Get to know the Data Quality Scanner

The Only End-to-End

Accuracy Solution for

credit reporting & disputes

in partnership with

Furnishing

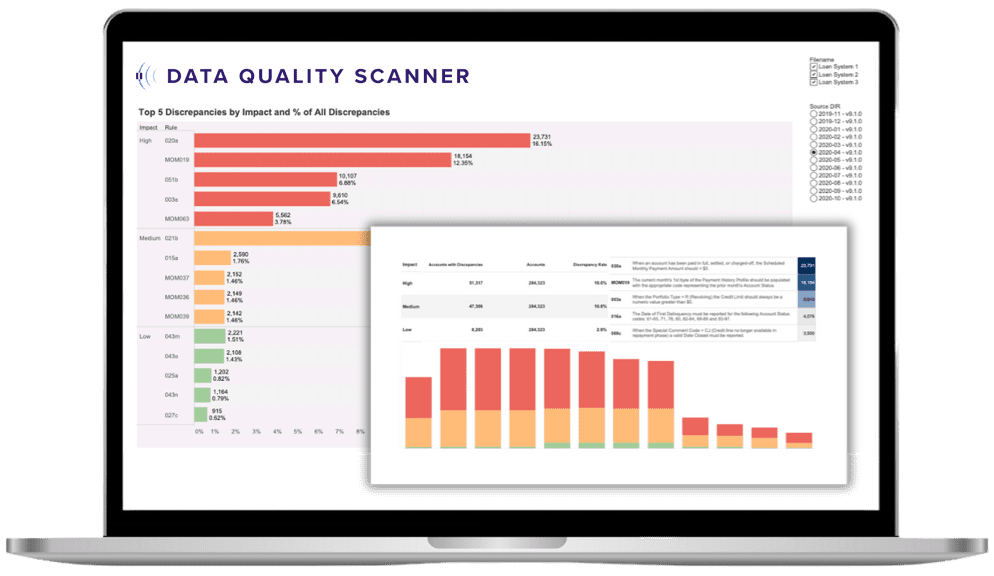

Data Quality Scanner Module

The Furnishing Module comprehensively assess the accuracy of your Metro 2® data against a ruleset of 392 risk-ranked rules. Take a proactive approach to finding, prioritizing, and fixing account-level issues and reduce costly regulatory scrutiny and litigation.

Find

Go beyond internal solutions with 392 risk-ranked rules and month-over-month analysis.

PRIORITIZE

Automate file inspections and drill down into account details to find the root cause of issues.

Fix

Leverage our consulting support to address all your credit reporting and disputes needs.

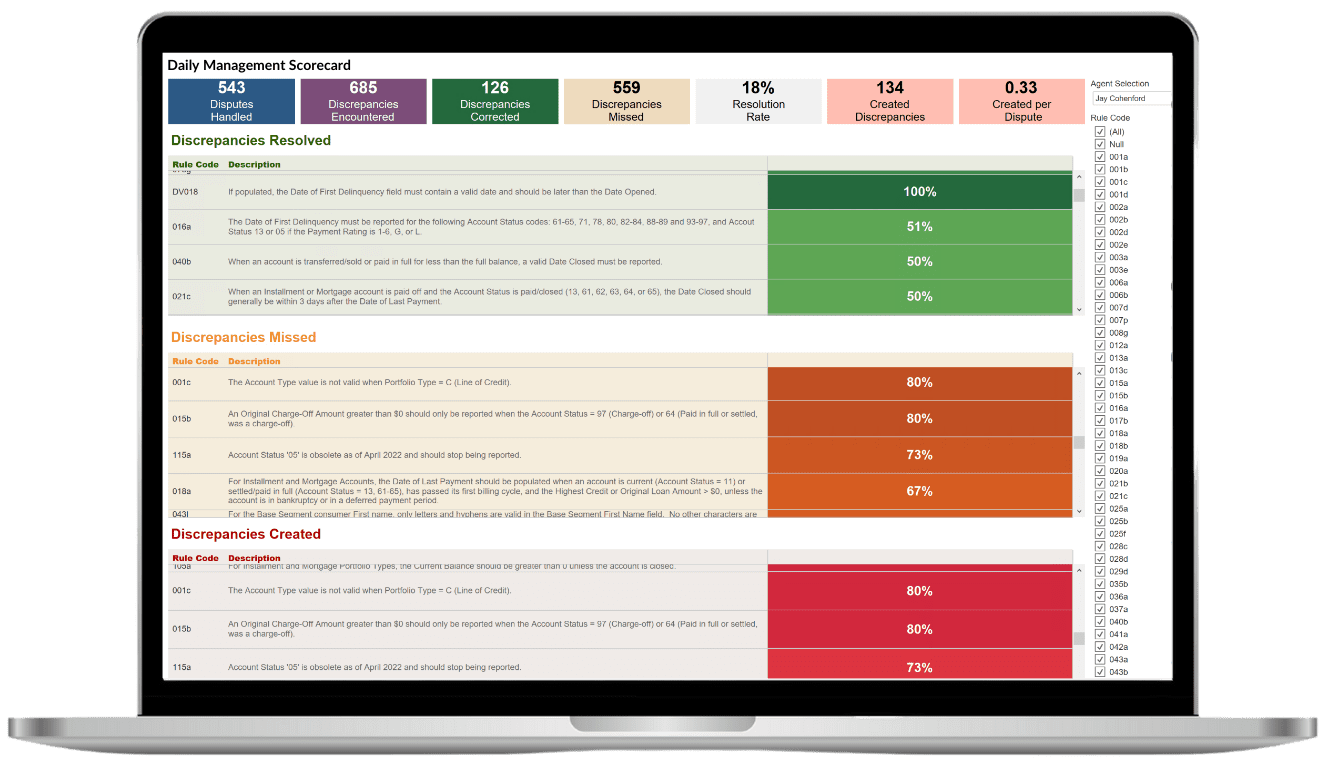

Our new Disputes Module provides actionable insights into credit bureau disputes and a comprehensive view when used together with our Furnishing Module. Leverage the combination of Data Quality Scanner rules, Metro 2® data, and ACDV data to create first-of-their-kind insights that significantly improve outcomes and reduce costs.

Find

Issues in the data being disputed, sources of those issues, and how well the disputes team is addressing them.

PRIORITIZE

Education opportunities within the disputes team and root-cause conversations with colleagues & CRAs.

Fix

Reduce both initial and repeat disputes through targeted actions.

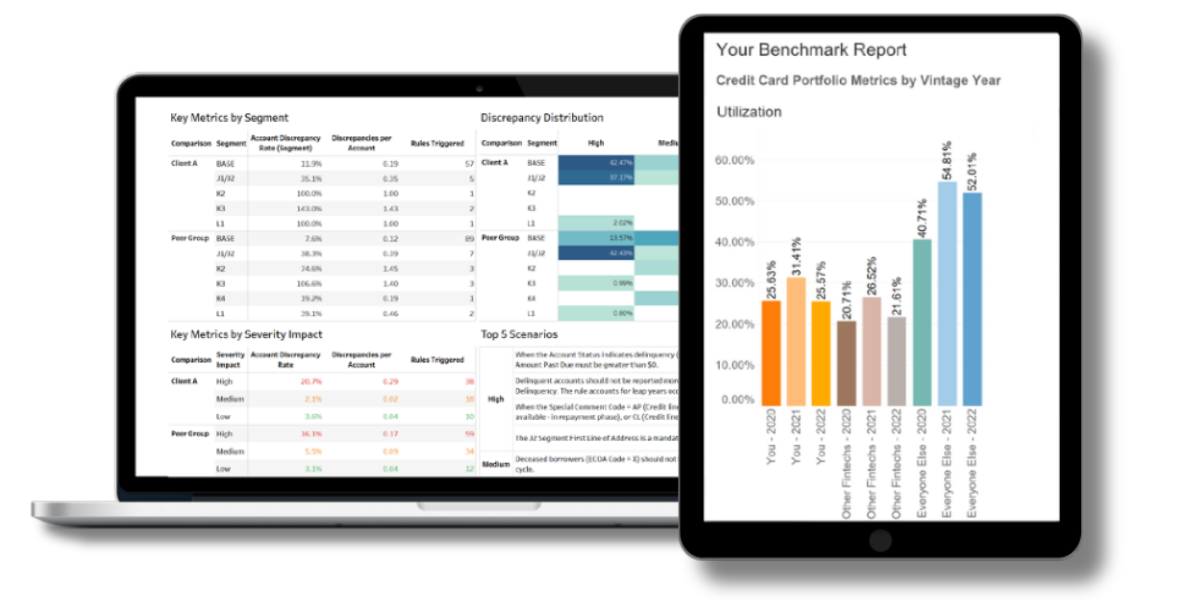

Benchmarking

The benchmarking tool enables you to compare the accuracy of your credit reporting data compared to your peers.

It also allows you to use your trusted credit bureau data for analytic insights – and assess your performance relative to your peers & others.

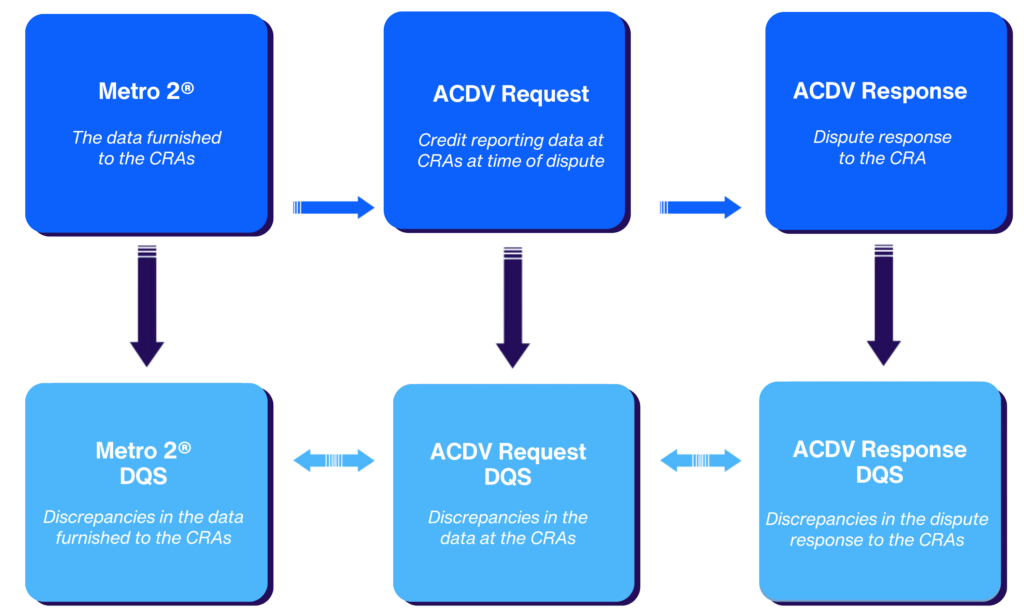

Leverage the furnishing & disputes modules together

Combine Data Quality Scanner rules, Metro 2® data, and ACDV data to create first-of their-kind insights that significantly improve outcomes and reduce costs.

Benchmarking

Cross-Module Solution

The benchmarking tool enables you to compare the accuracy of your credit reporting data compared to your peers. It also allows you to use your trusted credit bureau data for analytic insights – and assess your performance relative to your peers & others.

See how you stack up against your peers with our 1-minute self-audit.

Industry Need

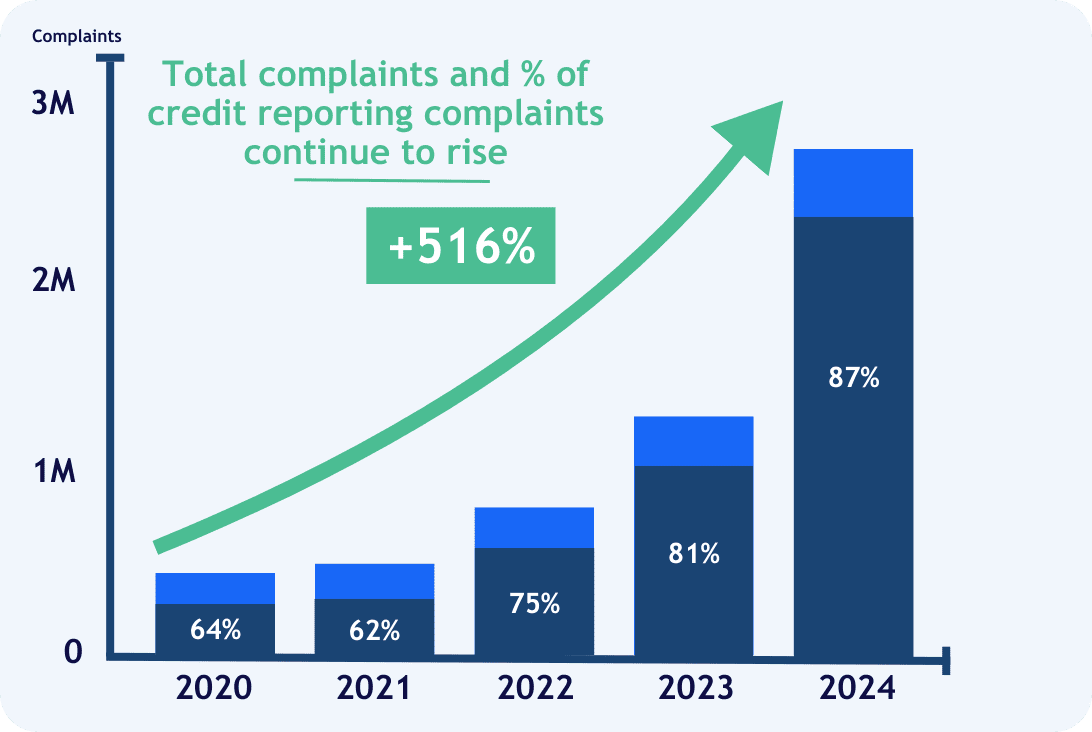

Credit reporting data quality & disputes handling continues to receive intense regulatory scrutiny.

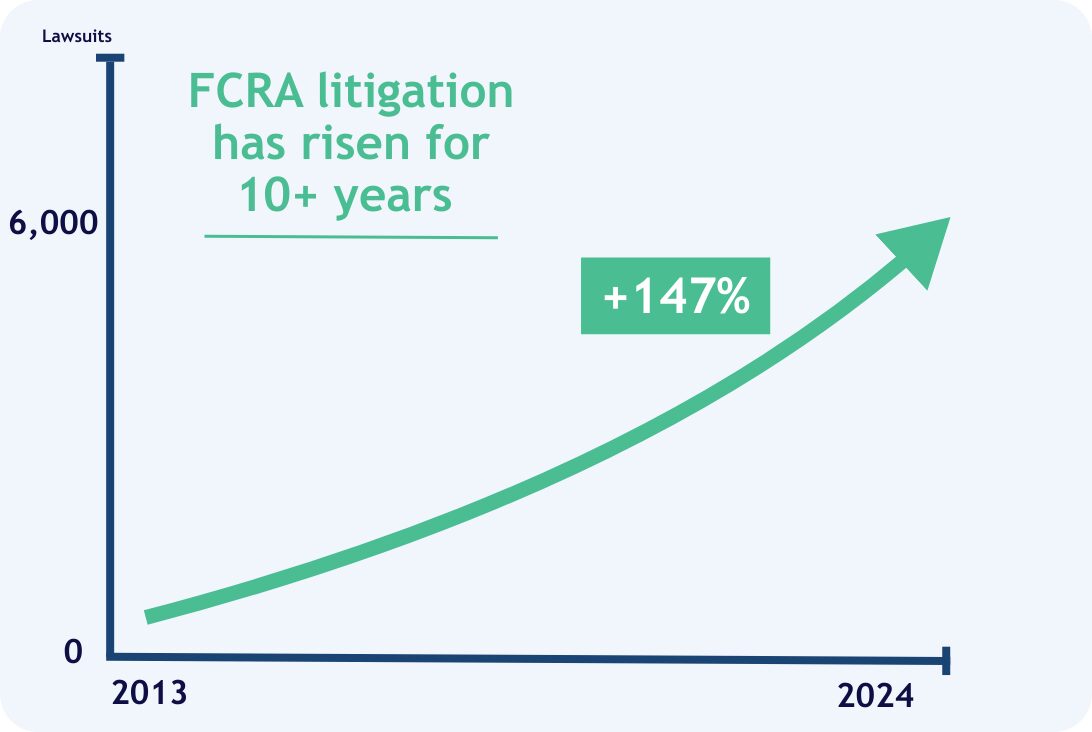

FCRA Litigation continues to rise for 10+ years straight.

In 2024, credit reporting accounted for 87% of all complaints submitted to the CFPB.

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and

Reduce credit reporting dispute rates by more than 30% and overall operational expense

Related Resources

Equifax and Bridgeforce Data Solutions Underscore Shared Commitment to Data Accuracy with New Partnership

ATLANTA, March 7, 2022 /PRNewswire/ — Equifax® (NYSE: EFX) and financial technology firm Bridgeforce Data Solutions today announced a new partnership reinforcing their shared commitment to the data furnisher community by providing them with additional tools and support mechanisms to enable optimal data accuracy. As part of the agreement, Equifax will now make Bridgeforce’s industry-leading

Credit Reporting & FCRA Compliance Experts Reveal Their List of Top Self-Audit Questions

Are you looking for a way to significantly reduce the risk of credit reporting accuracy issues that could lead to costly disputes, complaints, or regulatory inquiries, but aren’t sure where to start? Well, you’re in luck! For a limited time and for a limited number of respondents, Bridgeforce Data Solutions

Large U.S. Bank Achieves 30%+ Reduction in Average Quarterly Dispute Rate After Using Data Quality Scanner®

As the regulatory focus on credit reporting compliance continues to increase, lenders need to do more to mitigate both the risk of compliance issues and the costs of managing credit bureau disputes. In this case study, we show how a large, super-regional bank was able to achieve a 30%+ reduction