A recent study from Joshua Wortman at Ankura, Increasing Dissatisfaction: Major Areas of Growth in CFPB Consumer Complaints Data, shined a light on a concerning trend that has occurred over the past four years: Consumer Financial Protection Bureau (CFPB) Complaints have grown from about 20,000 a month in 2020 to nearly 100,000 per month in 2023. This spike signals a critical time for lenders, who must now navigate a landscape with heightened regulatory scrutiny and consumer expectations.

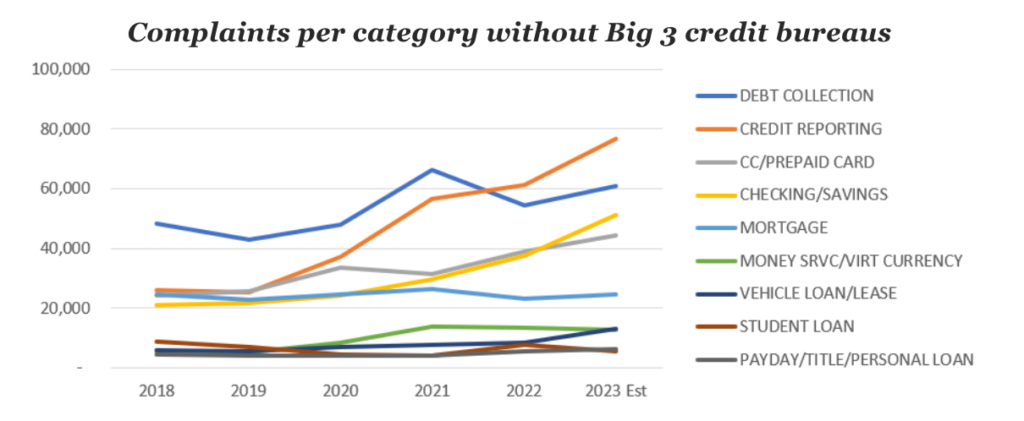

Wortman points out that while many of these complaints (about 69%) are directed at the three largest credit bureaus, Equifax, TransUnion, and Experian (also known as the Big 3), if they are removed from the equation, the number one complaint category for lenders is still credit reporting.

Source: Ankura (via JDSupra), “Increasing Dissatisfaction: Major Areas of Growth in CFPB Consumer Complaints Data”, October 19, 2023, https://www.jdsupra.com/legalnews/major-areas-of-growth-in-cfpb-consumer-7668127/

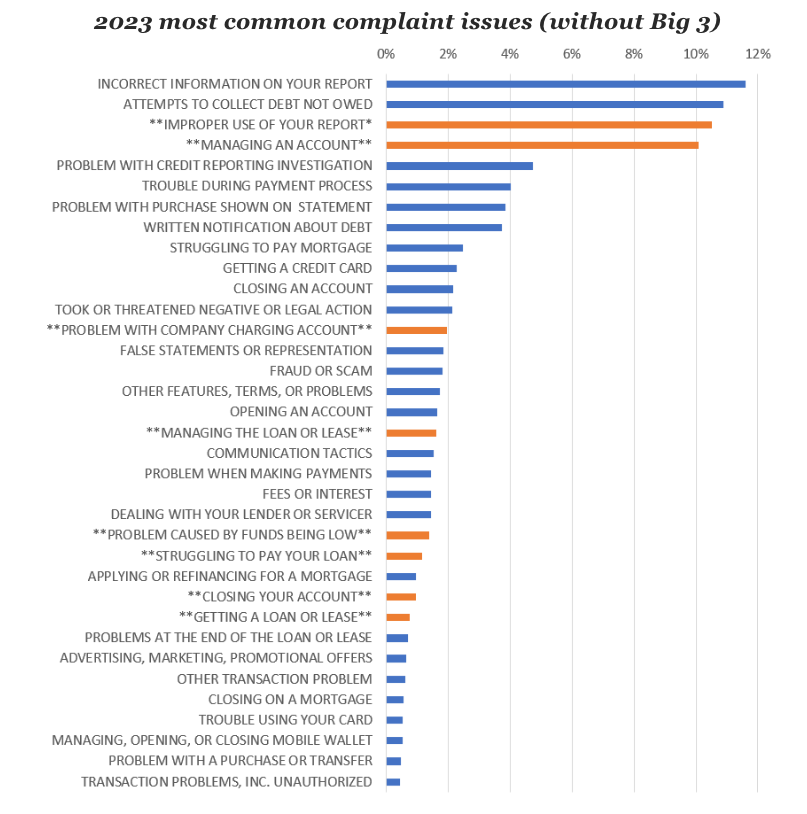

Furthermore, if we look at what’s happening in 2023, the independent analysis noted that credit reporting and dispute-related complaints are estimated to continue to rise as much as 50% with the Big 3 included and 18% if the Big 3 are not included. The chart below shows the most common complaint issues and their frequency. Those shown in orange are growing the fastest, with double-digit growth.

Source: Ankura (via JDSupra), “Increasing Dissatisfaction: Major Areas of Growth in CFPB Consumer Complaints Data”, October 19, 2023, https://www.jdsupra.com/legalnews/major-areas-of-growth-in-cfpb-consumer-7668127/

This significant rise in complaints could be perceived as a decline in service quality or a rise in consumer activism. However, it is crucial to understand that this reflects a changing financial ecosystem, where consumers are increasingly aware and assertive in voicing concerns because of the efforts of lenders and CRAs to proactively share monthly information about their credit scores. While this shift does present a challenge, it also presents opportunities for lenders to revolutionize their data practices, dispute resolution methodologies, and consumer relations.

To effectively address this uptick in complaints, lenders must adopt a strategic approach centered on proactive engagement and resolutions. Three areas that lenders can focus on now are:

Ensuring data quality and using analytics for early detection: The number one step that lenders of all sizes can take to decrease the likelihood of a dispute or complaint is ensuring that they are reporting the most accurate data possible to the credit bureaus. Automated solutions, such as our Data Quality Scanner (DQS), that enable end-to-end insights into the credit reporting and disputes data journey can lead to more accurate information being reported and more accurate resolutions during the disputes process – improving not only the relationship with customers but also with regulators.

Optimizing the dispute resolution process: Complex processes can intensify customer frustration. By streamlining the dispute resolution process, using workflow management solutions, and enhancing the disputes agents’ and user’s experiences, customer satisfaction can be improved, and the resolution of disputes can be expedited. This can include facilitating online dispute submissions, establishing clear timelines for resolution, providing regular status updates, and clear easy-to-understand letters that summarize the actions taken to resolve their dispute.

Improving communication and transparency: Proactive communications, such as educating customers, ensuring financial agreements are understood, and providing transparent updates on any changes affecting the consumer, can also help build trust. These actions can all lead to the reduction of complaints and disputes. The escalation in CFPB complaints serves as a wake-up call for lenders to re-evaluate and refine their approaches to interacting with customers and their personal credit data. By taking a proactive approach now, lenders can reduce the likelihood of dissatisfied customers and increased regulatory scrutiny and fines.