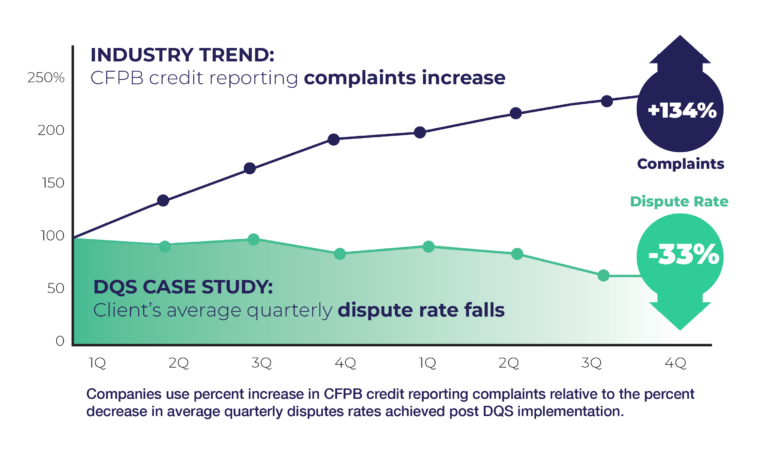

Case Study: Automated Solution Reduces Credit Bureau Disputes

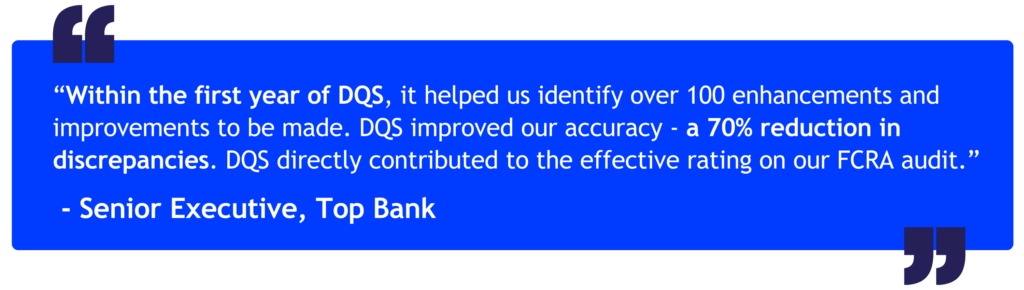

A large, super-regional U.S. Bank with a diversified mix of consumer lending products wanted to improve credit reporting accuracy and reduce credit bureau disputes. They formed a credit bureau working group and received Reject & Error reports from four credit reporting agencies, but lacked a process to review files pre-submission or to report back on what was being actively addressed. Additionally, the client was preparing for an upcoming FCRA Audit.

dQS: THE AUTOMATED CREDIT REPORTING COMPLIANCE SOLUTION TO REDUCE DISPUTES AND CREDIT REPORTING COMPLIANCE RISK

dQS: THE AUTOMATED CREDIT REPORTING COMPLIANCE SOLUTION

In light of a renewed regulatory focus, lenders need to mitigate credit reporting compliance risk and reduce the cost of disputes management. Both FCRA and potential reforms call for new requirements in the dispute process and stronger challenger tools for credit report information.

INDUSTRY LEADER IN ASSESSING METRO 2® COMPLIANCE

The DQS quickly and accurately assesses Metro 2 compliance across multiple systems of record, whether pre- or post-submission to the Credit Reporting Agencies. DQS couples 380+ risk-ranked rules to proactively identify discrepancies at the account level with clear, easy-to-use tools that mitigate compliance risk, and has been proven to reduce disputes and associated operational costs.

The Metro 2® Format and the Credit Reporting Resource Guide® (CPRG) are owned by the Consumer Data Industry Association® (CDIA®), www.cdiaonline.org. Bridgeforce Data Solutions, LLC is an independent entity that is not affiliated with CDIA® and CDIA® is not responsible for the content of the information contained here.

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and