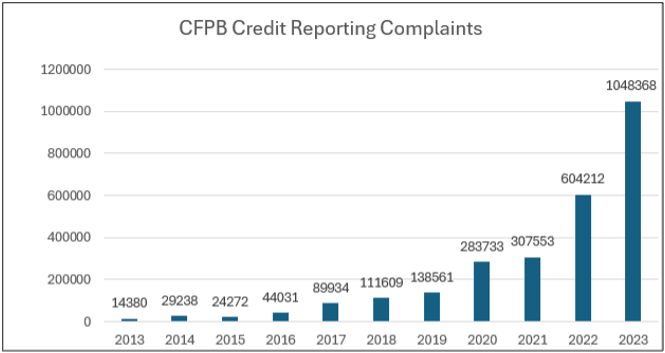

In recent years, there has been a substantial increase in the volume of complaints filed with the Consumer Financial Protection Bureau (CFPB), especially in areas concerning credit reporting and disputes. This past year, over 1 million complaints were filed in this category. This represents a substantial increase from the previous year. It is also the first time 1 million complaints have been reached since the CFPB started tracking specific complaint volumes in 2013.

We first covered the topic of rising complaint levels in November of last year. In that post, we addressed three proactive steps lenders can take to challenge these rises head-on. (You can read that post here.)

This time around, we are focusing on the key subcategories driving the rise in complaints and how this substantial growth over time stresses the need for furnishers of all sizes to have automated processes and controls in place.

Looking at the Substantial Rise

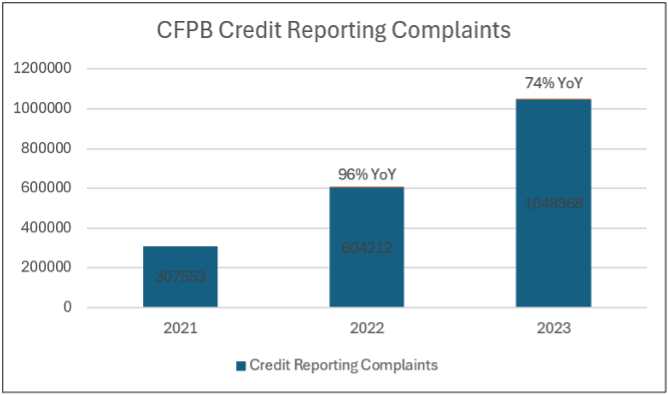

In 2021, approximately 307,000 complaints were submitted to the CFPB regarding credit reporting. The following year, this increased almost 100% to 604,000 complaints. Then, it crossed the 1 million mark, with nearly 1,050,000 complaints submitted for an overall growth of 74%.

This significant rise in complaint volumes can be attributed to the changing financial ecosystem. Consumers today are increasingly aware and assertive in voicing concerns due to the efforts of lenders and CRAs to share monthly information about their credit scores.

Additionally, Credit Repair Organizations (CROs) are more adept at finding innocuous credit reporting errors. They then use these errors to dispute the validity of the entire debt. As these changes are not going away, these complaint volumes are expected to continue to rise year-over-year unless the industry works together. All stakeholders in the credit reporting and disputes ecosystem have a role in ensuring data quality because no single party will ever be in the best position to address it.

Sub-Issues

Digging further into the CFPB numbers, other interesting findings regarding the sub-issues reported with these complaints arise.

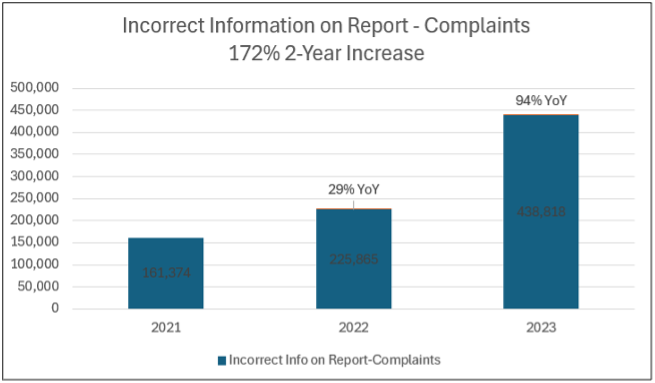

Over the last three years, about 826,000, or 42% of the total credit reporting complaints, were due to incorrect information being added to a report. Around 70% of these examples are attributed to ‘the information belonging to someone else’ (570,00 complaints). Other issues stemming from incorrect information on reports include that ‘account information was incorrect’ or ‘account status was incorrect,’ consisting of 11% and 9% of the complaints, respectively.

Looking at the data related to ‘incorrect information being on a report,’ we can see that these complaint levels have rapidly increased as well. Numbers rose from about 161,000 complaints in 2021 to 438,000 in 2023, for an overall increase of 172%, consisting of 11% and 9% of the complaints,

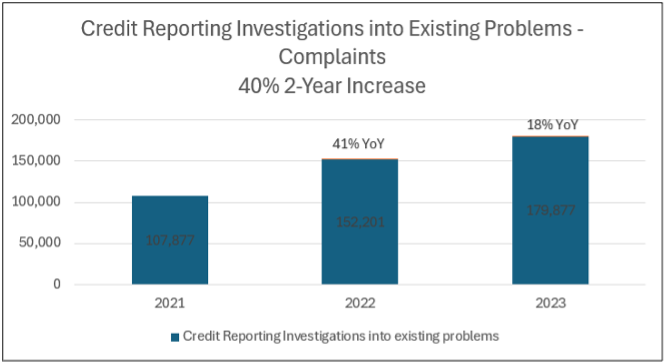

On the other hand, it is good to see issues like ‘credit reporting (and other) companies’ investigations into existing problems rising slower than the previous year. Over the last three years, there were 439,000 total complaints in this area. From 2021 to 2022, the number increased by 41%, from almost 108,000 complaints to 152,000 complaints. The following year, this number went up to 180,000, an increase of only 18%. While there is still work to be done, it is a good sign that improvements in this area are happening.

Addressing the Issue of Rising Complaints

With the significant rise in complaints, it is more crucial than ever for furnishers to have the right processes and controls in place. The Data Quality Scanner (DQS) from Bridgeforce Data Solutions allows lenders to ensure their data is accurately reported. With an automated ruleset of over 380 risk-ranked rules, lenders can proactively find, prioritize, and fix account-level issues before they become costly disputes, regulatory actions, or lawsuits.

Additionally, with our recently released Disputes Module, furnishers can assess their Metro 2® Data accuracy against 380+ risk-ranked rules, uncovering data changes and discrepancies with credit bureau data (ACDV requests and responses) and the next Metro 2® file. This comprehensive tool helps identify root causes and enhances dispute response quality.

Furnishers can now understand what was furnished or match what was in the dispute response with the Credit Bureaus. This allows furnishers to identify root causes and educational opportunities overall when data does not match. It will also help specific Dispute Agents enhance dispute responses’ accuracy, completeness, and consistency.

We will be actively monitoring the continued rise in CFPB complaints and will continue to share new findings as they become available.

For more information or to schedule a demo of the new DQS Disputes Modules, please contact:

Mike Eisel

[email protected]

VP of Product and CRM

About Bridgeforce Data Solutions:

Bridgeforce Data Solutions is a financial technology firm that provides automated compliance and benchmarking solutions for credit reporting and disputes to help consumer lenders of all sizes inspect, benchmark, and optimize their credit bureau data.