Automated Credit Reporting and Disputes Compliance and Benchmarking Solutions

Amid heightened regulatory scrutiny, credit reporting and dispute handling face a pivotal moment. In 2022, 76% of complaints to the CFPB were credit-report-related, signaling a pressing industry concern. With over a decade of continuous rise, FCRA litigation emphasizes the urgent need for proactive solutions in data quality and dispute resolution.

DQS: Data Quality Scanner

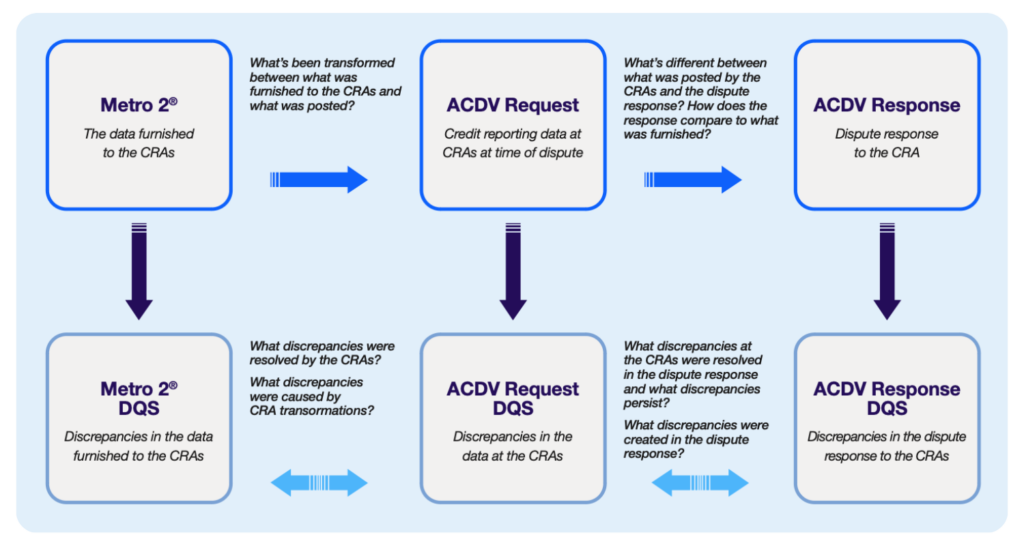

The Data Quality Scanner (DQS) is the only automated credit reporting and disputes compliance solution enabling data furnishers to see the end-to-end Metro 2® data journey and evaluate data quality at each step:

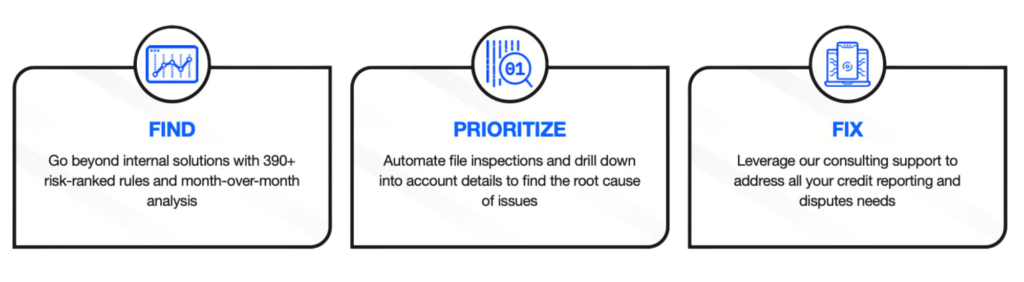

• Furnishing Module: Comprehensively assess the accuracy of your Metro 2® data against a ruleset of 390+ risk-ranked rules. Take a proactive approach to finding, prioritizing, and fixing account-level issues and reduce costly regulatory scrutiny and litigation.

• Disputes Module: Leverage the combination of DQS rules, Metro 2® data, and ACDV data to create first-of-their-kind insights that significantly improve outcomes and reduce costs.

DQS Furnishing module

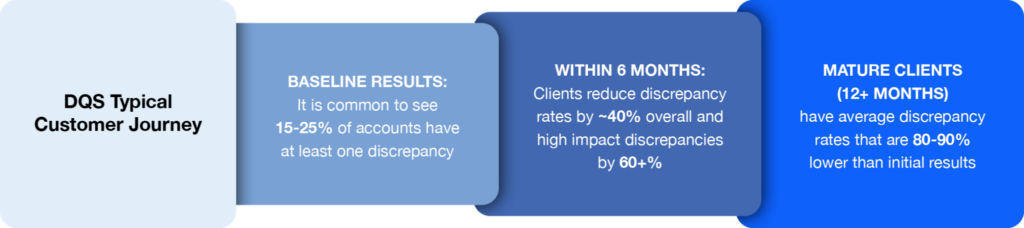

Our Furnishing Module ensures accurate credit reporting to mitigate your regulatory risks and decrease your dispute rates and associated OPEX by over 30%.

DQS disputes module

Our new Disputes Module provides actionable insights into credit bureau disputes and a comprehensive view when used together with our Furnishing Module.

How It Works: Furnishing & Disputes Modules Together

Leverage the combination of DQS rules, Metro 2® data, and ACDV data to create first-of their-kind insights that significantly improve outcomes and reduce costs.

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and

Reduce credit reporting dispute rates by more than 30% and overall operational expense

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and