Introduction

As 2025 comes to a close, the regulatory landscape remains dynamic. The CFPB remains mostly dormant with its future uncertain, yet it continues to publish complaint data, a trend we’ve monitored closely throughout the year.

This year also brought new insights from the FDIC’s 2025 Consumer Compliance Supervisory Highlights, which we reported on earlier this year, as well as information from the FTC and its Consumer Sentinel network. These sources offer a broader perspective on consumer sentiment and regulatory priorities.

As regulatory focus and consumer concerns continue to shift, staying informed is more important than ever. In the sections that follow, we’ll dive into the latest CFPB complaint data, FTC findings, and FCRA litigation data, highlight emerging trends, and explore what these developments mean for compliance and credit reporting as we head into 2026.

January 8, 2026, Update – The end of 2025 was an active time for regulators. View all of the recent updates from the CFPB, NCUA, OCC and FDIC below.

Key End‑of‑Year Regulatory Actions

As 2025 wrapped up, here are notable actions from U.S. financial regulators:

CFPB

NCUA

OCC

FDIC

FTC

Complaints Once Again Hit Record Highs in 2025

Note: All Data is from the CFPB Complaints Database as of December 5, 2025

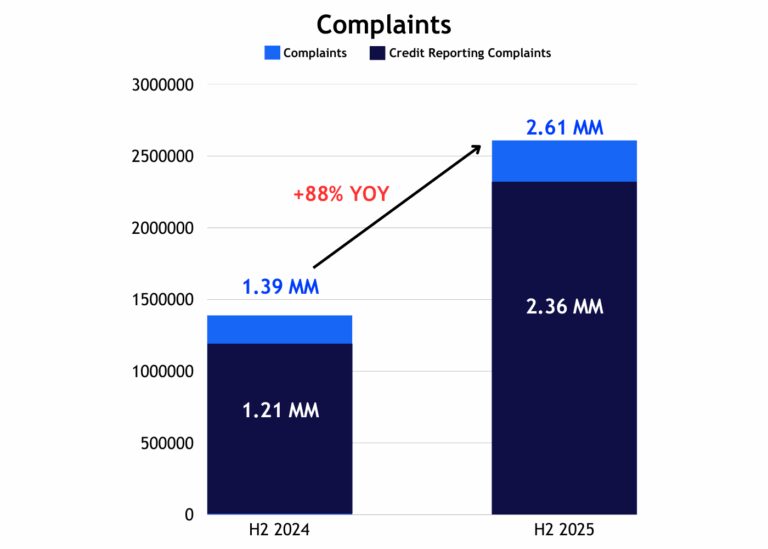

Consumer complaints filed through the CFPB Complaints Portal once again reached new highs in 2025, climbing from a little over 1.39 million in the second half of 2024 to 2.61 million in 2025 and marking an 88% increase year over year, with all signs pointing to continued growth.

Credit reporting complaints dominated again, accounting for 91% of total complaints in H2 (2.36 million), up from 88% (1.21 million) during the same period in 2024.

Credit Reporting Complaints: Year-over-Year Surge

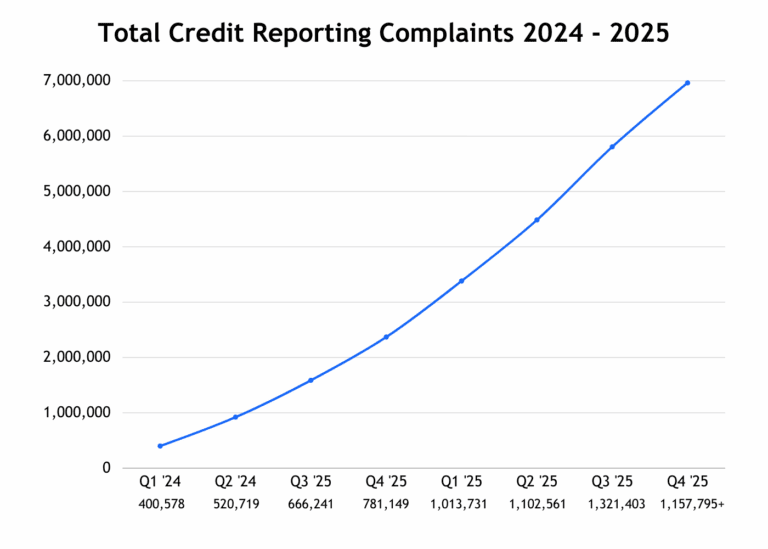

2024 vs. 2025 (so far): Credit Reporting Complaints jumped 95% from 2.37 million to 4.60 million and will be close to passing the 7 million Total Credit Reporting Complaints since 2024 mark at the end of this year.

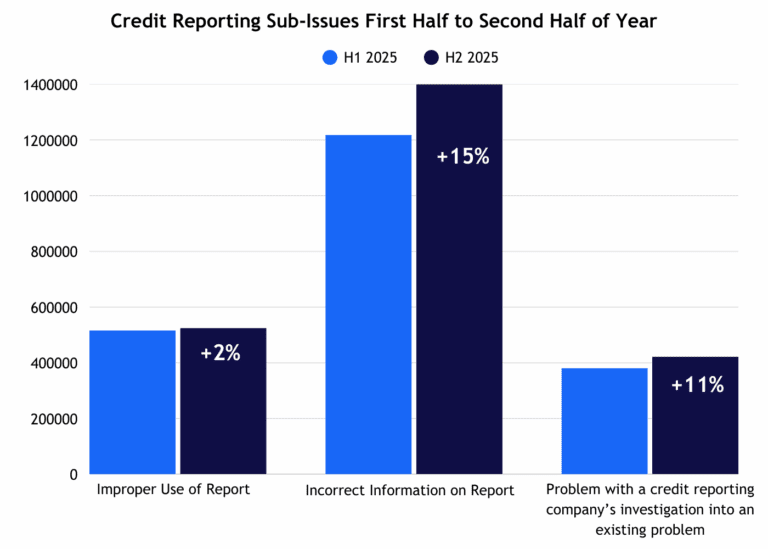

The top sub-issues have remained the same since we began tracking the data. In the second half of this year, the data was as follows:

- ‘Incorrect information on report’ accounted for 1.4 million of the 2.36 million credit reporting complaints in the second half of 2025.

- ‘Improper use of report’ accounted for 525,000 of the complaints.

- ‘Problems with a credit reporting company’s investigation into an existing issue’ accounted for 422,000 complaints.

The volume of complaints about ‘Incorrect information on report’ increased by 15% from the first half of the year to the second. In comparison, those concerning ‘Problems with a credit reporting company’s investigation into an existing issue’ rose by 11%. In contrast, complaints related to ‘Improper use of a report’ saw only a modest rise of 2%.

FTC Credit Reporting Trends and Compliance Insights

With changes to the CFPB’s role, we are now also tracking how the FTC is handling consumer complaints. They do not post updates as frequently as the CFPB, with their last report in August 2025 analyzing data from 2024. We shared more about this in September and you can read some overall highlights below.

Overall Highlights

- Credit reporting complaints surged from ~600K in 2021 to 1.36M in 2024, making it the largest category in the FTC Consumer Sentinel Network.

- Complaints about Credit Bureaus doubled from ~550K in 2022 to 1.26M in 2024; Furnisher complaints rose from ~41K to 88K.

- Credit Bureaus dominate the mix at 96% of total complaints, but furnisher-related issues are steadily growing.

- Trends point to rising consumer frustration with inaccurate data, delayed dispute resolution, and transparency gaps.

FCRA Litigation Trends

FCRA litigation also continued its upward trajectory according to WebRecon:

Year-to-Date: Lawsuits are up 30.7%, from 4,632 in January–September 2024 to 6,053 in January–September 2025.

With over all litigation set to hit an all time high by the end of the year.

Reducing FCRA-related Complaints and Litigation

Our polling of furnishers throughout 2025 revealed non-seasonal dispute increases of 10-50%, in alignment with the growth in FCRA-related complaints and litigation. Our team’s decade-long analysis shows that 15–25% of trade lines submitted without automated controls contain errors.

To help address these challenges, we offer a Free Trial Program of our Data Quality Scanner, the only end-to-end accuracy solution for credit reporting and disputes.

This free trial, completed with minimal IT involvement through our Equifax partnership, delivers actionable insights into FCRA data quality issues that lead to costly customer complaints and disputes.

Looking Ahead

We’ll continue monitoring complaint and litigation trends and share timely updates on regulatory developments impacting credit reporting and disputes in 2026.

Enter your name and email below to learn more about the Data Quality Scanner Free Trial offer.

About Bridgeforce Data Solutions

Bridgeforce Data Solutions is a new breed of RegTech SaaS company that offers the Data Quality Scanner, the only end-to-end accuracy solution for credit reporting and disputes.

The Data Quality Scanner is an automated, low-cost FCRA diagnostic and oversight solution that requires no IT integration. Trusted by top lenders and servicers for over a decade, our Data Quality Scanner ensures Metro 2® accuracy and FCRA compliance, scanning billions of tradelines and hundreds of thousands of disputes annually to reduce credit reporting errors by up to 90% and dispute rates by over 30%.