Benchmark: See Where You Stand

Compare the accuracy of your credit reporting data to your peers with our 1-Minute Self-Audit covering key credit reporting and FCRA accuracy and compliance processes.

With the threat of costly disputes, complaints, lawsuits, and regulatory inquiries looming, it’s important to ensure your credit reporting accuracy and compliance processes are in line with your peers. But it can be hard knowing where to start. That’s where the Data Quality Scanner (DQS) can help.

See how you stack up To Your peers

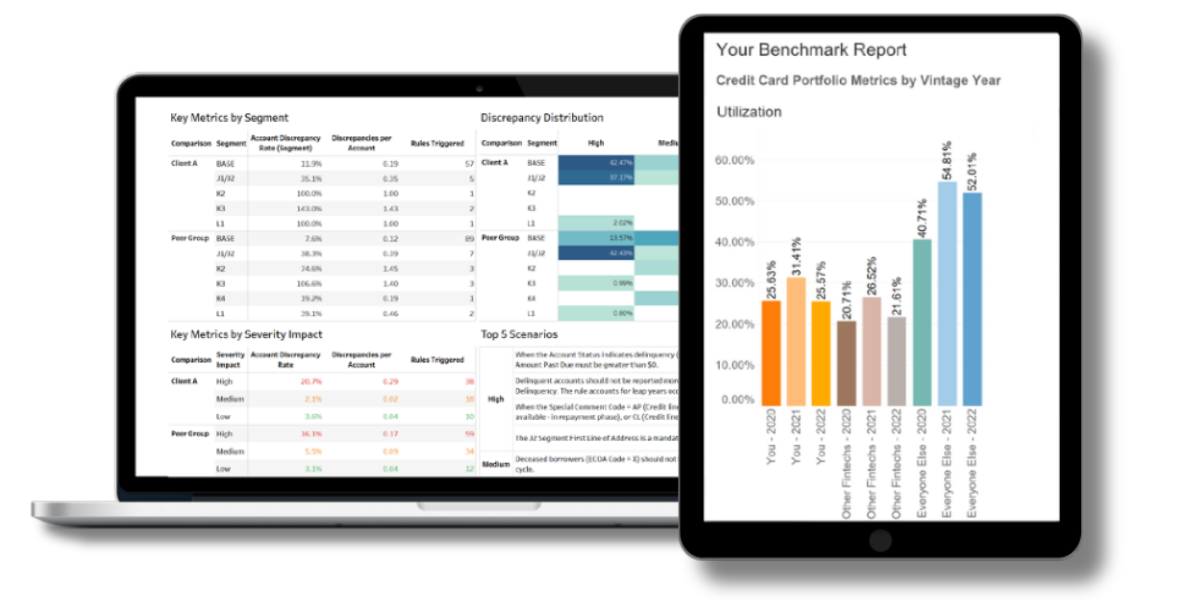

The Data Quality Scanner: The only automated credit reporting compliance and benchmarking solution partnered with a credit bureau. Comprehensively assess the accuracy of Metro 2® data against a ruleset of 380+ rules, enabling a proactive data-driven approach to finding, prioritizing, and fixing account-level issues.

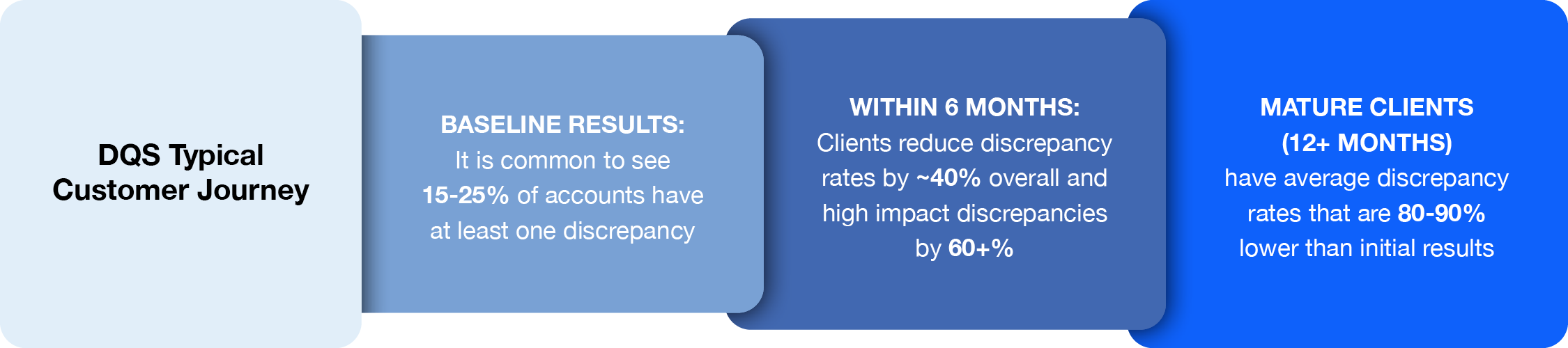

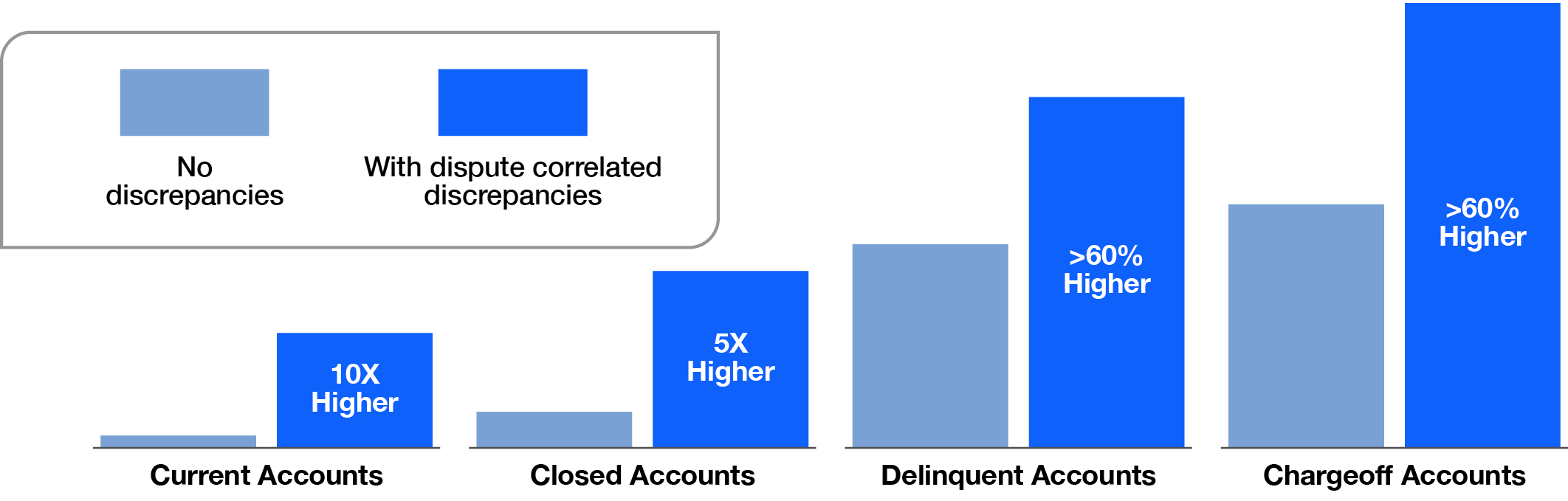

Furnishers have been able to minimize credit bureau discrepancies and reduce dispute rates by 10-30% by using DQS to improve their furnishing accuracy. Based on our latest research and analysis, we have seen dispute rates are up to 10x higher for accounts with dispute-correlated discrepancies.

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and