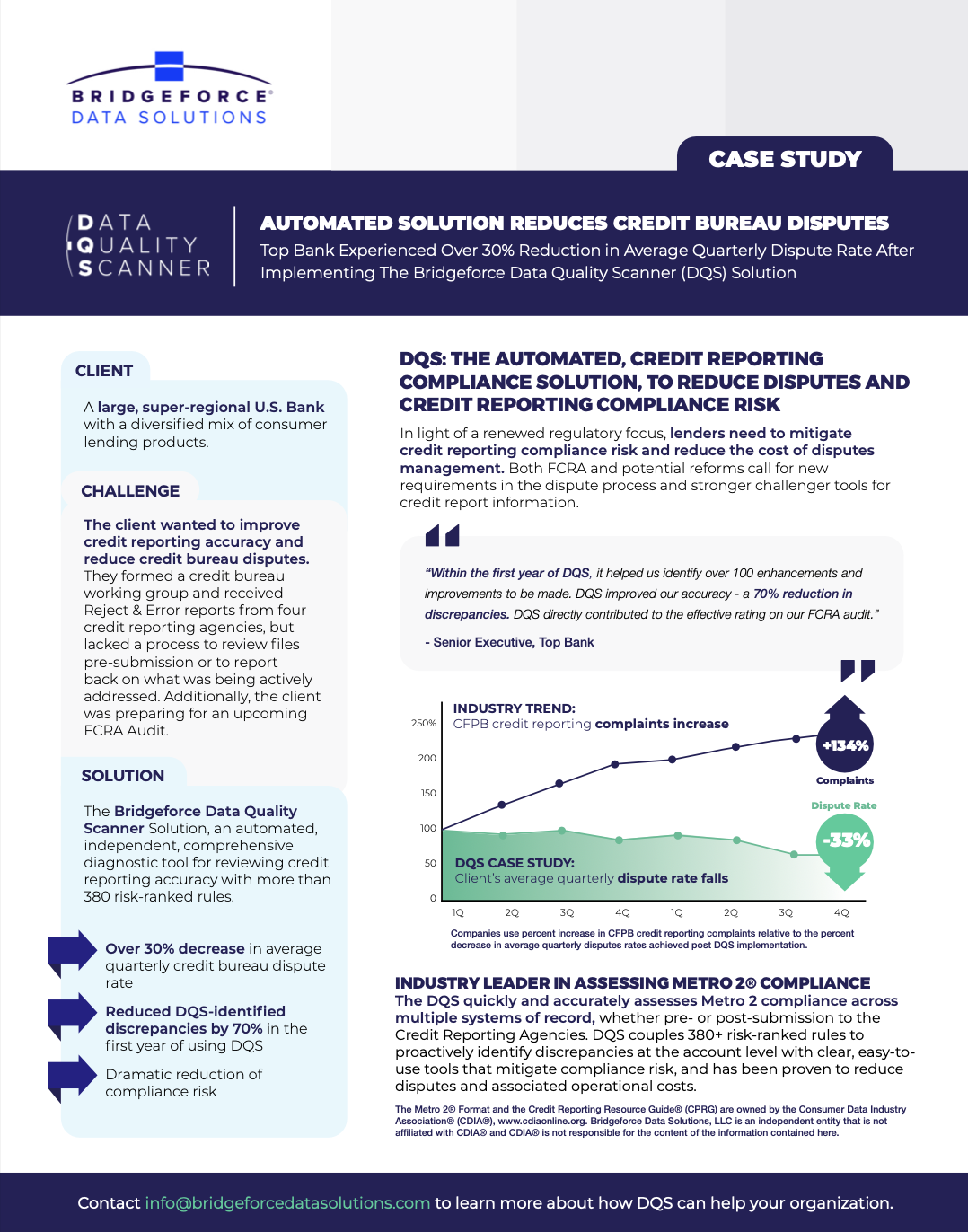

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and the costs of managing credit bureau disputes. In this case study, we show how a large, super-regional bank was able to achieve a 30%+ reduction in average quarterly dispute rate (and a 70% reduction in discrepancies) after using DQS for one year.

Blog

Credit Reporting and Repair Social Media Trends – Q2 2025

Earlier this year, we shared a blog about popular social media posts related to credit reporting and repair. With FCRA-related complaints and disputes reaching new