Introduction

With all the news swirling about the CFPB’s future, we were unsure if we could find complaint data for the first quarter of 2025. But to our surprise, the CFPB Consumer Complaint Database is still up and running, with complaints dating from the start of the year through the end of March.

Read further to dig into the trends we see and how consumer complaints continue to rise to all-time highs.

The Continued Rise of Complaints

Note: All Data is from the CFPB Complaints Database as of April 10, 2025

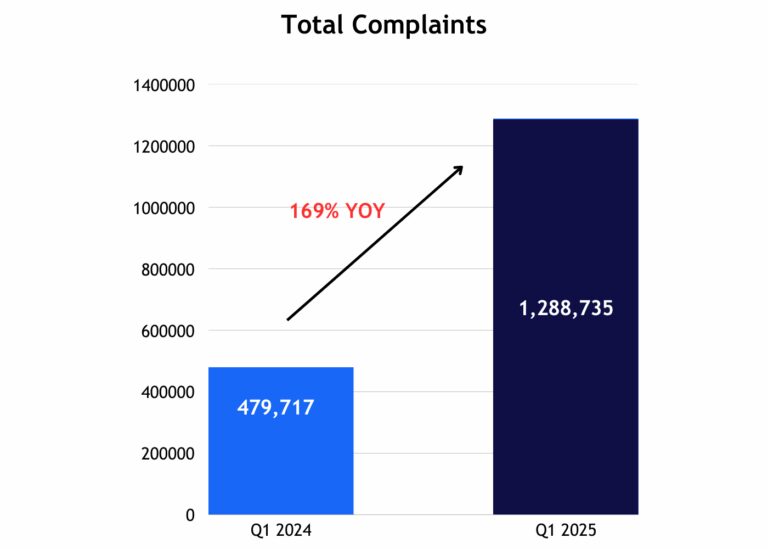

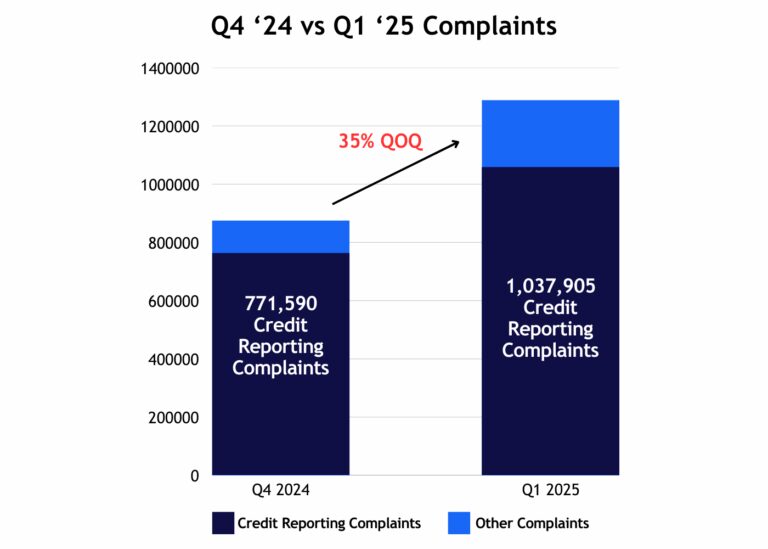

Once again, consumer complaints filed through the CFPB Complaints Portal have reached a new high. For the first time since the CFPB started receiving complaints, the number of complaints crossed the 1 million mark in a quarter. This means that the first quarter of 2025 had nearly as many complaints as the entire year of 2023, with 1,292,141 complaints filed in 2023 and 1,288,735 filed in the first quarter.

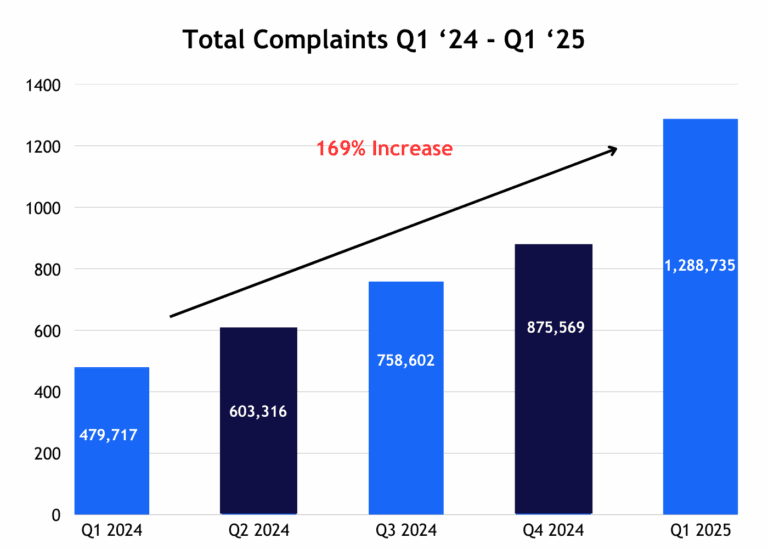

Looking at the year-over-year increase from Q1 of 2024 to Q1 of 2025, we see similar increases to past quarters. In the first quarter of last year, 479,717 total complaints were filed compared to 1,288,735 this past quarter, marking a 169% YoY increase.

This is not surprising, as there has been a steady increase quarter over quarter since Q1 of last year.

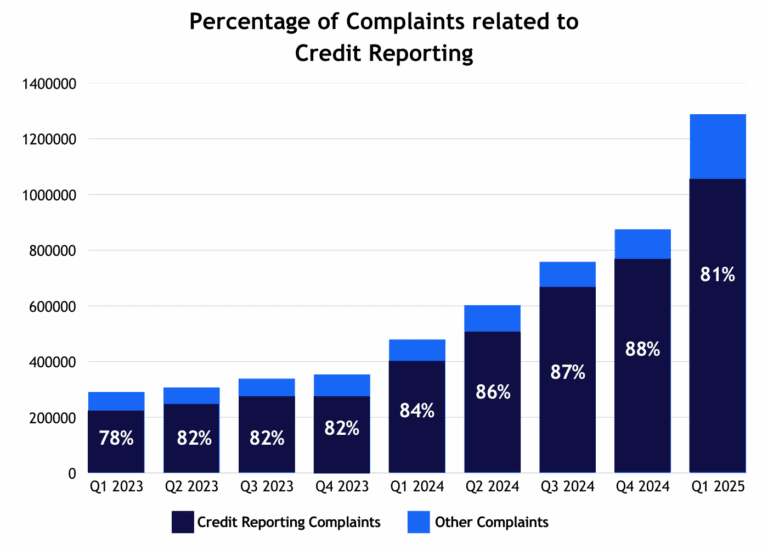

As mentioned in the past blogs, credit reporting complaints continue to make up most of these complaints, representing 81% of all complaints in Q1 of this year. On a percentage basis, this is down from highs of 88% in Q4 of 2024 but has remained relatively consistent since 2023.

We have written about a popular hypothesis on why these trends may be occurring, with one reason being the rise and use of AI in the world of Credit Repair. You can read more about these insights in our latest blog covering the topic.

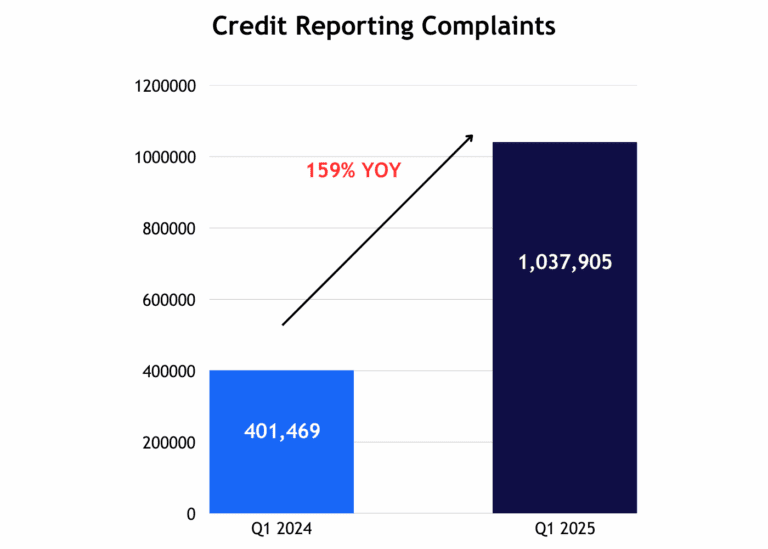

Credit Reporting Complaints Q1 ’24 to Q1 ’25

In the first quarter, we saw a 159% year-over-year increase, going from 401,469 complaints related to credit reporting in Q1 of last year to 1,037,905 in Q1 of this year

Credit Reporting Complaints Q4 ’24 vs Q1 ’25

Credit reporting complaints also rose from Q4 of 2024 to Q1 of 2025, from 771,590 in Q4 to 1,037,905 in Q1.

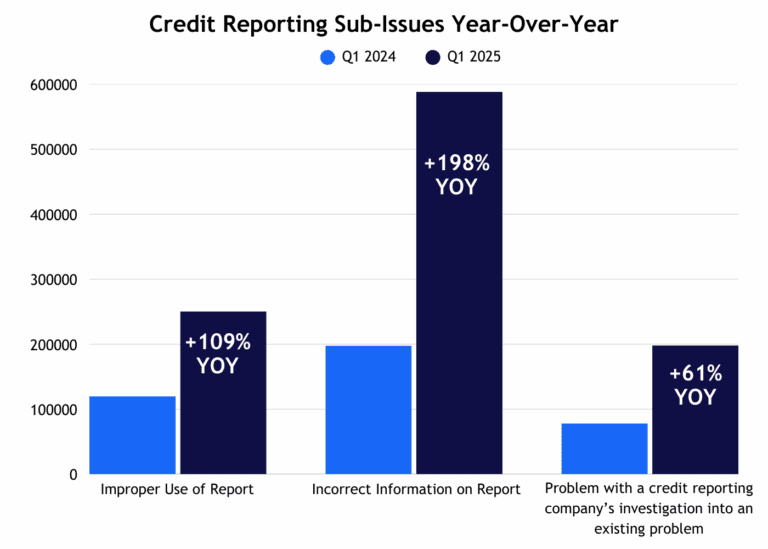

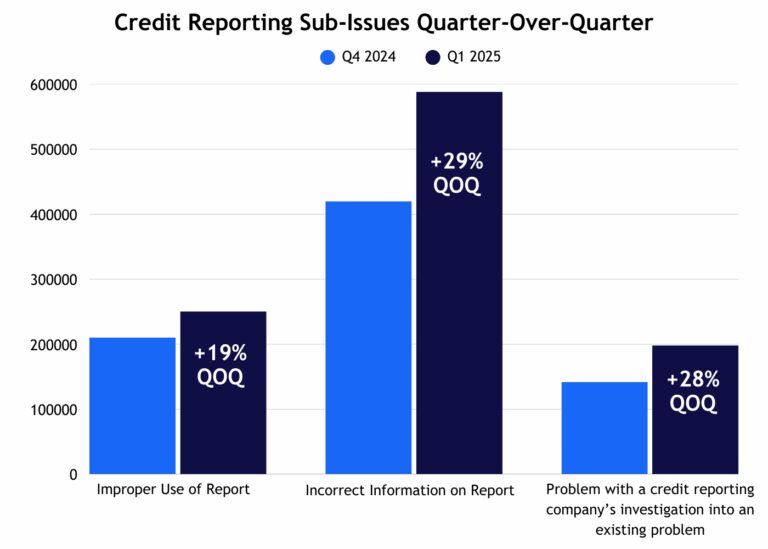

Credit Reporting Sub-Issues

The top sub-issues for credit reporting remained the same with the following three sub-issues being the main reason for credit reporting complaints: Incorrect information on report, improper use of report, and problem with a credit reporting company’s investigation into an existing problem. These all significantly increased in overall volume Year over Year and Quarter over Quarter.

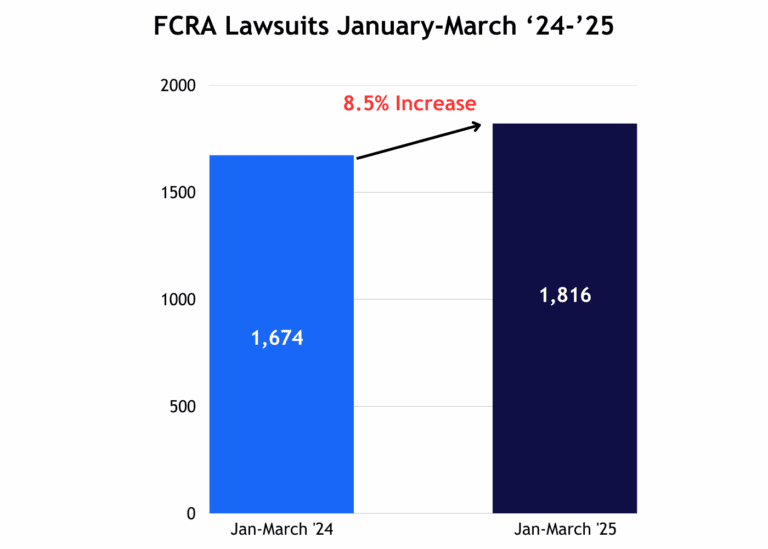

FCRA Lawsuits

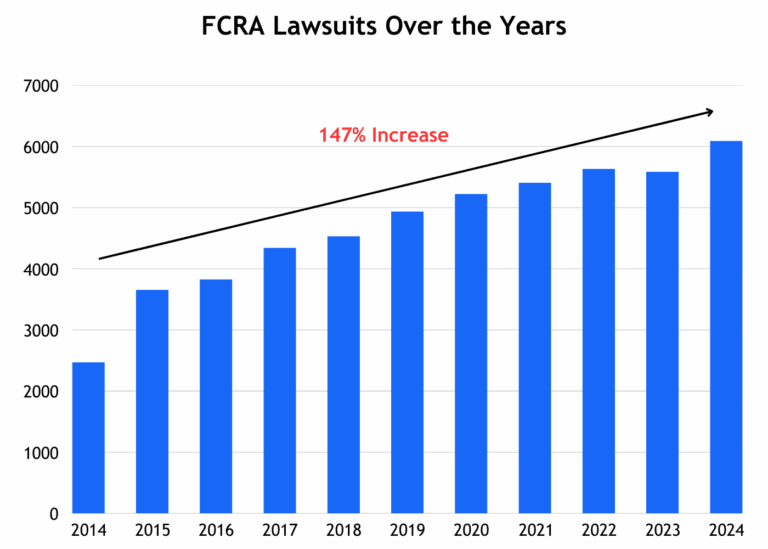

FCRA lawsuits have continued their rise as well. According to WebRecon, they have gone from 610 lawsuits in February of this year to 642 in March. They have also increased year to date, with lawsuits going from 1,674 in Q1 of 2024 to 1,816 lawsuits in Q1 of 2025.

The data looks the same over the last ten years, with FCRA lawsuits steadily rising Year-over-year for an overall percentage increase of 147% since 2014.

Reducing FCRA-related Complaints and Litigation

As complaint volumes hit new highs, we have also conducted recent polling of furnishers at various events. Our findings indicate non-seasonal increases in disputes ranging from 10% to over 50% from the start of the year, with some product categories experiencing increases of up to 100%. Additionally, our decade-long analysis shows that 15-25% of trade lines submitted to credit bureaus without automated controls contain errors.

While recent events at the CFPB have raised concerns about future enforcement, an internal memo outlines the Bureau’s revised supervision and enforcement priorities for 2025, including FCRA compliance as a top priority. This indicates that oversight efforts remain active on this bipartisan issue. Additionally, the CFPB has asked a California judge to keep its lawsuit against Experian, alleging that the company unlawfully failed to investigate consumer disputes properly and included incorrect information in credit reports. That’s why investing in proactive FCRA data quality management is more critical than ever.

Our Data Quality Scanner is the only end-to-end accuracy solution for credit reporting and disputes. It’s an automated, low-cost, no-integration solution used by leading financial institutions, including 6 of the top 20 banks, 7 of the top 10 credit unions, and many other lenders of all sizes, to reduce credit reporting errors by over 90% and disputes by over 30%.

We’ll continue to monitor complaints, and litigation trends each quarter and share timely updates on regulatory developments affecting credit reporting and disputes.

To learn more or request a demo of the Data Quality Scanner, please reach out to our Head of Product or schedule time directly here.

Mike Eisel Contact Info: [email protected]