Due to the continued rise in CFPB Complaints and FCRA Litigation year-over-year, especially those related to credit reporting accuracy and disputes handling, we are launching a new blog series to provide insights on the complaint data shared by the CFPB and FCRA Litigation data shared by WebRecon. In previous blogs, we discussed the rapid rise in consumer complaints. Moving forward, we will analyze and share this data in a quarterly blog.

Q1 and the Continued Rise of CFPB Complaints

Data Source: The CFPB Consumer Complaint Database

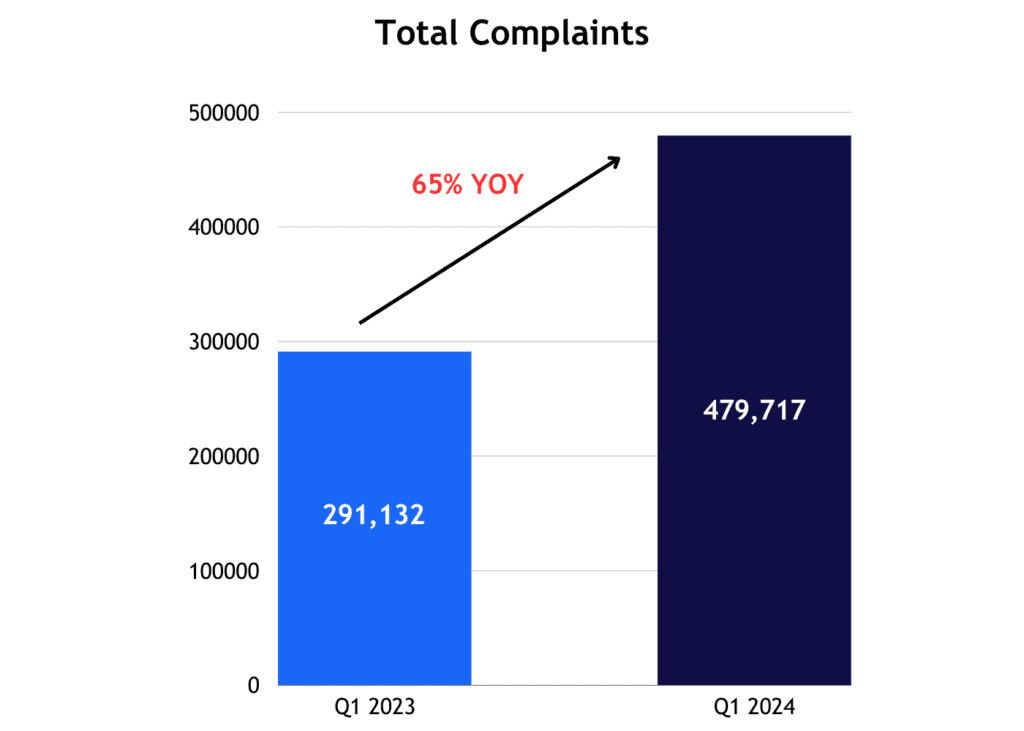

In the first quarter of 2024, consumers continued to file complaints at an increasing rate. According to CFPB data, which can be accessed via their website, complaint volumes rose significantly from 291,132 total complaints in Q1 of 2023 to 479,717 total complaints in Q1 of 2024, marking a 65% year-over-year increase.

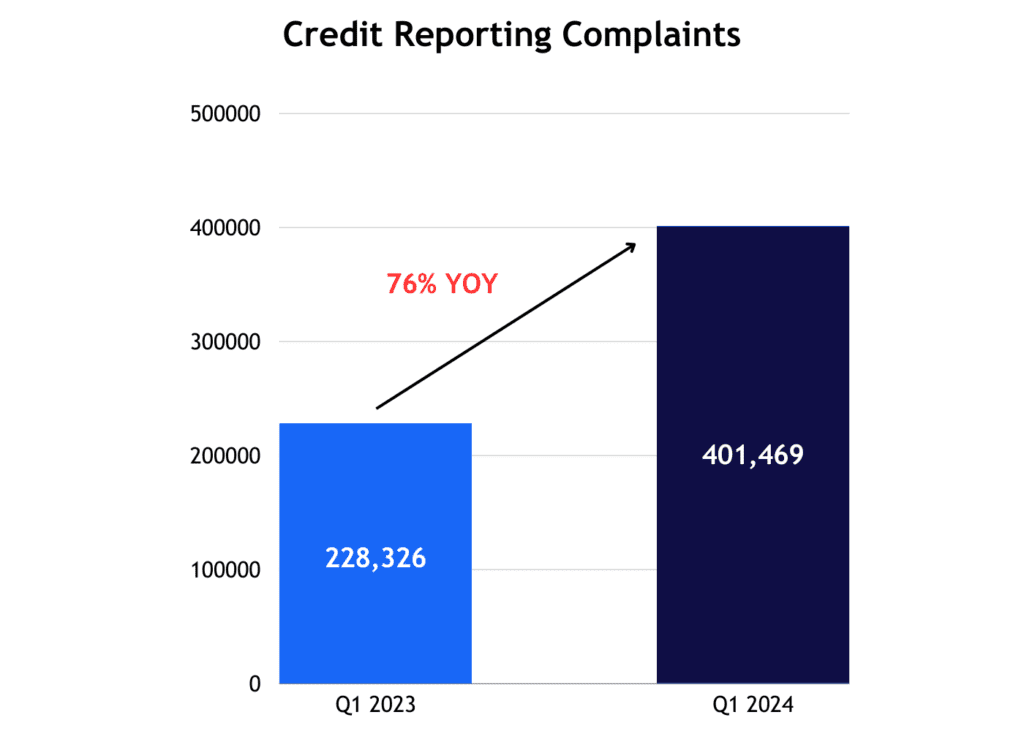

Credit reporting complaints continue to make up the bulk of the data, constituting 84% of complaints in the first quarter of 2024. This represents a 6% increase from 2023, where they accounted for 78% of total complaints.

In 2024, there have been 401,469 credit reporting complaints, nearly a 76% increase from the 228,326 complaints in Q1 of 2023.

Data Source: The CFPB Consumer Complaint Database

CFPB Complaint Sub-Issues

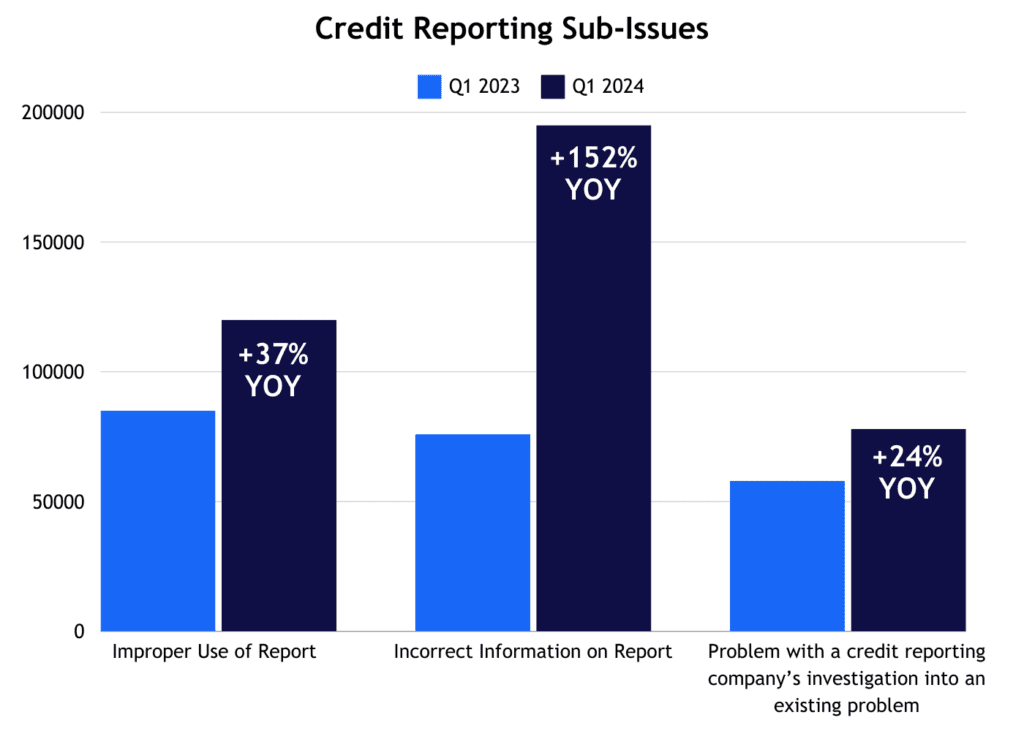

As it pertains to the sub-issues within the credit reporting complaints interesting trends arise.

In the first quarter of 2023 the number one sub-issue complained about was the ’improper use of a report’, accounting for 87,301 of the 228,326 total credit reporting complaints (or 38%). ‘Incorrect information on the report’ was a close second with 78,472 total complaints (or 34%).

This flipped in the first quarter of 2024, where there were 197,733 total complaints regarding ‘incorrect information on a report’ (or 49%) with ‘improper use of the report’ receiving 119,867 complaints (or 30%).

The third most reported on sub-issue in both years was ‘problems with a credit reporting company’s investigation into an existing problem,’ accounting for 59,258 complaints in Q1 2023 (or 26%) and 78,092 complaints in Q1 2024 (or 19%).

Complaints involving ‘incorrect information on a report’ saw the most significant year-over-year increase, with a 152% rise, followed by ‘improper use of the report’ with a rise of 37% and ‘problems with a credit reporting company’s investigation into an existing problem,’ rising by 24%.

Data Source: The CFPB Consumer Complaint Database

FCRA Lawsuits

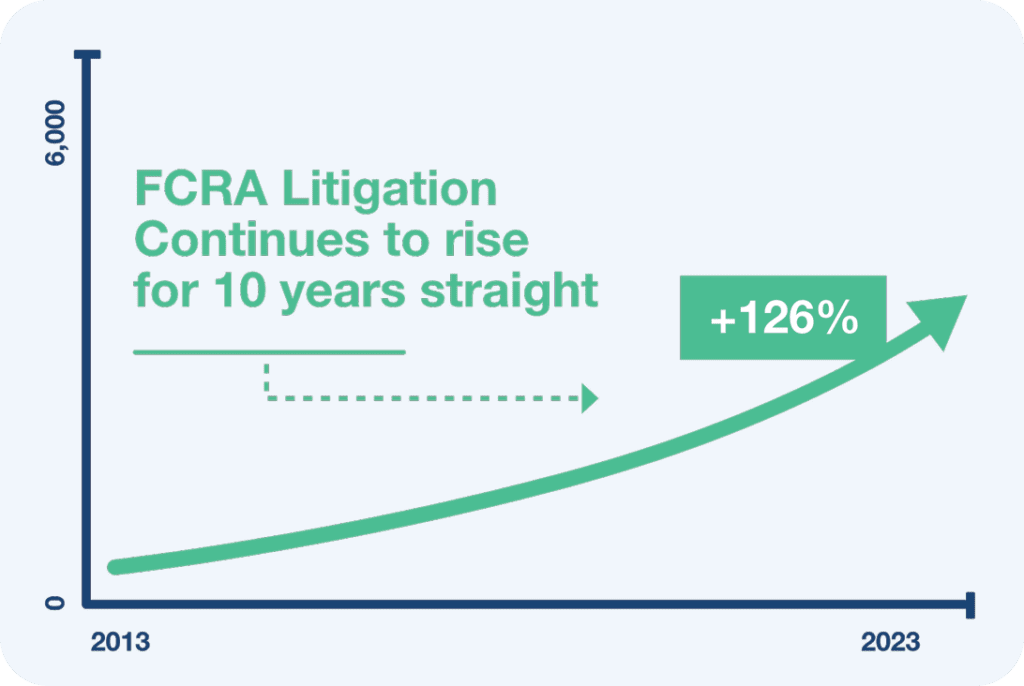

Looking at FCRA lawsuits as well, the numbers have greatly increased year-over-year, with a 126% rise since 2014.

This trend has continued into the start of 2024. In the first quarter 1,681 cases have been filed, which represents a 28% year-over-year increase from the 1,309 cases filed in the first quarter of 2023, as shared by WebRecon.

Conclusion

The continued rise in complaints indicates that consumers are becoming more aware and proactive in addressing concerns about their credit scores and reporting data. Lenders and credit bureaus regularly share alerts and status updates about consumers’ credit scores, increasing awareness of any potential issues within the credit reporting process.

As these numbers continue to rise, it becomes evident that all stakeholders in the credit reporting ecosystem must collaborate to ensure data quality. No single party can address all issues effectively. To support these collaborative efforts, our Data Quality Scanner (DQS) Platform offers a Credit Reporting Furnishing (DQS Furnishing Module) and a new Credit Bureau Disputes Module (DQS Disputes Module).

These tools enable furnishers and credit bureaus to monitor and evaluate the end-to-end Metro 2® data quality journey, significantly reducing CFPB complaints, FCRA regulatory and litigation risks, and disputes operational expenses.

We will monitor CFPB complaints and FCRA litigation quarterly and continue to share new credit reporting and disputes-related regulatory guidance and actions as they become available.

For more information or to schedule a demo of the new DQS Platform, contact our Head of Product. You can also schedule a meeting directly at this link.

Mike Eisel

[email protected]

VP of Product and CRM