Over the last year, we have seen FCRA-related disputes and litigation continue to rise. While several factors are at play, numerous people in the industry theorize that social media trends are to blame. A former Toyota worker reinforced this theory after sharing tips on TikTok on how to best navigate disputes.

We have written about credit repair organizations in the past. Still, with the rise in AI-generated content and new ‘tricks’ to fix credit reports, we wanted to investigate the most popular social media trends in credit repair, debt settlement, and other credit washing services.

This quarter, we will examine TikTok, YouTube, and Instagram to see the most popular trends. Be on the lookout for more blogs as we continually monitor social media discussions. Remember that while new trends develop on social media, the best way to defend against the rise in disputes is accuracy in furnishing and dispute resolution.

TikTok

The first social media site we looked at was TikTok. This short-form video app has nearly 1.6 billion monthly active users, 55% of whom are under 30. The platform is still going strong despite facing a potential US ban.

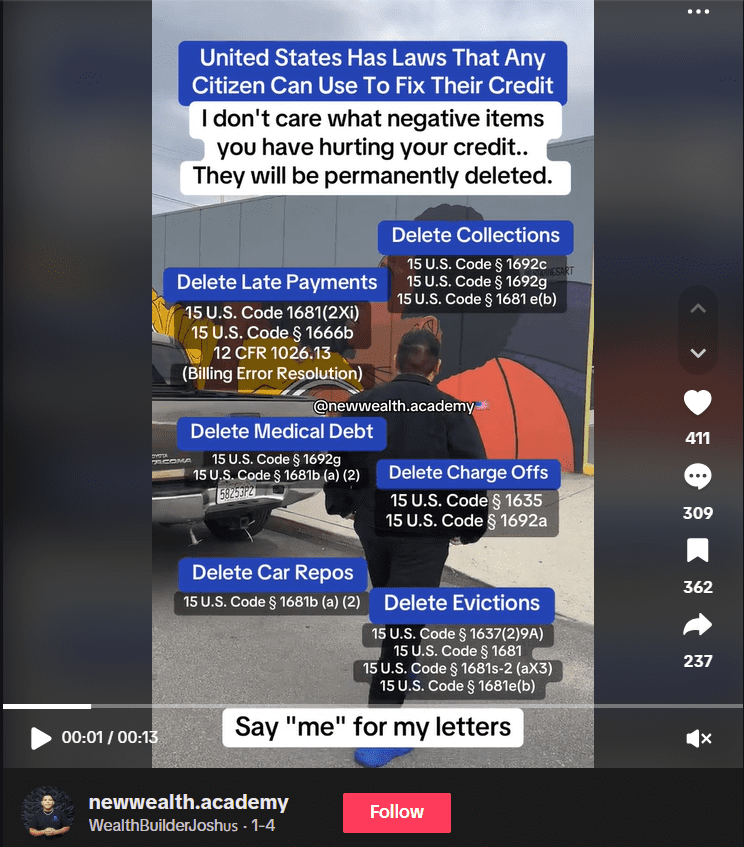

A search for ‘credit repair’ returned a flurry of results discussing services that can repair credit and remove late payments. A handful of posts also shared information about ‘laws’ that citizens can use to fix credit repair. These posts have hundreds of thousands of reviews and were all posted within the last month.

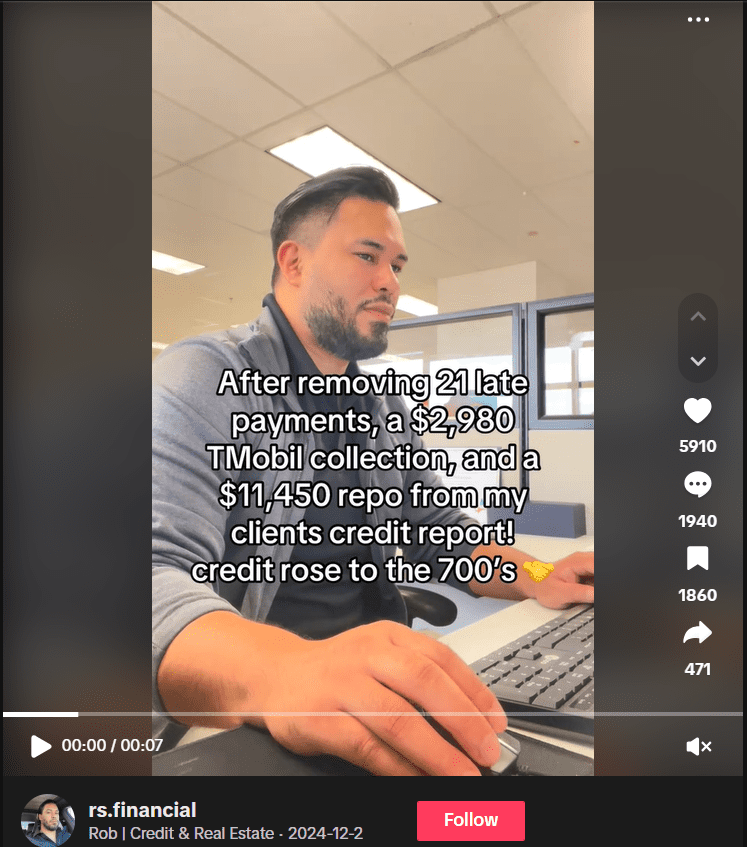

The first video we found was posted by a financial content creator on December 12, 2024, with 765,000 views. It shows a person removing late payments to improve a customer’s credit score.

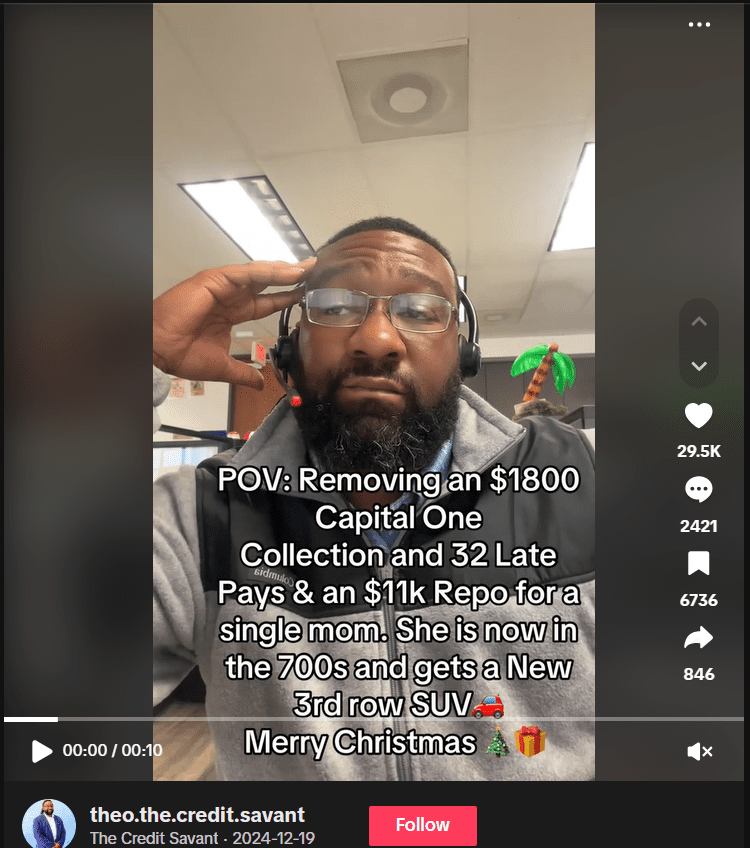

Click the images to be taken to the TikTok video

The second video, posted on December 19, 2024, garnered 348,000 views. It was similar to the first one, in which the poster shared that they could help a customer remove negative items on their credit report to get approved for a new vehicle.

The third video, posted on January 5, 2025, had 10,400 views. It shares information on how US Citizens can use specific laws and send letters to fix their credit.

YouTube

The next social media site that we searched was YouTube. This platform boasts 2.5 billion monthly users and is also a popular website returned on Google search results. Over the past month, several popular videos were shared about credit repair. Both videos advertised products and services that can help ‘fix credit instantly’ via AI tools and letter writing. There were also older videos that still appear in searches that recommend using ChatGPT to help fix credit.

The first video we found when searching for credit repair was posted on December 28, 2024, by a person with 700k subscribers and 8,600 views. The creator shared several ways to improve credit scores in this video, explicitly pointing to products linked in the description. One of these was a free AI tool to which they had an affiliate link.

The second video we came across was from a person with 23.6k subscribers. They posted a video on December 1, 2024, that has 1,800 views. This post was similar to the one above, where the creator advertises a service and other products that can help repair credit.

The third video was slightly older but still returned at the top of the search. It was posted on January 10, 2024, and has 77,000 views from a creator with 22,700 subscribers. In this video, the creator shows how discrepancies between the three bureaus can be exploited and how AI tools can assist.

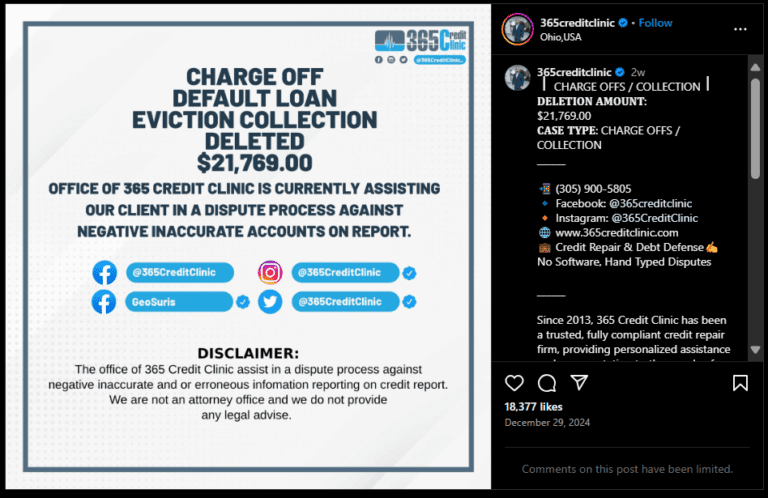

The final platform we searched was Instagram. This platform boasts 2 billion monthly active users, with another billion on Facebook (videos are often posted between the two). Credit repair and other debt settlement posts are less common on this platform, but nonetheless, there is content here from organizations that help individuals remove ‘inaccurate and erroneous information from credit reports.’

This example was from someone with 551,000 followers and 18,377 likes on a December 29, 2024, post.

Conclusion

The increasing number of Credit Repair organizations and consumer concerns about credit reporting highlight the need for accurate Metro 2® credit data reporting and dispute resolution.

Tools like the Data Quality Scanner enable furnishers of all sizes to ensure accurate reporting of Metro 2® data, reducing credit reporting errors by over 90% and lowering dispute rates by more than 30%. This automated, data-first approach allows furnishers to quickly address data errors, minimizing their impact on consumers’ credit scores.

The low-cost Data Quality Scanner analyzes furnished or disputed accounts using over 390 risk-ranked rules and has processed hundreds of millions of accounts. Additionally, the new Disputes Module aids Dispute Analysts in conducting more comprehensive and efficient reasonable investigations, and management can review 100% of dispute responses to determine how well their Dispute team and individual analysts are addressing these issues.

By providing an end-to-end view of the Metro2 data journey, furnishers can proactively address problems and counter frivolous disputes, ultimately lowering operating expenses and regulatory risks.

Schedule a demo with us today to learn how DQS can enhance your compliance efforts.