Auriemma Credit Bureau

Roundtable 2024 Insights

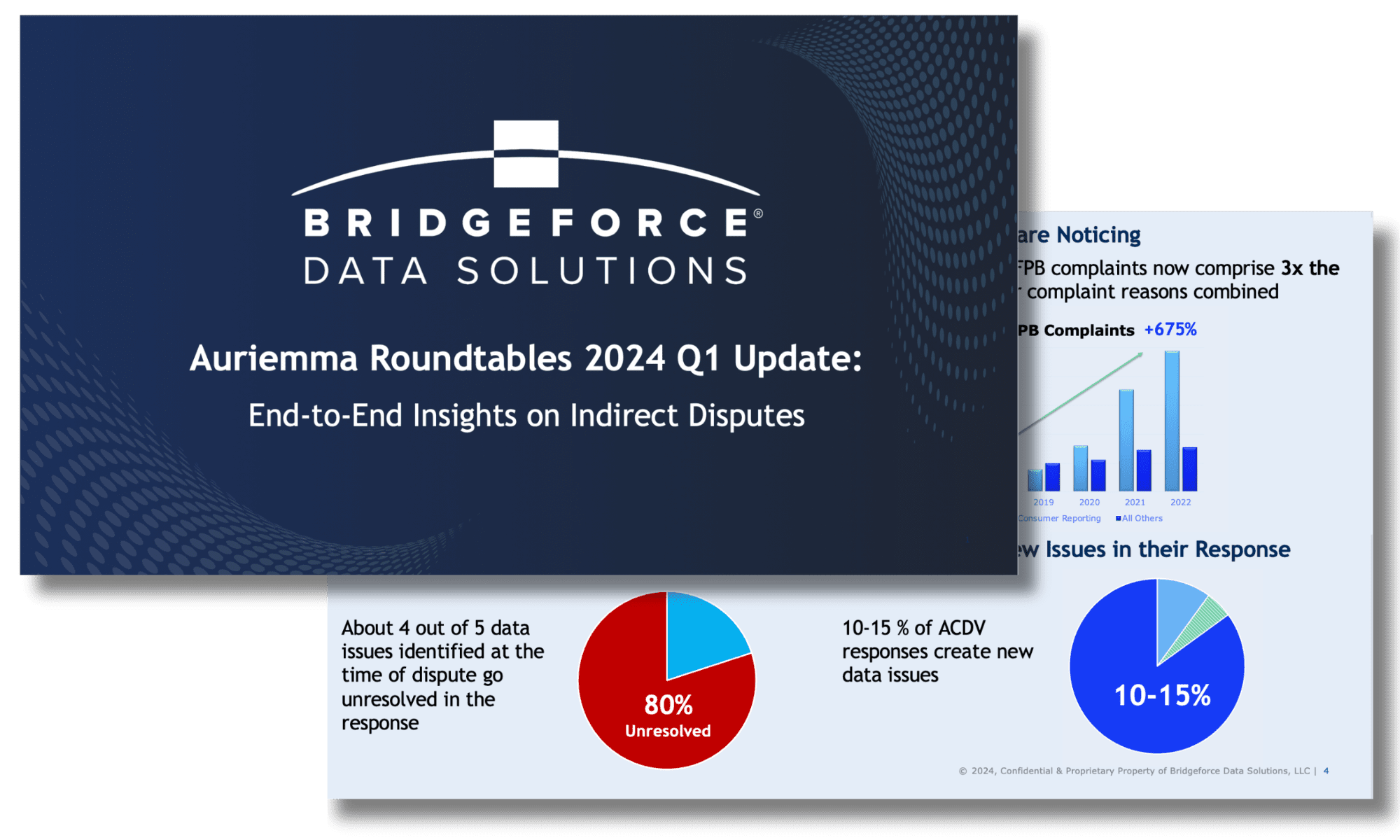

Bridgeforce Data Solutions was invited to join Auriemma’s Credit Bureau Roundtable event in Dallas on February 15, 2024 to discuss FCRA Compliance and share new end-to-end insights on indirect disputes with industry leaders.

Auriemma’s Credit Bureau Roundtable is an exclusive member-only event from leading lenders who are responsible for credit bureau reporting and dispute resolution. The Roundtable Group meets quarterly to discuss challenges associated with reporting and dispute handling, including compliance with regulatory and Metro 2® standards and procedural inconsistencies across credit bureaus.

NEW FCRA Compliance Research on Indirect Disputes

Our CEO, Matt Scarborough, shared new information about indirect disputes that we think you would find valuable. Here are the top 3 insights:

- 25-60% of indirect disputes have an identifiable data issue caused by furnishing discrepancies and credit reporting agency transformations and omissions.

- Most data issues in ACDV requests are not addressed, with approximately 80% going unresolved.

- Agents sometimes create new data issues. 10-15% of ACDV responses create new data issues.

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and