The past quarter was a time of exciting progress for the Bridgeforce Data Solutions team. We have continued substantial enhancement of our new Disputes Module and further refined and updated our flagship Furnishing Module.

Disputes Module Updates

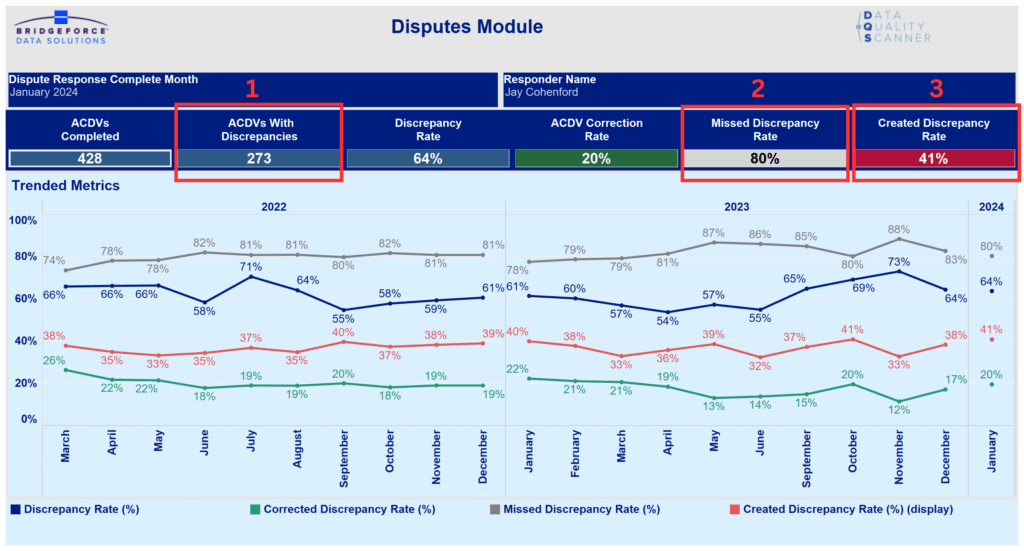

Since the official release of the Data Quality Scanner Disputes Module, our product team has been continuously enhancing the module based on direct feedback from our clients.

With the initial release of the Disputes Module, we focused on evaluating Indirect Disputes (utilizing ACDV data) against our DQS rules, as well as comparing Indirect Dispute requests and responses to each other and to the account information reported via Metro 2®. This allowed Dispute Agents to see data discrepancies in the ACDV requests and how they responded to them historically, thereby improving their ability to identify and address data issues.

Understand what percent of incoming indirect disputes have an identifiable data issue upon receipt (1). Of those issues, see what percent are not corrected in the dispute response (2). Lastly, see what percent of dispute responses create new issues (3).

Enhancements of the Disputes Module include:

Direct Dispute Response Monitoring

Now you can see where updates made directly to the credit bureaus via AUDs have potential data quality issues.

Full ACDV Dispute Review

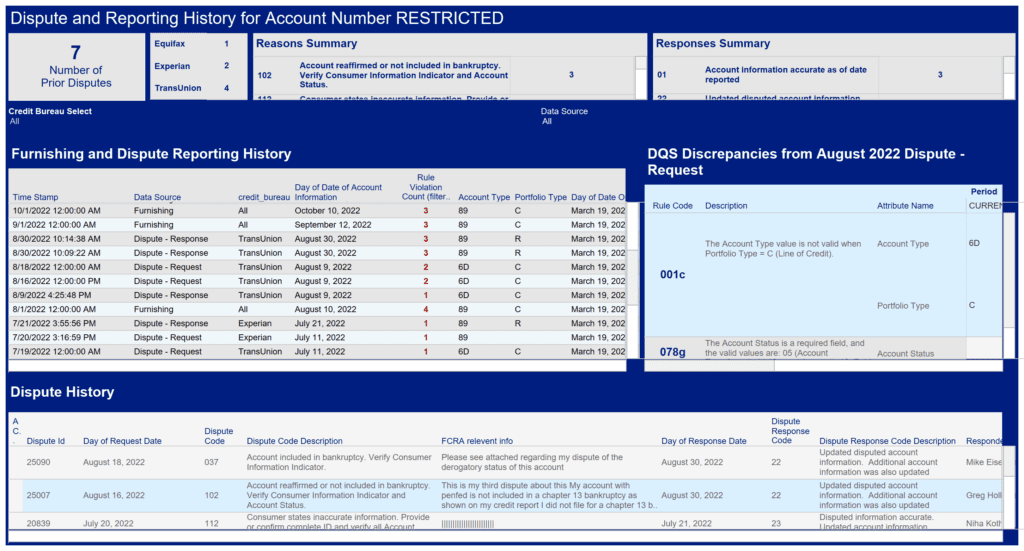

For any ACDV, you can see the request and the response side-by-side, with all changes highlighted for easy identification. See what discrepancies your agent fixed, missed, or created at a glance.

Re-pollution Tracking

See potential areas where your furnishing after a dispute response may be undoing the fix you intended in a dispute response (requires use of in the cloud).

Account Data History Lookup

See all furnishing, ACDV Request, ACDV Response, and AUDs sorted by time stamp to get a complete picture of the account’s history and simplify the identification of potential issues. You can see the Data Quality Scanner results at every step along the way. (Viewing furnishing records requires use of Data Quality Scanner Furnishing in the cloud)

View the entire history for accounts that have disputed. For all events (Metro 2®, ACDV Request, ACDV Response, and AUD) view the reported values over time and the data quality issues present in each event. This enables clients to see the entire record of events, which can be leveraged for both dispute responses and oversight.

Furnishing Module Updates

As the industry-leading independent solution for credit reporting accuracy, we are pleased to announce the release of Version 9.8 in the past quarter. Version 9.9 is scheduled for release in Q3 to account for recent updates made to the CRRG.

In the recent 9.8 release, we focused on adding and refining the Data Quality Scanner ruleset based on internal review and client feedback. It now incorporates over 380 risk-ranked rules, including new rules that review various aspects such as date closed by account status, current balance, ECOA code value, and more.

Looking Ahead

Looking to the future, we are evaluating how to integrate Artificial Intelligence tools into our products in collaboration with AWS. Additionally, we are developing real-time decision support tools for Dispute Agents. These tools will utilize our existing Data Quality Scanner ruleset and our insights into both direct and indirect dispute data. The aim is to provide the most effective decision-support tools for dispute resolution.

Thank you for taking the time to read this product update. Please stay tuned for further updates as we continue to offer industry-leading solutions for our clients.

If you have any questions or would like to learn more about our solutions, you can contact our VP of Product, Mike Eisel at [email protected] or schedule a time to meet with him below.

About Bridgeforce Data Solutions

Bridgeforce Data Solutions is a unique financial technology firm with over a decade of experience serving lenders of all sizes. Through its unique Data Quality Scanner Solutions, Bridgeforce Data Solutions offers automated compliance and benchmarking solutions for credit reporting and disputes.

These solutions help lenders of all sizes inspect, benchmark and optimize their credit bureau data.

With its Furnishing, Disputes, and cross-module Benchmarking and Data Storage capabilities, the Data Quality Scanner provides furnishers, servicers, and credit bureaus with the only comprehensive solution for managing their end-to-end credit bureau data quality and compliance.