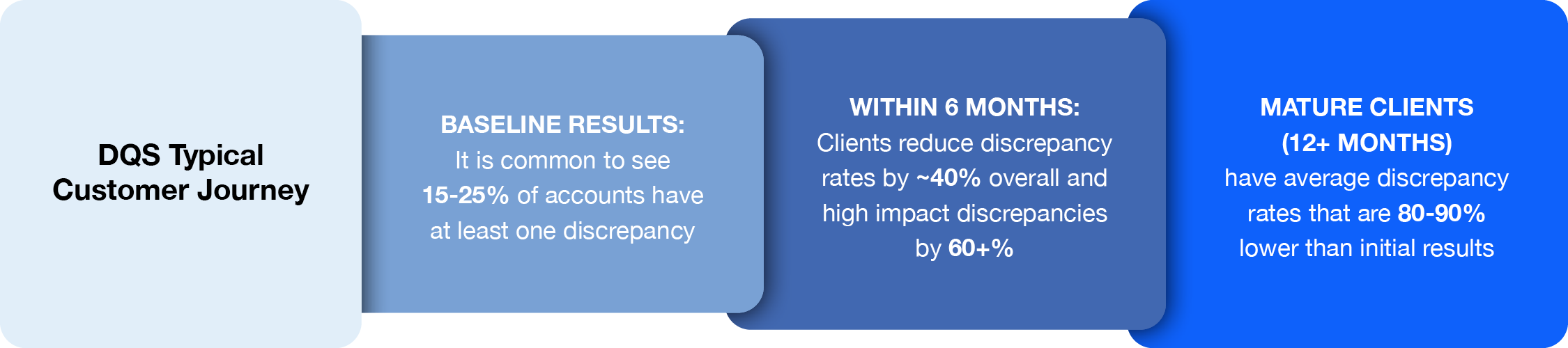

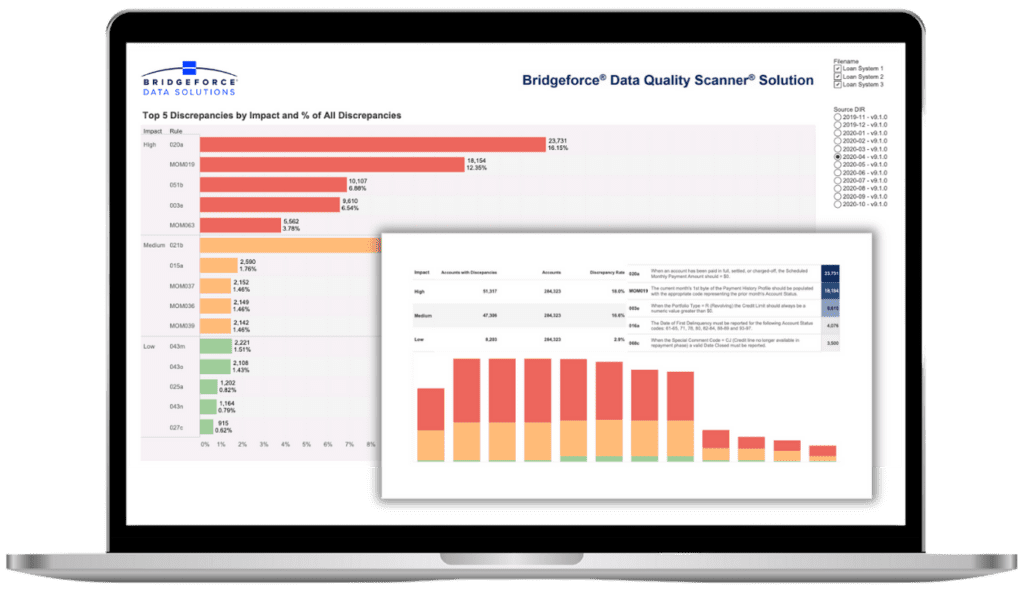

Introducing the Data Quality Scanner (DQS): Your essential tool for automating credit reporting compliance and benchmarking. Uncover the hidden discrepancies in your Metro 2® data with over 390 rules, empowering you to take a proactive, data-driven approach to identifying, prioritizing, and resolving account-level issues. With rising consumer awareness of data discrepancies, especially in disputes, and an increasing number of CFPB complaints, our solution equips you to address these challenges head-on.

Furnishing

DQS Module

DQS offers a compliance automation solution for accurate Metro 2® credit reporting, reducing dispute rates by over 30% with 390+ risk-ranked rules and detailed analysis. It streamlines file inspections, identifies root causes of issues, and provides consulting support for comprehensive credit reporting and dispute resolution.

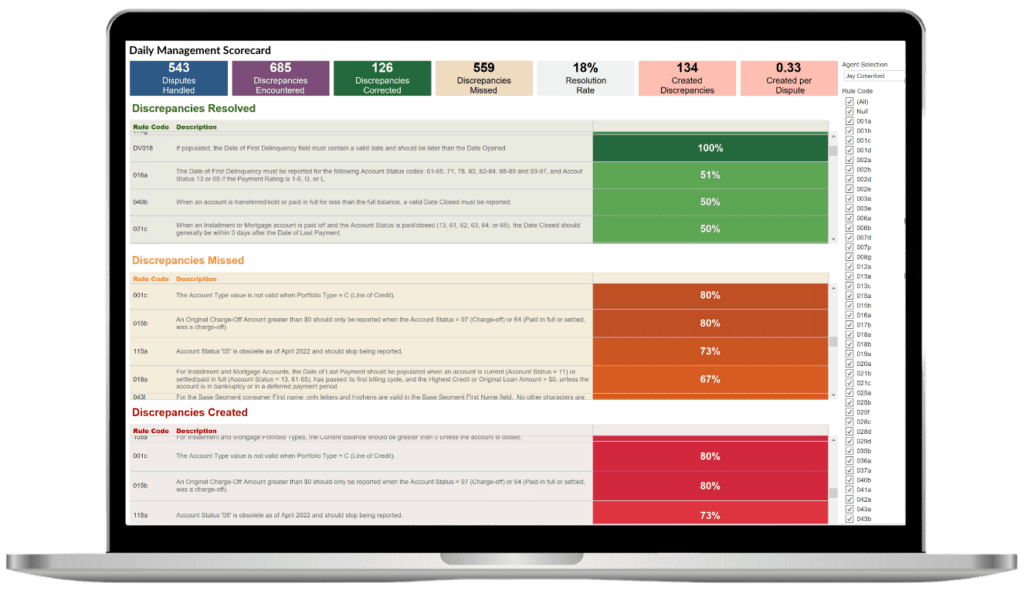

DISPUTES

Gain actionable insights into credit bureau disputes by utilizing DQS rules, Metro 2® data, and ACDV data, resulting in improved outcomes and cost reduction. Identify disputed data issues, their sources, assess team performance, prioritize education opportunities, and conduct root-cause conversations to effectively reduce initial and repeat disputes.